Crypto Legal Consequences: What Happens When You Break the Rules

When you trade, mine, or hold cryptocurrency, you’re not just dealing with technology—you’re dealing with crypto legal consequences, the real-world penalties and obligations tied to using digital assets under national laws. Also known as cryptocurrency regulations, these rules are no longer optional. They’re enforced by governments, tax agencies, and financial watchdogs—and ignoring them can cost you more than just money.

Many people think crypto is lawless, but that’s a myth. In places like South Korea, a country with strict crypto tax rules ranging from 5% to 45% on gains, failing to report your trades can lead to audits, back taxes, and fines. In Algeria, where crypto was banned in 2025, even holding digital assets can land you in legal trouble. And in China, using a VPN to bypass crypto restrictions carries serious legal risks, including criminal charges. These aren’t edge cases—they’re real examples of how crypto legal consequences hit people every day.

It’s not just about bans. KYC crypto, the process of verifying your identity to use exchanges, is now standard on almost every major platform. If you skip it, you can’t trade. If you lie on your application, you’re committing fraud. And when exchanges like OKX block users in the U.S. or UK, it’s not because they’re being picky—it’s because they’re following local laws. The same goes for crypto tax, where failing to report gains can trigger IRS-style investigations. You don’t need to be a millionaire to get caught. A $500 profit from a meme coin can be enough to trigger a notice.

Even charity donations made with crypto aren’t exempt. If you donate to a nonprofit using blockchain, you still need to track the value at the time of donation for tax purposes. The technology doesn’t erase your legal duties—it just changes how you prove them. And if you’re thinking about moving to a zero-tax crypto country, a place where you might avoid capital gains taxes, remember: residency rules, income thresholds, and reporting requirements still apply. You can’t just show up and claim tax freedom.

Underground markets in places like Myanmar and Egypt thrive because people avoid the rules—but they pay for it in higher prices, scams, and lost funds. The premium you pay for crypto in a banned country isn’t just market demand—it’s a tax on risk. And if you get caught, there’s no refund.

What you’ll find below aren’t just articles about coins or airdrops. They’re real-world case studies on how crypto legal consequences shape what you can do, where you can do it, and what happens when you push the limits. Some posts show you how to stay compliant. Others warn you what not to do. All of them are grounded in actual laws, real penalties, and the choices people are making right now.

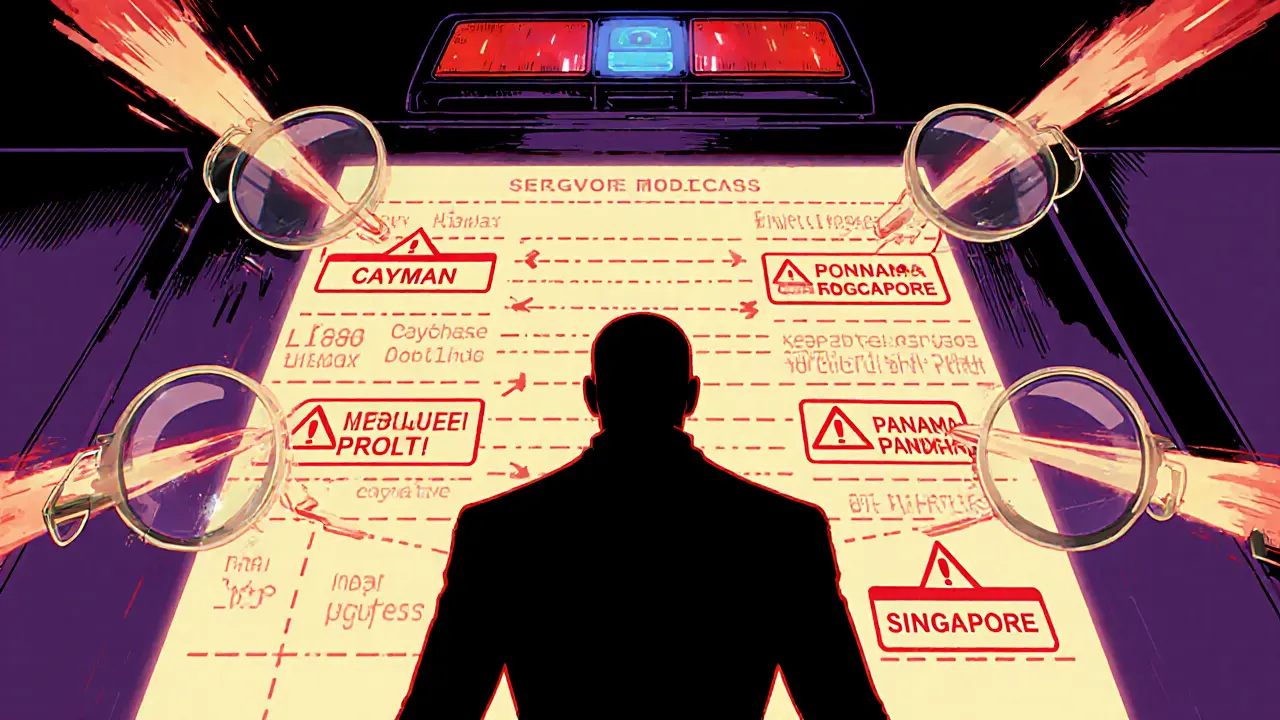

Offshore Crypto Accounts: How Detection Works and What Happens If You Get Caught

Offshore crypto accounts are no longer safe from detection. Learn how blockchain tracing, global regulations, and AI tools make hiding crypto risky-and what legal consequences you could face if caught.

November 5 2025