Crypto Regulations and Airdrops in 2025: Real Stories from Around the World

When it comes to crypto regulations, the legal rules that govern how digital assets are bought, sold, and tracked by governments and financial systems. Also known as digital asset laws, it has become the biggest factor deciding whether crypto is a tool for freedom or a risk to avoid. In 2025, these rules weren’t just paperwork—they changed lives. In Nigeria, banks started freezing accounts if you used unapproved exchanges. In Mexico, financial institutions were banned from touching crypto, but individuals could still hold it. Meanwhile, the U.S. tightened OFAC sanctions, a set of rules enforced by the Treasury Department that blocks transactions with certain countries, people, or wallets. Also known as blockchain compliance rules, it forced every crypto business—from small DeFi apps to big exchanges—to scan every transaction against a list of banned addresses. If you didn’t, you could face fines in the millions.

At the same time, Bitcoin ETFs, investment funds that let regular investors buy Bitcoin through traditional stock markets without holding the actual coin. Also known as crypto ETFs, it turned Bitcoin from a speculative asset into something banks and pension funds actually added to their portfolios. Over $58 billion flowed into these ETFs. Institutional investors didn’t just watch—they bought. And while that made Bitcoin more mainstream, it also meant more scrutiny. Governments now treat crypto like stocks, not just tech experiments. This shift affected everything: how exchanges operate, how airdrops are structured, and even how people in countries like China or Syria try to access crypto. Speaking of airdrops—crypto airdrops, free token distributions meant to reward users or spread awareness. Also known as token giveaways, it was the most popular way for new projects to get attention, but also the most exploited by scammers. In 2025, fake airdrops for NEKO, SUKU, and PNDR flooded social media. Real ones, like SAKE or MCASH, required actual usage—not just signing up. You didn’t just claim tokens; you had to trade, lend, or bridge assets. The line between opportunity and trap got razor-thin.

What You’ll Find Here

This collection pulls back the curtain on what really happened in November 2025. You’ll read about failed exchanges like BX Thailand, dead tokens like LICO, and how one meme coin, FOFAR, had no team, no liquidity, and zero chance of surviving. You’ll see how El Salvador’s Bitcoin experiment stalled, how Syria’s crypto access opened up while Cuba’s got tighter, and why buying virtual land in Decentraland might be riskier than it looks. There are no hype posts here—just facts, warnings, and straight talk about what works, what doesn’t, and who got left behind.

Metaverse Real Estate Investment: How to Buy and Profit from Virtual Land in 2025

Learn how to invest in metaverse real estate in 2025-where to buy, how to make money, which platforms to trust, and the real risks involved. No hype, just facts.

November 30 2025

How Banks in Nigeria React When You Withdraw Crypto to Fiat in 2025

As of 2025, Nigerian banks allow crypto-to-fiat withdrawals only through SEC-licensed exchanges, but impose strict limits, monitor transactions closely, and frequently freeze accounts linked to unverified activity. Compliance is mandatory.

November 28 2025

International Sanctions and Crypto Restrictions in Syria and Cuba in 2025

In 2025, Syria saw sweeping U.S. sanctions lifted, opening crypto access, while Cuba faced tighter restrictions. Learn how crypto is used-and blocked-in both countries under current U.S. policy.

November 27 2025

Institutional Crypto Adoption and Bitcoin ETF Approvals: How Regulation Is Changing the Game

Institutional investors are pouring billions into Bitcoin ETFs and crypto assets as regulation clears the way. With $58 billion in ETFs, corporate treasuries holding over a million BTC, and global adoption rising, crypto is no longer a fringe asset - it's a mainstream financial tool.

November 26 2025

SushiSwap (HAQQ) Crypto Exchange Review: Features, Fees, and Real-World Performance in 2025

SushiSwap is a top decentralized exchange offering fee-sharing rewards through its SUSHI token. With HAQQ integration, it now provides low-cost trading in Asia. Learn how it compares to Uniswap, earns passive income, and handles gas fees in 2025.

November 25 2025

FinTech Law and Cryptocurrency in Mexico: What You Can and Can't Do in 2025

Mexico allows individuals to use cryptocurrency but bans financial institutions from offering crypto services. Learn how the 2018 Fintech Law shapes crypto rules, what's changing in 2025, and how to stay compliant.

November 24 2025

BX Thailand Crypto Exchange Review: What Happened and Why It’s Gone

BX Thailand was Thailand's first major crypto exchange, trusted for years for easy THB trading. It shut down in 2020 after failing to keep up with competitors. Here's why it worked, why it failed, and what to use now.

November 23 2025

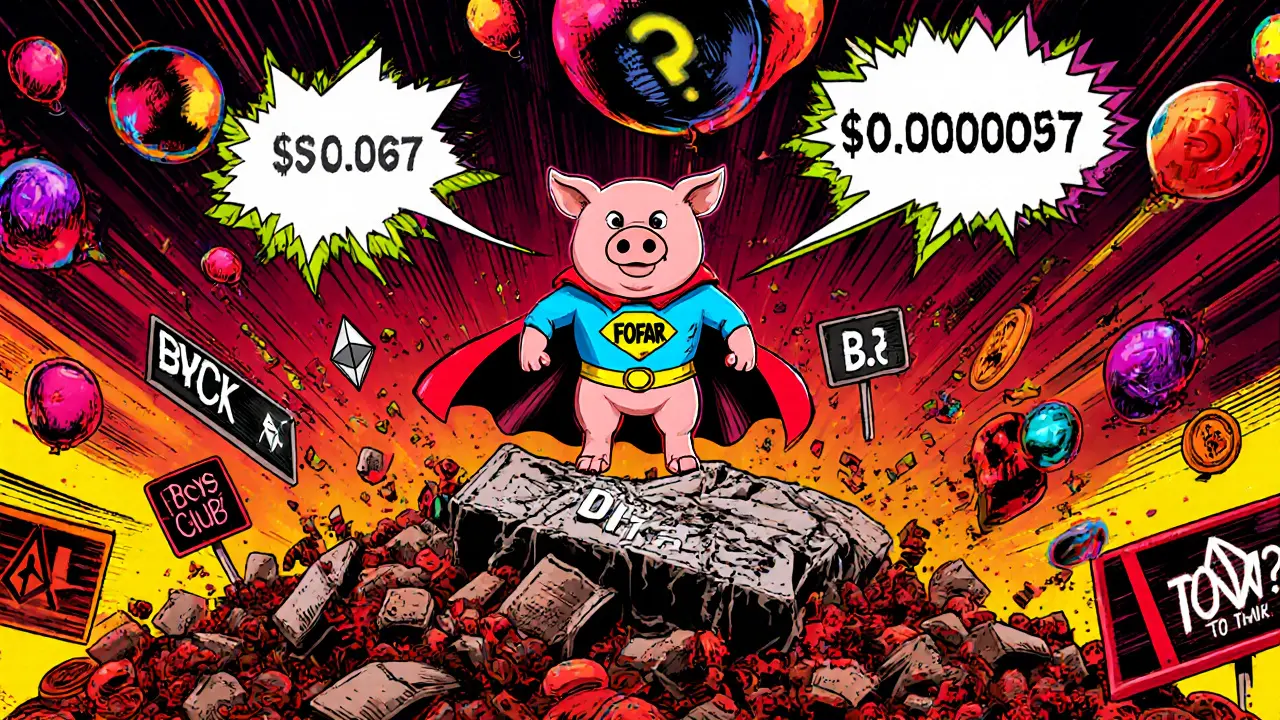

What is Fofar (FOFAR) Crypto Coin? The Truth Behind the Meme Token

Fofar (FOFAR) is a meme coin tied to the Pepe the Frog universe, but it lacks transparency, liquidity, and real utility. With conflicting blockchain data, zero team info, and extreme price inconsistencies, it's a high-risk gamble with little chance of long-term survival.

November 22 2025

ZWZ Giveaway Airdrop Details: What Happened to Zombie World Z Tokens?

The ZWZ airdrop by Zombie World Z attracted 4 million participants in 2021, but the token never gained traction. No game, no team, no updates - just silence. Here's what really happened.

November 20 2025

Schnorr Signatures vs ECDSA in Bitcoin: What Changed After Taproot

Schnorr signatures replaced ECDSA as Bitcoin's preferred signature scheme after Taproot. They're smaller, faster, private, and enable key aggregation - making multisig transactions look like regular ones.

November 18 2025

MCASH Airdrop by Monsoon Finance: What Really Happened and How to Earn Tokens

Monsoon Finance didn't do a traditional MCASH airdrop. Instead, it rewards users with tokens for using its privacy bridge across blockchains. Learn how anonymity mining works, why the price crashed, and if it's still worth using in 2025.

November 18 2025

How to Participate in the SAKE Airdrop: SakePerp and Sake Finance Rewards Guide

Learn how to earn SAKE tokens through the SakePerp and Sake Finance airdrop by trading, lending, and providing liquidity. No purchase needed-just active participation.

November 17 2025