Zero-Tax Crypto Country Finder

Select Your Situation

Key Takeaways

- Switzerland, Singapore, UAE, El Salvador, Germany, Portugal and the Cayman Islands lead the 2025 zero‑tax crypto rankings.

- Most jurisdictions require either a residency program or a business entity to unlock tax‑free status.

- Holding periods (e.g., 12 months in Germany and Portugal) and transaction frequency (e.g., Malaysia) are critical pitfalls.

- Strong regulatory frameworks - FINMA in Switzerland, VARA in the UAE - provide legal certainty for crypto businesses.

- Use the comparison table below to match your lifestyle, investment horizon, and operational needs.

Zero‑Tax Crypto Countries are jurisdictions that either waive capital gains tax, income tax or both on cryptocurrency transactions, holdings and related business revenue. In 2025 roughly fifteen nations qualify, offering a mix of outright tax exemption, conditional relief based on holding periods, or business‑friendly tax structures. For investors and founders, the lure is simple: keep more of your crypto profits and reduce compliance headaches.

But the landscape isn’t just about taxes. You also need to consider residency requirements, banking access, regulatory clarity and the surrounding ecosystem. That’s why this guide breaks down the top jurisdictions, walks you through the steps to establish a tax‑free foothold, and flags the hidden traps that could turn a zero‑tax oasis into a costly surprise.

How a Jurisdiction Earns the “Zero‑Tax” Badge

Three main ingredients create a crypto tax haven:

- No capital gains tax on the sale or swap of crypto assets.

- No personal income tax on crypto‑derived earnings, whether from mining, staking or trading.

- A clear regulatory framework that defines crypto as a taxable‑exempt asset class.

Some places, like the United Arab Emirates, check all three boxes for both individuals and companies. Others, such as Germany, exempt only long‑term capital gains (assets held over 12 months) while still taxing short‑term trading as regular income.

Top Zero‑Tax Crypto Jurisdictions in 2025

Switzerland

Switzerland stays at the summit of crypto‑friendliness. Federal law treats crypto capital gains as tax‑free for private investors, and its cantonal system lets you pick a canton with especially low rates. The Crypto Valley in Zug offers a dense network of blockchain startups, legal experts and banks that already understand digital assets. While wealth tax still applies to the total value of crypto holdings, the rates are modest and can be reduced through standard Swiss tax deductions.

Singapore

Singapore ranks second globally and is famous for its zero capital gains tax on crypto for individuals. The city‑state also has no capital controls, a stable regulatory environment and major exchanges like KuCoin and Phemex operating locally. To benefit, you need either a Singaporean residency (via an Employment Pass, EntrePass or Global Investor Programme) or a registered company that conducts crypto‑related business.

United Arab Emirates

The UAE, especially Dubai and Abu Dhabi, combines zero personal income tax with a proactive crypto regulator - the Virtual Asset Regulatory Authority (VARA). Free zones such as the Dubai Multi Commodities Centre (DMCC) let you set up a crypto‑focused company with 100 % foreign ownership. Recent data shows over $30 billion in crypto transactions processed in the UAE in a 12‑month window, underscoring its growing ecosystem.

El Salvador

El Salvador made headlines by adopting Bitcoin as legal tender. The country’s Digital Assets law guarantees zero capital gains and zero income tax on Bitcoin transactions, whether you trade, hold or spend. The ambitious Bitcoin City project promises a geothermal‑powered zone with no taxes on income, property or capital gains - a true test case for a fully tax‑free crypto nation.

Germany

Germany offers a simple rule: keep crypto for more than 12 months and any profit is tax‑free. This applies to private investors only; professional traders still face ordinary income tax. The rule is embedded in existing German tax law for personal property, so you don’t need a special crypto statute - just a reliable record of acquisition dates.

Portugal

Portugal mirrors Germany’s approach. Long‑term crypto gains (over 12 months) escape capital gains tax, while short‑term trading is taxed as ordinary income. The country also provides a “non‑habitual resident” tax regime that can further reduce tax on foreign‑sourced income, making it attractive for digital nomads.

Cayman Islands

The Cayman Islands stand out because they impose zero personal income tax and zero capital gains tax with no holding‑period condition. They are a go‑to hub for crypto funds and token issuers thanks to a clear corporate law framework and a robust financial services sector.

Comparison Table: Tax, Residency & Ecosystem

| Country | Personal Tax on Crypto | Corporate Tax on Crypto Business | Residency Requirement | Key Crypto Ecosystem |

|---|---|---|---|---|

| Switzerland | 0 % (private capital gains) | Variable - cantonal rates, often 12‑15 % | Swiss residency (permit L, B or C) | Crypto Valley (Zug), FINMA guidance |

| Singapore | 0 % (no CGT) | 0‑17 % (depending on income source) | Work/EntrePass or Investor Programme | Strong fintech hub, major exchanges |

| UAE | 0 % personal income tax | 0 % in free zones (e.g., DMCC) | Golden Visa (5‑10 yr) or company‑based visa | VARA regulator, Dubai Crypto Hub, $30 B annual volume |

| El Salvador | 0 % (Bitcoin law) | 15 % corporate tax (standard rate) | National residency (no visa needed for many) | Bitcoin City, state‑backed Bitcoin holdings |

| Germany | 0 % after 12‑mo hold, otherwise 0‑45 % | 15‑30 % corporate tax | EU/German residence permit | Robust banking, clear tax guidance |

| Portugal | 0 % after 12‑mo hold, otherwise 14‑48 % | 21 % corporate tax (reduced for NHR) | D7 visa or NHR status | Growing crypto community, Lisbon events |

| Cayman Islands | 0 % (no personal tax) | 0 % (no corporate tax) | Work permit or investment‑linked residency | Fund domicile hub, strong legal services |

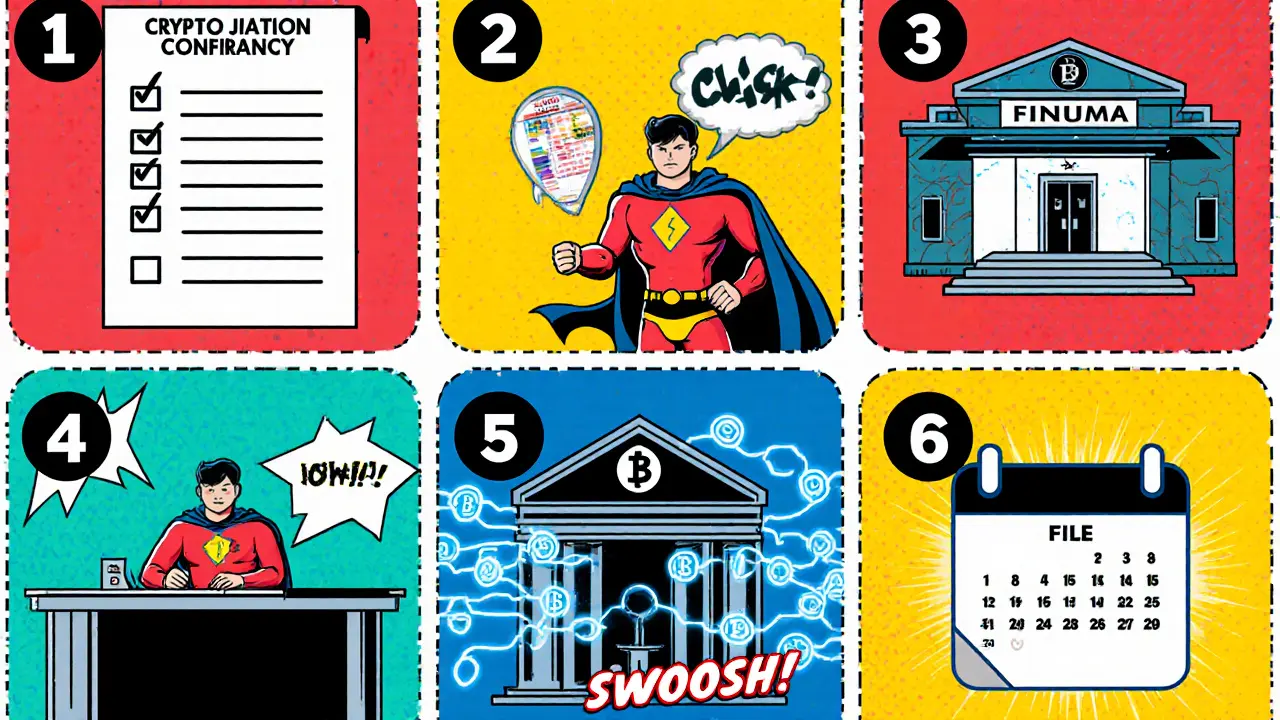

Step‑by‑Step: How to Set Up a Tax‑Free Crypto Base

- Choose your jurisdiction based on the comparison table and personal priorities (cost of living, language, travel freedom).

- Secure residency or company registration. Most zero‑tax countries require either a personal residency permit or a locally registered business to claim tax benefits. Follow the official immigration portal for the specific visa (e.g., Swiss B‑permit, Singapore EntrePass, UAE Golden Visa).

- Open a local bank account. Crypto‑friendly banks in Switzerland (e.g., SEBA), Singapore (DBS), or the UAE (Emirates NBD) will let you hold fiat and convert crypto proceeds.

- Transfer your crypto. Use a reputable exchange or a cross‑border crypto‑payment processor to move assets to a wallet registered in the new jurisdiction. Keep detailed blockchain records - timestamps, transaction hashes and wallet addresses.

- Document holding periods. In Germany and Portugal, mark the exact date you acquired each asset. A simple spreadsheet or a specialized crypto‑tax app (e.g., CoinTracker) can generate the required audit trail.

- File the necessary tax declarations. Even with zero tax, many jurisdictions require a “non‑taxable” statement. Submit the declaration on time to avoid penalties and retain your tax‑free status.

- Stay compliant. Monitor regulatory updates - FINMA releases guidance annually, VARA publishes rulebooks bi‑annually. Subscribe to official newsletters or local crypto law blogs.

Common Pitfalls & How to Avoid Them

- Frequent trading in “tax‑free” zones. Countries like Malaysia treat regular, repetitive trades as business income, which is taxable. Keep trading activity under the local definition of casual investing.

- Missing the holding‑period deadline. In Germany and Portugal, the 12‑month clock starts at the moment you receive the crypto, not when you decide to sell. Set calendar reminders.

- Assuming corporate tax is also zero. The UAE’s free‑zone exemption applies to companies registered there, but a mainland entity would face a 9‑10 % corporate tax introduced in 2023.

- Ignoring wealth tax. Switzerland taxes net wealth, including crypto, at cantonal rates (0.1‑0.3 %). Proper structuring (e.g., holding via a family foundation) can reduce the charge.

- Overlooking crypto‑friendly banking. Some banks still view crypto as high‑risk and may freeze accounts. Choose institutions with a proven crypto‑services track record.

Beyond Taxes: Why the Ecosystem Matters

Tax policy is just one piece of the puzzle. A thriving ecosystem gives you access to talent, funding, legal counsel and networking opportunities. Here are a few highlights:

- Switzerland’s Crypto Valley hosts over 800 blockchain firms, venture capital, and the Swiss Financial Market Supervisory Authority (FINMA) that publishes clear ICO guidelines.

- Singapore’s fintech hub includes the Monetary Authority’s Sandbox, which lets you test blockchain solutions with regulatory support.

- UAE’s VARA and DMCC provide fast licensing - you can get a crypto‑business license in under three weeks.

- El Salvador’s Bitcoin City offers low‑cost energy from geothermal plants, ideal for mining operations.

- Portugal’s Lisbon Crypto Week draws thousands of developers and investors each October, creating a vibrant community.

Future Outlook: What to Watch in the Next Few Years

Zero‑tax jurisdictions are likely to evolve as more countries vie for crypto capital. Keep an eye on:

- Potential EU‑wide directive that could harmonise crypto tax treatment - could erode Germany’s advantage.

- UAE’s planned expansion of the Free‑Zone Model to include a dedicated “Crypto Free‑Zone” with bespoke regulatory sandbox.

- Progress on El Salvador’s Bitcoin City - if the geothermal power project scales, mining profitability could skyrocket.

- Switzerland’s ongoing debate about wealth tax reforms - could affect overall net‑worth calculations for crypto holders.

Quick Checklist Before You Move

- Identify primary goal - tax avoidance, business expansion, or both?

- Pick jurisdiction that matches your lifestyle and legal comfort.

- Secure residency or company registration first.

- Open a crypto‑friendly bank account.

- Document every transaction with timestamps.

- File a “zero‑tax” declaration annually.

- Stay updated on regulatory changes.

Do I need to become a tax resident to enjoy zero‑tax crypto benefits?

Most jurisdictions require either personal residency (e.g., Swiss B‑permit, Singapore EntrePass) or a locally registered company to activate the tax exemptions. Some places like the Cayman Islands grant tax‑free status to non‑residents who hold assets through a local entity.

Can I keep my crypto in a foreign exchange and still claim zero tax?

Yes, as long as the exchange is licensed in the jurisdiction you’re claiming benefits from and you can prove the assets are held under that jurisdiction’s tax rules. Keep detailed transaction logs and account statements.

What happens if I sell crypto before the 12‑month period in Germany or Portugal?

Profits are treated as ordinary income and taxed at your marginal rate (up to 45 % in Germany, up to 48 % in Portugal). You’ll also need to report the transaction on your annual tax return.

Is wealth tax a deal‑breaker in Switzerland?

Wealth tax applies to the total net value of assets, including crypto, at rates between 0.1‑0.3 % depending on canton. Many high‑net‑worth individuals use foundations or holding companies to lower the effective rate.

Can I use crypto as collateral for a loan without triggering tax?

Generally, yes. Collateralizing crypto does not constitute a disposal, so no taxable event occurs in most jurisdictions. However, you must keep the collateral intact; a forced liquidation could be treated as a sale.

Patrick Day

October 20, 2025 AT 08:13Everyone’s already got a hidden ledger tracking every crypto whisper, and they’ll pounce the second you slip.

Scott McCalman

October 20, 2025 AT 08:21Alright folks, buckle up because the crypto tax game is a maze that only the bold survive. 😊 The notion that you can just hop onto a zero‑tax passport and walk away with untaxed gains is a myth that the elites love to sell. In reality, every jurisdiction listed in that guide still demands a concrete residency paper trail, whether it’s a Swiss B‑permit or a UAE Golden Visa. If you try to fake a residence, the FINMA and VARA have deep data‑sharing agreements that will flag inconsistencies faster than you can swap an asset. Take Germany, for example: the 12‑month holding rule is crystal clear, but the tax office now audits blockchain timestamps with automated tools. Missing a single day can turn a zero‑tax profit into a 45% tax bill, and they’ll add penalties that melt your returns. 😱 Singapore’s EntrePass is not a tourist visa; it requires a solid business plan, a local office address, and proof of capital deployment within 12 months. If you simply stash crypto on a foreign exchange without a local entity, the IRAS will consider it foreign‑sourced income and tax it accordingly. The Cayman Islands sound seductive because there’s no personal tax, yet the offshore fund registries demand a registered manager and a substantive presence. Banks in Switzerland now ask for detailed source‑of‑wealth documentation for any crypto‑linked account, and they will freeze funds that look like “quick‑flip” trading. 🚨 UAE’s free‑zone regime is generous, but mainland companies are now subject to a 9% corporate tax that applies to crypto mining profits as well. El Salvador’s Bitcoin City is still in beta, and the promised tax‑free enclave hinges on the success of geothermal power projects that are nowhere near completion. Don’t forget wealth tax in Switzerland-0.2% might look tiny, but on a multi‑million crypto portfolio it’s a six‑figure hit every year. 💸 The hidden cost is compliance: you’ll need a crypto‑tax app, a local accountant, and possibly a legal counsel to keep the paperwork spotless. Bottom line: zero‑tax is possible, but only if you treat it like an international business venture with proper licensing, banking, and record‑keeping. 📌 Stay sharp, keep every transaction timestamp, and never assume a jurisdiction’s headline policy applies without the fine‑print.

PRIYA KUMARI

October 20, 2025 AT 08:30The so‑called “zero‑tax” narrative is a smoke‑screen for regulators to tighten controls on crypto flow. You can’t ignore the fact that most of these jurisdictions require you to report holdings to foreign tax authorities anyway. The guide omits the hidden compliance fees that erode any supposed benefit. In short, it’s a reckless shortcut that will bite you when the audits arrive.

Andrew Smith

October 20, 2025 AT 08:36I hear the concerns, but many investors have successfully navigated the paperwork with local experts, turning the “smoke‑screen” into a clear path. By partnering with a Swiss tax advisor you can map out the reporting obligations and keep your gains intact. Collaboration beats isolation, and the ecosystem around Crypto Valley is built for that exact purpose. Stay proactive, and the “reckless shortcut” becomes a well‑planned route.

Joy Garcia

October 20, 2025 AT 08:45The world’s elite are funneling crypto wealth into secret tax havens while the rest of us scramble for crumbs, and they’ll label us greedy if we dare ask for fairness. Every jurisdiction listed is a pawn in a larger scheme to concentrate power under the guise of “business friendliness.” Don’t be fooled by glossy brochures; the moral cost of hiding assets is far greater than any temporary tax gain.

mike ballard

October 20, 2025 AT 08:53From a regulatory standpoint, the interoperability of AML/KYC frameworks across Singapore, Switzerland, and the UAE creates a quasi‑global compliance lattice 🌐. When you establish a corporate entity in a Free Zone, you benefit from a double‑layered legal shield: the local statutory code and the overarching FATF standards. Leveraging these synergies can streamline cross‑border fiat on‑ramps and reduce latency in settlement pipelines. Think of it as building a modular fintech stack that plugs into each jurisdiction’s API‑first banking infrastructure. 🚀

Molly van der Schee

October 20, 2025 AT 09:00It’s fascinating how the technical scaffolding you described mirrors the human need for connection-each protocol a handshake, each regulation a promise of trust. When we see crypto as a bridge between societies, the compliance layers become shared language rather than barriers. Keeping that perspective helps us stay grounded amid the jargon and remember the ultimate goal: financial empowerment for individuals worldwide.

Mike Cristobal

October 20, 2025 AT 09:08We must hold ourselves accountable; exploiting loopholes while ignoring societal impact is unethical. 🌱 Ethical finance starts with transparency, not just tax avoidance.

John Lee

October 20, 2025 AT 09:15Ethics and tax strategy can coexist; consider structuring assets through charitable foundations that both reduce tax burden and fund community projects. This approach aligns personal gain with social good, turning a loophole into a lever for positive change. It’s a win‑win if done responsibly.

Jireh Edemeka

October 20, 2025 AT 09:23Ah, the classic “move to a tax‑free island and live forever in bliss,” as if the world’s fiscal policies were written on a napkin. One must admire the optimism of assuming that a single passport erases every legal nuance. Reality, however, enjoys reminding us that statutes are rarely that accommodating.

del allen

October 20, 2025 AT 09:30lol u r rght, i guess i wnted to be a crypto king but got stuck in the tax maze 🙃. Gotta read the fine print next time, lol.

Jon Miller

October 20, 2025 AT 09:38Honestly, the drama of chasing tax‑free status feels like a reality TV show-there’s hype, cliffhangers, and inevitable plot twists when the tax office shows up. Still, the adrenaline rush of setting up a company in Dubai’s DMCC beats any boring 9‑to‑5.

Rebecca Kurz

October 20, 2025 AT 09:45Wow!!! The excitement is real!!! But remember, you still have to file paperwork!!! No shortcuts!!!

Nikhil Chakravarthi Darapu

October 20, 2025 AT 09:53Our nation’s crypto policy must prioritize sovereignty, not cater to foreign tax havens that undermine domestic economic strength.

Tiffany Amspacher

October 20, 2025 AT 10:00In the grand theater of wealth, the quest for a zero‑tax stage is the ultimate act of rebellion against the fiscal narrative imposed upon us. Yet every rebellion needs a script, and the script here is written in residency permits, corporate charters, and legal footnotes. Embrace the drama, but know the lines before you step into the spotlight.