Finance & Cryptocurrency Overview

When you look at Finance & Cryptocurrency, the blend of traditional finance ideas and digital assets such as cryptocurrencies, stablecoins, and decentralized finance protocols. FinTech Crypto, you’re stepping into a space that changes how money moves, how value is stored, and how people invest. Finance & Cryptocurrency touches everything from personal tax planning to global market rules. It encompasses Crypto Tax Havens, jurisdictions that offer little or no tax on digital‑asset income, often paired with residency programs for crypto investors. Zero‑Tax Crypto Countries, and it requires a solid grasp of Regulation, the set of laws, licensing regimes, and compliance standards that governments impose on crypto activities. Crypto Legal Frameworks to stay on the right side of the law. The rise of DeFi Restaking, a method where validators lock up their stake a second time to earn extra rewards while exposing themselves to slashing risks. Restaking Rewards shows how the ecosystem keeps innovating on earning models. Finally, Banking‑as‑a‑Service, a cloud‑based platform that lets fintechs embed banking features via APIs, speeding up product launches and compliance. BaaS is reshaping how traditional banks and crypto firms cooperate.

Key Themes Covered

One core idea is that Finance & Cryptocurrency isn’t a single rulebook; it spreads across tax strategies, legal environments, and technology stacks. For instance, choosing a crypto tax haven influences residency steps, banking access, and even the type of digital assets you can hold. Meanwhile, strict regulation in places like China or Russia forces traders to adopt VPNs, P2P networks, or localized exchanges—each decision carries risk and opportunity. DeFi restaking adds a layer of yield engineering, where validators weigh extra rewards against potential slashing penalties, a balance that shapes platform security. Banking‑as‑a‑Service platforms bring these pieces together, offering APIs that let a crypto exchange instantly comply with KYC checks or integrate stablecoin wallets, which in turn lowers entry barriers for new users. Understanding how these entities intersect helps you spot where the market will move next.

Below you’ll find a curated collection of articles that dig into each of these angles. From a country‑by‑country guide on zero‑tax crypto jurisdictions to deep dives on China’s VPN risks, Russian central bank policies, and the future of BaaS platforms, the posts give you concrete steps, data‑driven analysis, and real‑world examples. Whether you’re planning a relocation, building a validator node, or just trying to stay compliant, the resources here will arm you with the knowledge you need to act confidently in the fast‑changing world of Finance & Cryptocurrency.

Tethys Crypto Exchange Review: Leveraged Yield on Metis L2 Explained

Tethys Finance is a leveraged yield farming protocol on the Metis Layer 2 network, not a traditional crypto exchange. It lets users multiply their APY up to 20x using LP tokens, but comes with high risk and limited liquidity. Learn how it works, who it's for, and whether it's worth using.

January 17 2026

Velodrome Finance V2 Crypto Exchange Review: Best for Optimism DeFi Users

Velodrome Finance V2 is a specialized DeFi exchange built for the Optimism ecosystem, offering zero trading fees and unique rewards for liquidity providers through its veVELO governance system. Ideal for advanced users seeking high yield on Optimism.

January 13 2026

Portugal Crypto Tax Benefits for Bitcoin Investors in 2026

Portugal offers one of Europe’s most favorable crypto tax regimes: Bitcoin held over a year is tax-free, short-term gains are taxed at just 28%, and crypto-to-crypto trades aren’t taxable. Learn how to use it in 2026.

January 11 2026

Binance TR Crypto Exchange Review: Is It the Best Choice for Turkish Users in 2025?

Binance TR is Turkey's top crypto exchange for buying Bitcoin and Ethereum with Turkish Lira. Learn its fees, features, verification deadline, and whether it's safe and worth using in 2025.

December 20 2025

Crypto Business Licensing Requirements in Malta: What You Need to Know in 2025

Malta's crypto licensing system in 2025 requires businesses to meet strict capital, AML, and local presence rules. Learn the four license classes, hidden costs, approval timeline, and why it's still a top EU choice despite MiCA integration.

December 8 2025

Wealth Tax Treatment of Crypto in Switzerland: What You Need to Know in 2025

Switzerland taxes crypto wealth, not gains. Private investors pay 0.3%-1% annual wealth tax on crypto holdings as of December 31st, with no capital gains tax. Learn how to declare crypto, which tokens matter, and how cantonal rates affect your bill in 2025.

December 2 2025

How Banks in Nigeria React When You Withdraw Crypto to Fiat in 2025

As of 2025, Nigerian banks allow crypto-to-fiat withdrawals only through SEC-licensed exchanges, but impose strict limits, monitor transactions closely, and frequently freeze accounts linked to unverified activity. Compliance is mandatory.

November 28 2025

Institutional Crypto Adoption and Bitcoin ETF Approvals: How Regulation Is Changing the Game

Institutional investors are pouring billions into Bitcoin ETFs and crypto assets as regulation clears the way. With $58 billion in ETFs, corporate treasuries holding over a million BTC, and global adoption rising, crypto is no longer a fringe asset - it's a mainstream financial tool.

November 26 2025

FinTech Law and Cryptocurrency in Mexico: What You Can and Can't Do in 2025

Mexico allows individuals to use cryptocurrency but bans financial institutions from offering crypto services. Learn how the 2018 Fintech Law shapes crypto rules, what's changing in 2025, and how to stay compliant.

November 24 2025

OFAC Cryptocurrency Sanctions and Compliance: What Crypto Businesses Must Do in 2025

OFAC cryptocurrency sanctions apply to all digital asset transactions involving U.S. persons or systems. Learn how crypto businesses must screen wallets, block sanctioned addresses, and build compliance programs to avoid massive fines in 2025.

November 14 2025

How El Salvador Uses Bitcoin for National Economy - And Why It’s Struggling

El Salvador made Bitcoin legal tender in 2021 to boost remittances and financial inclusion. Three years later, adoption is minimal, costs remain high, and the government has scaled back its efforts after losing billions and facing IMF pressure.

November 13 2025

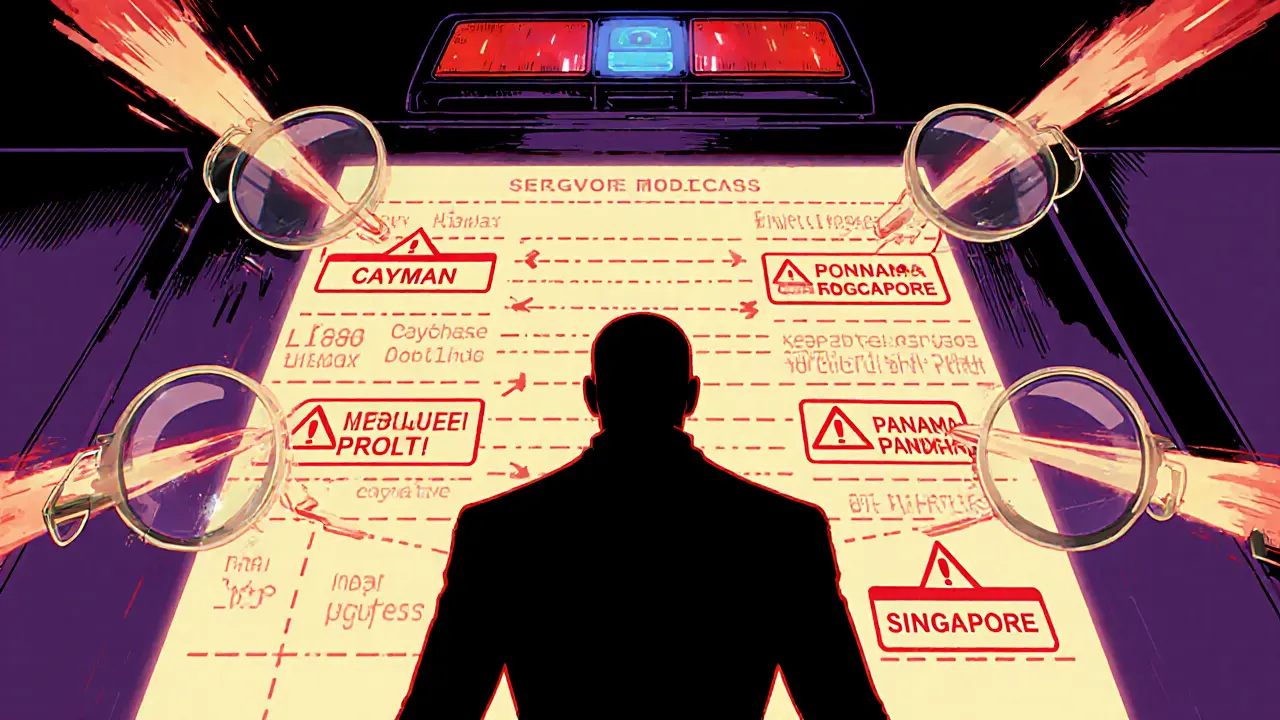

Offshore Crypto Accounts: How Detection Works and What Happens If You Get Caught

Offshore crypto accounts are no longer safe from detection. Learn how blockchain tracing, global regulations, and AI tools make hiding crypto risky-and what legal consequences you could face if caught.

November 5 2025