Digital Asset Classification Calculator

This tool helps determine whether your digital asset should be classified as property or currency based on key legal criteria discussed in the article.

Classification Result

Important Note: Classification may vary by jurisdiction. This tool provides general guidance based on the article content but does not constitute legal advice.

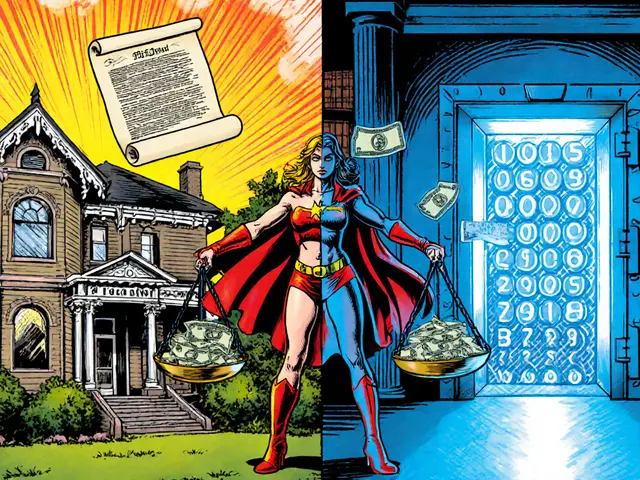

Ever wonder why a bank account isn’t treated the same as a piece of land when you’re sorting out an estate or a divorce? The answer lies in how the law draws a line between property is a legal relationship that gives a person rights over a thing, and currency is the medium we use to measure and exchange value. In the world of blockchain and digital assets, that line gets blurry fast. This guide walks you through the historic roots, the modern technical tests, tax fallout, and the newest challenges posed by crypto.

Historical Roots of the Property‑Currency Divide

The split between real and personal property goes back to English common law. William Blackstone’s *Commentaries on the Laws of England* (1765‑1769) first codified land (real property) versus movable items (personal property). In the United States the American Law Institute’s Restatement (Third) of Property (1995‑2020) refined the definition to “the legal relationship between persons with respect to a thing.” That relational view still underpins every tax code, deed, and probate filing today.

Currency, meanwhile, has always been a special case. Early courts treated coins and paper money as tangible personal property, but once you move money into a bank account it becomes a “chose in action” - a right to sue for payment - as the Supreme Court held in United States v. Bajakajian (1998). The distinction matters because the legal remedies, tax treatment, and paperwork differ dramatically.

Real Property vs. Personal Property: Core Definitions

Real property includes land, any permanent structures, subsurface rights, and even airspace. The universal test for deciding whether an item is a fixture (and thus part of real property) is the MARIA test - Method of attachment, Adaptability, Relationship of parties, Intent, and Agreement. The test first appeared in Holland v. Bagtal (1984) and is now baked into statutes in 26 states.

Personal property is anything movable. It splits into:

- Tangible personal property - cars, furniture, physical cash.

- Intangible personal property - rights, securities, and digital assets.

For intangible items, the Uniform Commercial Code (UCC) Article 9 (2022 revision) provides the legal framework. It defines commercial paper, investment securities, and other financial instruments, and it dictates how you perfect a security interest.

Currency as Tangible vs. Intangible Property

Physical cash sits comfortably under the tangible personal property umbrella. The Federal Reserve Act (1913) explicitly calls coins and notes “legal tender” and treats them as moveable assets.

Bank deposits, on the other hand, are intangible. They are claims against the bank, not the paper in your wallet. This classification shapes everything from probate timing (bank accounts can be frozen for months) to tax reporting (no capital‑gain tax until you convert the claim into another asset).

Enter blockchain. Cryptocurrencies such as Bitcoin and Ethereum were first treated by the IRS as property for tax purposes (Notice 2014‑21). Yet the OCC’s 2020 interpretive letter called them “currency” for banking regulation. The tug‑of‑war continues, and the classification you pick changes your filing forms, audit risk, and even which court hears your dispute.

Tax and Transaction Implications of Each Class

Real property transactions demand deeds recorded at the county clerk, title insurance (0.5‑1 % of the value), and an average $300‑$500 recording fee. The tax bite is an annual ad valorem levy, about 1.08 % of assessed value nationwide (Tax Foundation 2023).

Personal tangible property usually moves with a bill of sale and faces little to no ongoing tax, except in states that tax vehicles or other high‑value chattels. Intangible property - stocks, bonds, and most crypto - is taxed on capital gains at 0 %, 15 % or 20 % depending on your income bracket (IRS 2023). Physical cash isn’t taxed until you exchange it for something that appreciates.

Because cryptocurrency is deemed property for tax, every trade is a taxable event. Yet if a state treats it as currency, you might avoid some reporting thresholds. The difference can swing your tax bill by thousands of dollars.

Legal Remedies: What Happens When Things Go Wrong?

When a buyer refuses to transfer a house, courts can order specific performance - a forced signing of the deed - in 49 states (ABA 2022). For personal property disputes, the usual remedy is monetary damages. Currency disputes fall under the Electronic Fund Transfer Act (15 U.S.C. §1693) and often result in restitution rather than ownership claims.

Crypto adds a layer of uncertainty. In United States v. Gratkowski (2020) a federal judge applied the Bank Secrecy Act, treating Bitcoin as a currency for anti‑money‑laundering purposes. In contrast, the IRS still asks you to report every crypto transaction on Schedule D as property. That split means the same Bitcoin holding could be the subject of a specific‑performance lawsuit in one jurisdiction and a simple restitution claim in another.

Emerging Challenges with Digital Assets and Blockchain

Traditional classifications were built for bricks, paper, and metal. Digital assets break the mold:

- Smart contracts can own other smart contracts, blurring the line between “thing” and “right.”

- Stablecoins pegged to fiat are treated as Tier 2 currency under the IRS’s 2024 draft, while non‑pegged tokens fall into Tier 3, a new “property‑like” category.

- The EU’s MiCA regulation (June 2024) calls crypto “virtual assets,” a third bucket separate from both property and currency.

Law firms are scrambling. Baker McKenzie reported a 218 % jump in crypto‑related property cases between 2020 and 2023. Yet a National Association of Real Estate Lawyers survey (Q4 2023) found only 32 % of attorneys felt adequately trained to handle these issues.

Practical Checklist for Classifying an Asset

- Identify the *physical* versus *digital* nature of the asset.

- Apply the MARIA test if the asset is attached to land (e.g., a server rack embedded in a data center).

- Determine if the asset is *tangible* or *intangible* personal property.

- Consult the IRS guidance: is it listed as property (Schedule D) or as currency (Form 1099‑INT)?

- Check state statutes - some states treat crypto as personal property, others as currency.

- Document the classification in any transfer agreements, wills, or divorce settlements.

Following this list helps you avoid frozen accounts, unexpected tax bills, and costly courtroom battles.

Mini‑FAQ (Schema.org markup)

Is Bitcoin considered property or currency in the United States?

The IRS treats Bitcoin as property for tax reporting, meaning every sale or exchange is a taxable event. However, the OCC’s 2020 interpretive letter classifies it as currency for banking regulation, creating a split that can affect compliance and litigation.

How does the MARIA test affect crypto‑related assets?

If a crypto‑mining rig is permanently installed in a property, the MARIA test helps decide whether the equipment is a fixture (real property) or just personal property. The outcome determines if a deed amendment is needed during a sale.

Do bank accounts count as personal property in estate planning?

Bank accounts are “choses in action,” so they are intangible personal property. They require probate or a qualified transfer‑on‑death designation to avoid freezing after death.

What tax rate applies to gains from selling cryptocurrency?

Gains are taxed as capital gains. Short‑term gains (held ≤ 1 year) are taxed at ordinary income rates, while long‑term gains qualify for 0 %, 15 % or 20 % rates based on your taxable income.

Can a divorce court treat crypto as marital property?

Yes. Most states apply the same rules they use for other intangible personal property. However, the classification (property vs. currency) can affect how the court values the asset and whether it’s subject to division.

Looking Ahead: Toward a New Taxonomy

Legal scholars agree the binary property‑currency model is straining. The Uniform Law Commission’s 2023 revision of the Uniform Electronic Transactions Act adds a “digital asset” category, and the IRS draft for 2024 proposes three tiers that separate government money, stablecoins, and non‑pegged crypto. By 2027, many experts predict a dedicated “digital property” classification that will sit beside real and personal property, cleaning up the current confusion.

If you’re a lawyer, accountant, or developer building blockchain solutions, start mapping your assets to the existing framework now. Use the checklist above, watch the evolving guidance, and make sure every contract spells out the chosen classification. That way, when the law finally catches up, you’ll already be on the right side of the line.

Patrick Rocillo

October 25, 2025 AT 08:42Wow, this deep‑dive into property vs currency really untangles a knot that’s been driving me bonkers! 🎉 The way you laid out the MARIA test alongside the crypto nuances makes the whole legal jungle feel like a well‑marked hiking trail. I love how you linked historic Blackstone to modern IRS notices – it shows the evolution isn’t a jump but a slow climb. Thanks for the checklist; I’m already bookmarking it for my next client meeting. 🚀

Aniket Sable

October 30, 2025 AT 11:08Thats a great summary, really helps me get the gist. You made the 1800s stuff sound less boring lol.

Santosh harnaval

November 4, 2025 AT 14:33The article nails how digital assets force us to rethink old property categories.

Will Atkinson

November 9, 2025 AT 17:59Indeed-your observation is spot‑on!; the legal world is finally catching up to the blockchain boom, and it’s refreshing to see such a clear roadmap laid out. Kudos for bridging the gap between statutes and real‑world practice.

monica thomas

November 14, 2025 AT 21:25I commend the author for presenting a comprehensive comparative analysis of property and currency classifications, particularly with respect to digital assets. The exposition of the MARIA test and its applicability to crypto‑related fixtures is both thorough and instructive. Such clarity aids practitioners in navigating the intricate tax and probate implications.

Edwin Davis

November 20, 2025 AT 00:50While the treatise is exhaustive, it neglects the primacy of American jurisprudence in safeguarding our financial sovereignty!; the emphasis on foreign regulatory frameworks should be tempered by a stronger focus on domestic statutes!!!

emma bullivant

November 25, 2025 AT 04:16Contemplating the line between property and currency invites us to question the very nature of value itself-what we deem “ownable” is often a collective agreement rather than a fixed reality. If money is merely a claim, then crypto, as a claim on a claim, blurs the ontology of ownership. This philosophical lens may guide future codifications beyond mere tax tables.

Michael Hagerman

November 30, 2025 AT 07:42Whoa, talk about a mind‑bender! You just turned my coffee break into a full‑blown existential crisis-who owns a digital promise, anyway? 🎭

Karla Alcantara

December 5, 2025 AT 11:07What a fantastic guide! The checklist alone will save countless hours for anyone trying to untangle crypto in estate plans. I especially appreciate the balanced view on tax implications-so many resources either over‑hype or under‑state the risks. Keep the insightful content coming, it truly empowers the community.

Jessica Smith

December 10, 2025 AT 14:33This piece glosses over the real danger: treating crypto as property invites endless litigation and skews tax compliance. Readers need a harsher reality check.

Petrina Baldwin

December 15, 2025 AT 17:59Classifying digital assets without clear statutes is a legal gray area.

Ralph Nicolay

December 20, 2025 AT 21:25Indeed, the absence of explicit legislative guidance creates uncertainty for both practitioners and clients, underscoring the necessity for interim best‑practice frameworks.

sundar M

December 26, 2025 AT 00:50The rapid evolution of blockchain technology has forced a seismic shift in how we conceptualize ownership, compelling legislators and courts to revisit centuries‑old doctrines.

First, the traditional dichotomy of real versus personal property, rooted in Blackstone’s commentaries, proves inadequate when an asset exists purely as code on a distributed ledger.

Second, the MARIA test, while elegant for physical fixtures, struggles to address whether a smart contract embedded in a data center qualifies as a fixture or merely a service.

Third, courts have taken divergent paths: some treat cryptocurrency as intangible personal property for tax purposes, while others, following the OCC’s guidance, view it as a form of currency for banking regulation.

Fourth, this split creates practical turmoil for taxpayers, who must navigate dual reporting regimes that can trigger double taxation or inadvertent non‑compliance.

Fifth, the tax code’s reliance on “capital gains” language does not capture the continuous, transaction‑heavy reality of decentralized finance, where assets are swapped minute‑by‑minute.

Sixth, estate planners now grapple with whether to classify a client’s Bitcoin holdings as probate‑eligible property or to use payable‑on‑death designations akin to traditional bank accounts.

Seventh, the emerging EU MiCA framework introduces a third category, “virtual assets,” which could serve as a model for U.S. lawmakers seeking to bridge the property‑currency divide.

Eighth, the Uniform Law Commission’s recent revision to the Electronic Transactions Act hints at a legislative willingness to codify a “digital asset” class, signaling a possible convergence of tax, probate, and regulatory treatment.

Ninth, practitioners must stay vigilant about state‑level variations, as some jurisdictions already treat stablecoins as fiat equivalents while others maintain them as property.

Tenth, the practical implication for litigation is profound: a single Bitcoin holding might be subject to specific performance claims in one court and mere restitution in another.

Eleventh, this legal uncertainty fuels a market premium on compliance solutions, driving the growth of crypto‑focused law firms and specialized accounting platforms.

Twelfth, from a policy perspective, regulators must balance consumer protection with innovation, ensuring that over‑regulation does not stifle the productive potential of decentralized finance.

Thirteenth, the author’s checklist provides a valuable starting point, yet it must be continuously updated as statutes and guidance evolve.

Fourteenth, I recommend that any professional dealing with digital assets adopt a layered documentation strategy, capturing classification decisions, supporting statutes, and client intent.

Fifteenth, by doing so, they mitigate the risk of frozen accounts, unexpected tax liabilities, and costly courtroom battles.

Finally, the legal community should view this transitional period not as a crisis but as an opportunity to modernize property law for the digital age.

Nick Carey

December 31, 2025 AT 04:16Nice effort, but the piece could have used fewer buzzwords and more straight‑to‑the‑point examples.

Sonu Singh

January 5, 2026 AT 07:42Hey folks, just wanted to add that when you’re filing crypto on Schedule D, make sure to pull the fair‑market value from the exact day of the trade – the IRS won’t accept a rough average. Also, don’t forget to keep the blockchain transaction hash; it can save you a ton of hassle if the IRS calls you in for an audit. Good luck!