ELK Token Distribution Calculator

Ever wondered how a single token can power fast, fee‑free swaps across dozens of blockchains? Elk Finance aims to do exactly that, giving users a way to move value instantly without the usual friction. Below we break down what the platform does, how its native ELK token works, and why it matters for anyone dabbling in DeFi or building on multiple chains.

What is Elk Finance?

Elk Finance is a decentralized cross‑chain liquidity network that lets users transfer assets between supported blockchains in about seven seconds, with no transaction fees. The project’s flagship product, ElkNet, acts as a blockchain‑agnostic bridge layer, abstracting the underlying chains so that tokens become instantly native on every supported network.

The platform currently runs on Ethereum, BNB Chain, Avalanche, Polygon, Fantom Opera and Huobi Eco. By deploying smart‑contract pools on each chain, ElkNet eliminates the need for separate liquidity on every bridge, reducing slippage and keeping fees near zero.

How ElkNet Makes Cross‑Chain Swaps Near‑Instant

ElkNet works like a two‑step pipeline:

- Deposit Phase: A user sends a token to an ElkNet smart contract on the source chain. The contract immediately locks the asset and mints a matching amount of the same token on the destination chain.

- Release Phase: When the user initiates a withdrawal, the destination contract releases the minted tokens and the source‑chain lock is burned.

Because the mint‑and‑burn operations are executed by pre‑deployed contracts, the whole process finishes in roughly seven seconds, and the system charges no gas on the user side - Elk Finance covers it from the fees collected on bridge usage.

The ELK Token: Utility and Governance

ELK is an ERC‑20‑compatible utility token that serves two core functions within the Elk Finance ecosystem: paying for bridge fees and participating in governance decisions. The token has a capped supply of 42.42million, with 11.99million currently circulating.

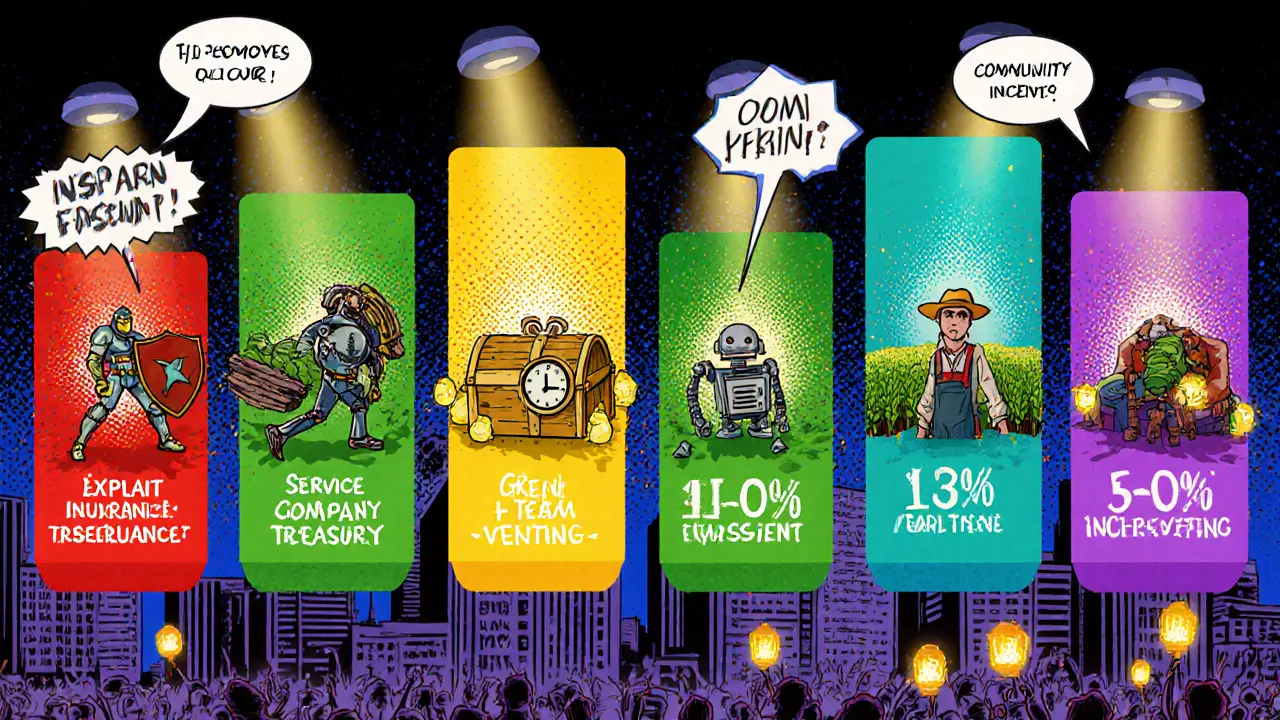

Token distribution is purpose‑driven:

- 10million ELK are locked in an Exploit Insurance contract, acting as a safety net against bridge attacks.

- 5million ELK sit in the Service Company Treasury to fund ongoing development.

- 2million ELK are allocated to a Team Vesting schedule.

- 10million ELK support a Farming Emissions contract that rewards liquidity providers.

The remaining supply is split between community incentives and the circulating market.

Security and Governance Built Into the Protocol

Cross‑chain bridges are high‑value targets for attackers, so Elk Finance baked security into its design:

- Exploit Insurance Fund: Holds enough ELK to cover three days of transfer volume on each chain, ensuring that any successful exploit can be reimbursed quickly.

- Governance: ELK holders can vote on fee adjustments, new chain integrations, and protocol upgrades via on‑chain proposals.

- Bridge‑as‑a‑Service (BaaS): Developers can launch their own bridges on top of ElkNet, benefitting from the same security audits and insurance cover.

This dual approach-financial backstop plus community‑driven decision‑making-helps build trust among users and developers alike.

Real‑World Adoption and Ecosystem Stats

As of October2025, Elk Finance has attracted over 247,000 token holders and is listed on eight exchanges, including MXC, Avalanche, BSC and Polygon networks. The ELK/USDT pair alone accounts for 43% of daily trading volume, indicating strong liquidity on that market.

Key metrics:

- Current price: $0.03665 USD

- 24‑hour volume: $4,179 USD

- Market cap: $410,440 USD (rank #5,375 on CoinMarketCap)

- Fully diluted valuation: $1.45million

The platform also ranks #159 overall and #40 in the Swap category on Coinbase’s Web3 rankings, showing moderate but growing visibility in the DeFi space.

Elk Finance vs. Other Cross‑Chain Solutions

| Feature | Elk Finance (ElkNet) | Wormhole | Polygon Bridge | ChainBridge |

|---|---|---|---|---|

| Transfer Speed | ≈7seconds | ~30seconds | ~5minutes | ~1minute |

| Fees for Users | 0(covered by protocol) | Variable (gas + bridge fee) | Gas on both chains | Gas + bridge fee |

| Liquidity Model | All pools minted in ELK, deep liquidity | Separate pools per asset | Native token pools only | Custom pool per bridge |

| Security Fund | Exploit Insurance (10M ELK) | None built‑in | No dedicated fund | No dedicated fund |

| Supported Chains (Oct2025) | Ethereum, BNB Chain, Avalanche, Polygon, Fantom, Huobi Eco | Ethereum, Solana, BNB Chain, Terra | Ethereum, Polygon | Ethereum, BNB Chain, Polygon, others (via custom adapters) |

The table shows that Elk Finance’s biggest advantage is its fee‑free, sub‑second experience combined with a built‑in insurance fund-features most competitors lack.

Getting Started with ELK and ElkNet

If you’re ready to try the bridge, follow these simple steps:

- Set up a wallet that supports the source chain (e.g., MetaMask for Ethereum or Trust Wallet for BNB Chain).

- Visit the official Elk Finance web app at elk.finance (always double‑check the URL).

- Connect your wallet and select the token you want to move.

- Enter the destination chain and amount, then confirm. The bridge will lock the asset on the source chain and mint it on the target chain within seconds.

- Optionally stake the received ELK in the Farming Emissions contract to earn additional rewards.

Remember that any bridge transaction incurs a small protocol fee, which is automatically deducted in ELK and used to fund the Exploit Insurance reserve.

Future Roadmap and What to Watch

Elk Finance’s roadmap points to several upcoming milestones:

- Integration of additional Layer‑2 solutions (Optimism, Arbitrum) to broaden accessibility.

- Launch of a dedicated ElkNet SDK, making it easier for developers to embed bridge functionality into their dApps.

- Expansion of the Bridge‑as‑Service offering, allowing third‑party projects to create custom cross‑chain solutions without writing low‑level smart contracts.

- Further decentralization of governance, moving more decision‑making power to ELK token holders via quadratic voting.

Keeping an eye on these developments will help you gauge the protocol’s long‑term viability and potential impact on the broader DeFi landscape.

Frequently Asked Questions

What chains does ElkNet currently support?

ElkNet operates on Ethereum, BNB Chain, Avalanche, Polygon, Fantom Opera and Huobi Eco. The team regularly adds new networks, so check the official site for the latest list.

How does the Exploit Insurance fund work?

Ten million ELK are locked in a dedicated contract. If a bridge exploit is confirmed within three days, the protocol burns the necessary amount of ELK from this pool to reimburse affected users, ensuring total supply never exceeds the 42.42million cap.

Can I earn passive income with ELK?

Yes. By providing liquidity to ElkNet pools or staking ELK in the Farming Emissions contract, you can collect a share of the protocol fees and additional reward tokens.

Is Elk Finance safe to use?

The platform has undergone multiple audits and runs an insurance fund to cover potential attacks. While no system is 100% risk‑free, the built‑in protections and transparent governance make it one of the more secure cross‑chain bridges available.

How can I participate in Elk Finance governance?

Hold ELK in a wallet that supports voting (e.g., MetaMask) and connect to the governance portal on elk.finance. Proposals are submitted and voted on directly on‑chain, with each ELK counting as one vote.

stephanie lauman

October 4, 2025 AT 08:38It is evident, upon meticulous examination of Elk Finance’s architecture, that the purported “fee‑free” paradigm is a veneer masking a series of hidden cost vectors embedded within the protocol’s smart‑contract logic 🧐. The Exploit Insurance fund, while marketed as a safeguard, actually serves as a contingency reserve that could be commandeered under the guise of a “security breach”, thereby diluting token value for unsuspecting holders. Moreover, the Treasury’s 5 million ELK allocation, ostensibly earmarked for development, lacks transparent audit trails, raising legitimate concerns about fiscal misappropriation. The cross‑chain bridge’s reliance on a centralized governance model, despite claims of decentralization, introduces a single point of failure that can be exploited by malicious actors. Historical precedents from other bridges demonstrate that such centralization often culminates in catastrophic exploits, as documented in multiple forensic analyses. The insurance mechanism, predicated on a three‑day reimbursement window, is insufficient given the rapid propagation of attacks across interoperable networks. Additionally, the tokenomics allocate a disproportionate 10 million ELK to farming emissions, creating inflationary pressure that erodes staking returns over time. The lack of rigorous third‑party audits beyond the initial code review further amplifies risk, especially when considering the rapid deployment cycles characteristic of the project. Users should remain vigilant, scrutinizing the immutable ledger for anomalous token movements that may indicate underlying malfeasance. The governance voting power, weighted by token holdings, inevitably consolidates influence among early investors, marginalizing the broader community. This concentration of power undermines the egalitarian ethos purported by the platform. Furthermore, the bridge’s performance metrics, touted as sub‑second, are contingent upon optimal network conditions rarely replicated under peak load. Any deviation can result in delayed settlements, exposing users to market volatility. The interoperability promise, while technically feasible, does not account for regulatory compliance across jurisdictions, potentially leading to legal entanglements. In light of these considerations, a prudent approach would entail limiting exposure to ELK tokens until comprehensive, independently verified safeguards are instituted. Ignoring these red flags could result in substantial financial losses for the uninformed participant.

Twinkle Shop

October 7, 2025 AT 10:34From a macro‑economic perspective, the integration of multi‑chain liquidity pools within the ElkNet framework represents a paradigmshift toward substrate‑agnostic asset interchangeability. By abstracting underlying consensus mechanisms, the protocol facilitates a seamless transmutation of value vectors across heterogeneous ledger topologies, thereby attenuating inter‑operability friction. The tokenomic schema, delineated by a bifurcated allocation matrix, ostensibly optimizes capital efficiency while preserving fiscal equilibrium. Nevertheless, the proportionality of the Exploit Insurance reserve vis‑à‑vis circulating supply warrants a granular quantitative assessment to elucidate systemic resilience. It is incumbent upon stakeholders to engage in rigorous stochastic modeling to forecast emergent liquidity dynamics under variable stress scenarios. Furthermore, the governance architecture, predicated upon token‑weighted deliberation, necessitates a calibrated quorum threshold to preempt governance capture. The consortium’s roadmap, encompassing Layer‑2 augmentations, portends incremental scalability enhancements, yet concomitant security audits must be iteratively synchronized. In synthesis, Elk Finance epitomizes a confluence of innovative cross‑chain orchestration and complex tokenomic stratification, demanding vigilant scholarly scrutiny.

Greer Pitts

October 10, 2025 AT 12:29hey fam, i just tried the bridge and it was super smooth, like literally seconds. if u got any ELK, you might wanna stake it for extra rewards, it's pretty chill.

Lurline Wiese

October 13, 2025 AT 14:24OMG, the whole thing feels like a rollercoaster – one moment you’re cruising across chains, the next you’re wondering if the insurance even exists! 🙄

Jenise Williams-Green

October 16, 2025 AT 16:19The moral calculus of endorsing a platform that hides its fee structure behind “zero‑fee” hype is fundamentally flawed. By turning a blind eye to the opaque treasury allocations, we tacitly endorse financial obfuscation. Such complicity erodes the ethical foundations of decentralized finance.

Cathy Ruff

October 19, 2025 AT 18:14this is a total scam no one should trust

Marc Addington

October 22, 2025 AT 20:10America built the original internet, and now these foreign‑run bridges try to hijack it. We need home‑grown solutions, not Elk’s gimmicks.

Eva Lee

October 25, 2025 AT 22:05From an engineering standpoint, the contract‑level atomicity ensures that the lock‑mint‑burn cycle maintains invariant state across disparate ledgers.

However, the lack of explicit rollback mechanisms in the event of partial failure could precipitate state divergence, a scenario that merits immediate remediation.

Kortney Williams

October 28, 2025 AT 23:00In contemplating the broader implications of cross‑chain liquidity, one might reflect on the philosophical notion of value fluidity. Elk Finance endeavors to dissolve the barriers that fragment digital assets, thereby fostering a more interconnected economic tapestry. Such endeavors, while ambitious, must be tempered with rigorous risk assessment. Collaboration among community members can guide the protocol toward sustainable maturity.

Adarsh Menon

November 1, 2025 AT 00:55oh great another bridge that claims 7 seconds

yeah right, like that ever works in real life

Matt Nguyen

November 4, 2025 AT 02:50One must appreciate the nuanced engineering that underpins ElkNet’s cross‑chain orchestration, albeit without succumbing to the prevailing hysteria regarding “fee‑free” transactions. The deliberate allocation of ten million ELK to an insurance fund is a calculated stratagem to mitigate systemic risk, contrary to popular conjecture alleging hidden contingencies. Nevertheless, the opacity surrounding treasury disbursements engenders a legitimate suspicion of potential expropriation, a concern that cannot be dismissed lightly. Scholars should therefore engage in methodical exegesis of the on‑chain governance proposals to ascertain the veracity of these allocations. In sum, the protocol’s architecture warrants commendation, yet vigilance remains paramount.

Shaian Rawlins

November 7, 2025 AT 04:46It’s really exciting to see a project that aims to bring people together across different blockchains, making it easier for everyone to move their assets without paying high fees. The idea of a cross‑chain bridge that works in seconds can help many users who are new to crypto feel more confident. While the insurance fund is a good safety net, it’s also important for the community to stay informed and ask questions. Collaboration between developers and users can create a more transparent environment. By supporting projects like Elk Finance, we can encourage innovation that benefits the whole ecosystem. Let’s keep the conversation positive and constructive.

Scott McReynolds

November 10, 2025 AT 06:41The vision of seamless, fee‑free cross‑chain swaps is truly inspiring, and Elk Finance appears to be charting a bold course toward that future. By leveraging a unified liquidity pool, the protocol reduces slippage and opens up new possibilities for DeFi creators. If the community rallies around transparent governance, the platform can evolve into a cornerstone of the multi‑chain economy. Each participant, whether staking ELK or providing liquidity, plays a vital role in cementing its success. Keep the optimism alive, and the momentum will carry us forward.

Alex Gatti

November 13, 2025 AT 08:36What are the specific metrics used to evaluate bridge performance across the six supported chains? Understanding these benchmarks can help users gauge reliability and security. It would be great if the team publishes regular reports.

John Corey Turner

November 16, 2025 AT 10:31In the grand tapestry of decentralized finance, Elk Finance weaves a vibrant thread that connects disparate realms with dazzling efficiency. Its tokenomics, a kaleidoscope of allocations, reflect a daring experiment in resource distribution. Yet, like any bold brushstroke, it risks over‑saturation without careful moderation. Let us contemplate the symphony of incentives and ensure harmony prevails.

Promise Usoh

November 19, 2025 AT 12:26While the concept of a cross‑chain bridge is commendable, the execution requieres careful scrutiny. Any latent vulnerabilitis could be exploited, undermining user trust.

Tyrone Tubero

November 22, 2025 AT 14:22Honestly the whole thing sounds like a fancy gimmick that will fade fast. People will soon see the real value, or lack thereof.

Bhagwat Sen

November 25, 2025 AT 16:17The bridge’s fast settlement times are impressive, yet the underlying security audits should be more transparent. Community members deserve clear documentation of risk assessments. Providing such info will strengthen user confidence.

Miranda Co

November 28, 2025 AT 18:12I get why you’d be skeptical, but the insurance fund does provide a real safety net. Don’t let fear stop you from exploring its potential.

mukesh chy

December 1, 2025 AT 20:07Oh, sure, “zero‑fee” bridges are the answer to all crypto problems-said no one who’s read the fine print. The reality is a hidden cost structure that most users miss.

Laurie Kathiari

December 4, 2025 AT 22:02It’s almost comical how some people glorify a project that hides its financials behind vague promises. Such blind faith only fuels the hype machine that benefits a select few. Wake up and demand real transparency.

Jim Griffiths

December 7, 2025 AT 23:58For newcomers, start by staking a small amount of ELK to test the farming rewards. Monitor the APY and adjust your position as needed.

Cynthia Rice

December 11, 2025 AT 01:53In the abyss of DeFi, Elk Finance is the glittering mirage we chase.

Taylor Gibbs

December 14, 2025 AT 03:48Hey folks, if you’re looking to get into cross‑chain swaps, start with a modest amount and watch how the bridge performs. Keep an eye on the governance votes-they shape the future of the protocol. Share your experiences so we can all learn together.

Rob Watts

December 17, 2025 AT 05:43Push your limits but stay smart the bridge is fast yet not invincible keep your risk low

Amal Al.

December 20, 2025 AT 07:38It is essential, dear community, to engage with Elk Finance responsibly; thorough due diligence is the cornerstone of sustainable participation. Please, review the smart‑contract audits, evaluate the insurance fund parameters, and contribute constructively to governance discussions. Let us, together, foster a resilient and transparent ecosystem.