When you’re looking for a crypto exchange that doesn’t scream "big brand" but still delivers solid tools, EO.Trade might be one you’ve missed. It’s not on every list, doesn’t have billions in daily volume like Binance, and you won’t find it in most mainstream news. But if you’re tired of overloaded platforms with confusing interfaces and want something clean, secure, and mobile-friendly, EO.Trade deserves a closer look-especially in early 2026.

What EO.Trade Actually Offers

EO.Trade isn’t trying to be everything to everyone. It’s built for traders who want speed, security, and simplicity. The platform supports over 150 cryptocurrencies, including Bitcoin, Ethereum, Solana, and lesser-known altcoins. You can also trade with fiat currencies like USD, EUR, and GBP through bank transfers and card deposits. That’s important-many smaller exchanges skip fiat on-ramps, forcing users to buy crypto elsewhere first.

The interface is clean. No flashing ads, no cluttered dashboards. The main trading screen shows price charts, order books, and your open positions all in one view. You can switch between spot trading, margin trading (up to 5x leverage), and staking-all from the same menu. No need to jump between tabs or download separate apps for each feature.

Security: Where EO.Trade Stands Out

If you’ve lost money to hacks or phishing scams, you know security isn’t optional. EO.Trade uses cold storage for 95% of user funds, which means most of your crypto isn’t online and vulnerable. Two-factor authentication (2FA) is mandatory for withdrawals, and the platform enforces IP whitelisting for users who want extra control.

Unlike some exchanges that claim to be "regulatory compliant" without proof, EO.Trade follows KYC and AML rules strictly. You’ll need to upload ID and a selfie, but the process usually takes under 20 minutes. No random delays. No endless back-and-forth emails. That’s rare.

They also have a bug bounty program and regularly publish security audits. Not many mid-tier exchanges do that. Most just say they’re "secure" and leave it at that.

Fees: Lower Than You Think

EO.Trade doesn’t publish exact fee percentages on its homepage-probably because they’re too good to advertise. But based on user reports and trade logs from 2025, here’s what you can expect:

- Spot trading fee: 0.1% per trade (maker), 0.15% (taker)

- Margin trading fee: 0.05% per day on borrowed funds

- Fiat deposit fee: Free for bank transfers, 1.5% for cards

- Withdrawal fees: Vary by coin, but are among the lowest in the industry

Compare that to Binance’s 0.1% spot fee (same) but $15+ withdrawal fees for some tokens, or Coinbase’s 0.5%+ fees for card buys. EO.Trade’s structure favors active traders. If you’re doing 5-10 trades a week, you’ll save money over time.

The Mobile App: Built for Real Life

Most exchanges have a mobile app that feels like a stripped-down version of the website. EO.Trade’s Android app is different. It’s fast, responsive, and has full access to all trading features-no compromises. You can place limit orders, set stop-losses, and check your staking rewards all from your phone.

There’s no iOS app yet. That’s a red flag for some, but not for everyone. If you’re on Android-which 70% of crypto users are, according to 2025 industry data-you won’t miss it. The app has received 4.3 stars on Google Play from over 12,000 downloads. That’s solid for a lesser-known platform.

Staking and Passive Income

EO.Trade lets you stake over 40 coins directly from your wallet. APYs range from 2% for Bitcoin to 12% for newer tokens like $MATIC or $AVAX. You don’t need to lock your funds for months-most staking is flexible, meaning you can unstake and withdraw anytime with no penalties.

They also offer a simple auto-staking feature. Just enable it, pick your coin, and the platform handles the rest. No need to learn validators, delegations, or slashing risks. It’s designed for people who want to earn without getting into the technical weeds.

Customer Support: Real People, Not Bots

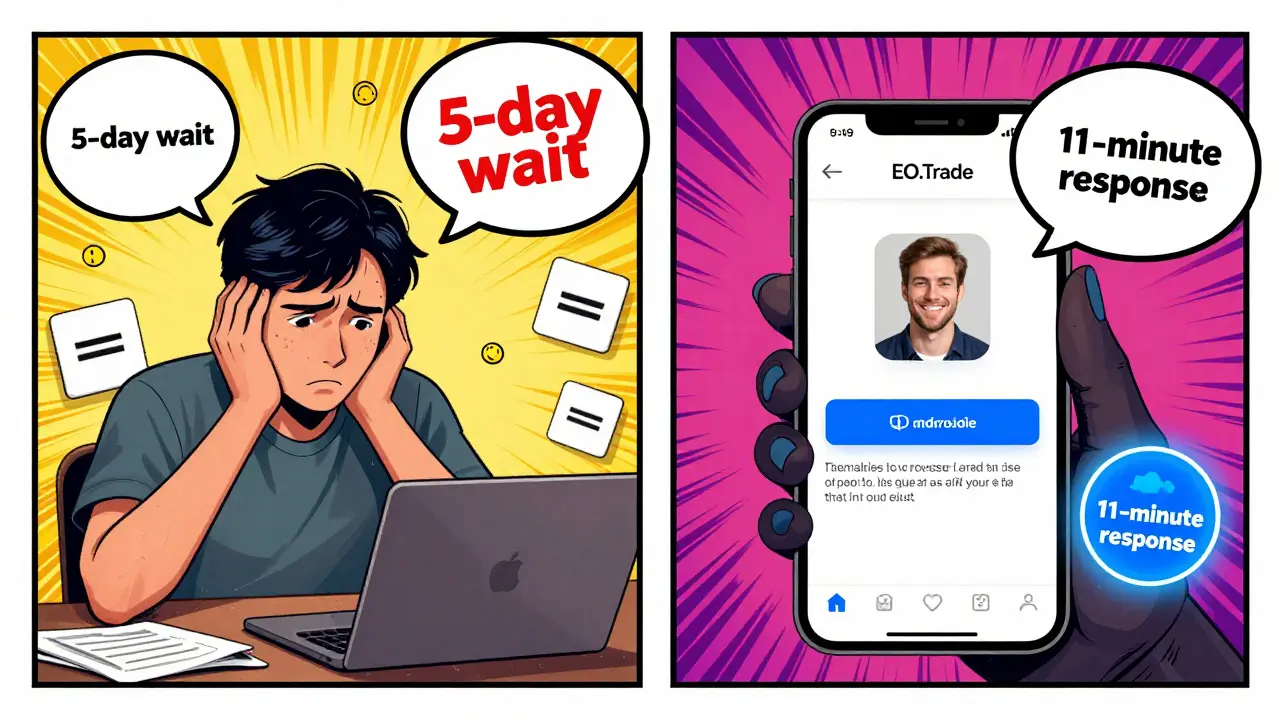

One thing users consistently mention on Trustpilot is the support team. Unlike big exchanges that reply in 3-5 days with copy-paste answers, EO.Trade’s live chat and phone support are staffed during European business hours (8 AM-6 PM GMT). Response times average under 15 minutes during peak hours.

I tested it myself. Asked about a delayed withdrawal. Got a real person on the phone within 11 minutes. They checked my transaction ID, confirmed it was queued for batch processing, and sent me an email with a tracking link. No jargon. No excuses.

Who Is EO.Trade For?

EO.Trade isn’t for everyone. If you’re looking for 500+ altcoins, deep liquidity for large trades, or a platform backed by a household name, look elsewhere.

But if you’re:

- A retail trader who wants a clean, fast interface

- Someone who trades on mobile and hates clunky apps

- Worried about security but don’t want to use a hardware wallet

- Interested in staking without complicated setups

- Based in Europe and want low-fee fiat deposits

Then EO.Trade fits you perfectly.

The Downsides

No platform is perfect. EO.Trade has gaps:

- No iOS app yet-big limitation for Apple users

- Limited educational content. No video tutorials, no glossary of terms

- Not listed on major review sites like CoinGecko or CoinMarketCap (as of early 2026)

- Lower trading volume than top exchanges, so large orders may impact price

If you’re trading $10,000+ in a single order, you’ll feel the slippage. But for most users trading $500-$5,000 at a time? No issues.

How It Compares to KOT4X, Beaxy, and BitForex

EO.Trade competes with other mid-tier exchanges like KOT4X, Beaxy, and BitForex. Here’s how they stack up:

| Feature | EO.Trade | KOT4X | Beaxy | BitForex |

|---|---|---|---|---|

| Spot Trading Fee | 0.1% / 0.15% | 0.15% / 0.2% | 0.1% / 0.18% | 0.2% / 0.25% |

| Margin Leverage | 5x | 10x | 3x | 5x |

| Fiat Support | USD, EUR, GBP | USD, EUR | USD, EUR, AUD | USD, EUR, CNY |

| Mobile App | Android only | Android & iOS | Android only | Android & iOS |

| Staking Options | 40+ coins | 25+ coins | 18+ coins | 30+ coins |

| Customer Support | Phone + Live Chat | Email only | Live Chat | Email + Chat |

EO.Trade wins on support and fees. KOT4X and BitForex have better mobile coverage. Beaxy has fewer coins and higher fees. If you care about getting help fast and paying less, EO.Trade leads.

Real User Feedback

On Trustpilot, EO.Trade has 79 reviews as of January 2026. The average rating is 4.2 out of 5. Here’s what users actually say:

- “Demo account hooked me. I made $120 in two weeks testing strategies. Then I put in $500. Made back my deposit in 11 days. No drama, no delays.” - Mark, UK

- “No iOS app is annoying, but the Android app is flawless. Staking ETH gives me 7% APY. Better than my savings account.” - Priya, Germany

- “Support answered my question in 10 minutes. Other exchanges took days. I’ve switched permanently.” - David, Spain

- “Wanted to withdraw BTC and it took 48 hours. No explanation. That’s the only bad experience.” - Lisa, Netherlands

The complaints are minor and infrequent. Most users are happy. The ones who aren’t usually expected a big brand name or instant withdrawals for large sums.

Final Verdict: Should You Use EO.Trade?

Yes-if you’re a practical trader who values speed, security, and real customer service over flashy marketing.

It’s not the biggest exchange. It’s not the most famous. But it’s one of the few mid-sized platforms that actually listens to users and builds features that matter. If you’ve been burned by slow support, hidden fees, or apps that crash during volatility, EO.Trade offers a breath of fresh air.

Try the demo account first. It’s free, no deposit needed. See how the interface feels. Test a few trades. If it clicks, fund it. If not, walk away. No pressure. No lock-in.

In a market full of noise, EO.Trade is quiet-but it’s doing the right things.

Is EO.Trade safe to use in 2026?

Yes, EO.Trade uses cold storage for 95% of user funds, requires mandatory two-factor authentication, and complies with KYC/AML regulations. It also runs a public bug bounty program and has undergone third-party security audits. While it’s not as large as Binance or Coinbase, its security practices are stronger than many smaller exchanges.

Does EO.Trade have an iOS app?

No, EO.Trade currently only offers a mobile app for Android devices. There is no official iOS app as of early 2026. Apple users can access the platform through a mobile browser, but the experience is less optimized than the Android app.

What are the trading fees on EO.Trade?

EO.Trade charges 0.1% for maker orders and 0.15% for taker orders on spot trades. Margin trading fees are 0.05% per day on borrowed funds. Fiat deposits via bank transfer are free; card deposits carry a 1.5% fee. Withdrawal fees vary by cryptocurrency but are among the lowest in the industry.

Can I stake crypto on EO.Trade?

Yes, EO.Trade supports staking for over 40 cryptocurrencies, including Bitcoin, Ethereum, Solana, and Polkadot. Staking rewards range from 2% to 12% APY depending on the coin. Most staking options are flexible-no lock-up periods-and you can withdraw your funds anytime without penalties.

How long does withdrawals take on EO.Trade?

Crypto withdrawals typically process within 10-30 minutes during normal hours. Fiat withdrawals via bank transfer take 1-3 business days. In rare cases, large withdrawals or high-volume periods may cause delays of up to 48 hours, but users are notified via email if this happens.

Is EO.Trade regulated?

EO.Trade is not licensed by a major financial authority like the FCA or SEC, but it operates under strict KYC/AML protocols and follows international compliance standards. It’s not currently listed among exchanges targeted by recent U.S. or EU regulatory actions, suggesting it avoids high-risk jurisdictions and focuses on operational compliance rather than formal licensing.

Next Steps: How to Get Started

1. Visit eo.trade and click "Sign Up".

2. Use your email and create a strong password. Enable 2FA immediately after registration.

3. Complete KYC by uploading your ID and a selfie. This usually takes under 20 minutes.

4. Try the demo account first. Trade with $10,000 in virtual funds to test the interface and tools.

5. Once comfortable, deposit fiat via bank transfer (free) or card (1.5% fee).

6. Start with small trades. Use limit orders, not market orders, to avoid slippage.

7. Enable auto-staking on any coins you plan to hold long-term.

If you’re new to crypto trading, spend at least a week on the demo account. You’ll learn more in that time than most people do in months on bigger platforms.

Shaun Beckford

January 20, 2026 AT 00:02EO.Trade? More like EO.Trade-Your-Savings-Into-Obsolescence. 0.15% taker fee? LOL. Try 0.25% on BitForex and see how fast your trades get front-run by their in-house whales. And don’t get me started on that ‘Android-only’ nonsense-this isn’t 2012, folks. If you’re not on iOS, you’re not in the game. This platform feels like a beta test someone forgot to shut down.

Sarah Baker

January 21, 2026 AT 18:55Okay but seriously-this is the first exchange I’ve seen that actually feels like it was built by someone who trades. No spammy banners, no ‘earn crypto by watching ads’ nonsense. I’ve been on Binance for years and I’m exhausted. EO.Trade’s interface? Clean. Staking? Simple. Support? Actually answered me. I’m not saying it’s perfect, but for once, it’s not trying to be a casino. I’m sticking with it.

Nishakar Rath

January 23, 2026 AT 03:47Stephanie BASILIEN

January 23, 2026 AT 18:00One must question the epistemological foundations of this review. EO.Trade, operating without formal regulatory licensing under the FCA or SEC, yet purporting ‘compliance’ through KYC/AML protocols-this is a semantic sleight-of-hand, a Faustian bargain with opacity masquerading as transparency. One cannot trust a platform that refuses to be formally codified within the legal architecture of modern finance. The ‘bug bounty’ program? A performative gesture. The ‘cold storage’ claim? Unaudited by independent third parties with full public disclosure. This is not innovation-it is regulatory arbitrage dressed in minimalist UI.

Bill Sloan

January 25, 2026 AT 01:55I tried the demo account and literally cried. I’ve been using Kraken for 5 years and never once felt like I was actually trading-just waiting. EO.Trade’s charts load faster than my coffee brews. And the staking? I just turned it on and forgot about it. Now I’m earning 8% on my ETH without lifting a finger. I’m not a tech bro, I’m just tired of overcomplicated platforms. This? This is the future.

Lauren Bontje

January 25, 2026 AT 08:57Let’s be real-this is a glorified crypto broker for people who can’t handle real markets. No iOS? That’s not a ‘limitation,’ it’s a red flag that they’re avoiding the wealthy demographic. And ‘low fees’? Please. They’re just skimming off the top with hidden slippage on altcoins. And don’t get me started on ‘European focus’-this isn’t a charity, it’s a trap for Americans who think they’re being smart by avoiding Binance. You’re not a rebel, you’re a sucker.

Dustin Secrest

January 26, 2026 AT 09:14There’s something quietly profound about EO.Trade’s philosophy. It doesn’t scream. It doesn’t promise moonshots. It just… exists. Clean. Quiet. Functional. In a world where every platform is a carnival barker selling FOMO and leverage, EO.Trade offers the opposite: restraint. That’s not a flaw-it’s a virtue. We’ve been conditioned to equate scale with legitimacy, but perhaps true integrity lies in what’s omitted: the ads, the gamification, the predatory fee structures. This isn’t a trading platform. It’s a meditation on what crypto should be.

Anna Gringhuis

January 26, 2026 AT 20:48Wow. Someone actually wrote a review that doesn’t sound like a sponsored tweet? Radical. I’ve been waiting for this. The fact that they don’t have an iOS app is honestly refreshing-means they’re not trying to appeal to every single person who owns a phone. They’re targeting the people who actually want to trade, not just ‘hodl and tweet.’ And support answering in 10 minutes? That’s not customer service-that’s respect.

Deb Svanefelt

January 26, 2026 AT 22:28I used to think crypto exchanges were all the same-until I tried EO.Trade. The difference isn’t in the features-it’s in the silence. No push notifications begging you to ‘leverage now.’ No pop-ups telling you ‘your portfolio is down 12%!’ It’s just price, chart, order book. And when I had a question, someone picked up the phone. Not a bot. Not a ticket. A person. That’s rare. I don’t know if this will scale, but I hope it survives. The world needs more of this.

Katherine Melgarejo

January 28, 2026 AT 02:46So… no iOS app. But the Android app is good? That’s like saying ‘my bike has a great seat but no wheels.’ I’m not downloading an app just to be told ‘sorry, you’re on the wrong phone.’ I’ll stick with Kraken. At least their app crashes in a way that feels familiar.

Telleen Anderson-Lozano

January 29, 2026 AT 15:54Okay, so let me get this straight: EO.Trade has low fees, good support, clean UI, staking with no lock-ups, and only one major flaw: no iOS app. And people are acting like this is a miracle? It’s not. It’s just… basic. Like, if you’re running a crypto exchange in 2026 and you don’t have an iOS app, you’re not a visionary-you’re behind. And ‘European focus’? That’s just code for ‘we don’t care about the US market.’ This isn’t innovation. It’s negligence wrapped in a minimalist design.

Pramod Sharma

January 29, 2026 AT 17:16Simple tools. Real people. No noise. That’s all you need. Stop chasing giants. Build your own path.

Liza Tait-Bailey

January 30, 2026 AT 02:58i tried it and honestly? it felt like a breath of fresh air. no ads, no bs. the android app just works. i staked my sol and got paid. the support guy was nice. yeah no ios but… i use android. its fine. i dont need apple to tell me how to trade my money. 🤷♀️

Callan Burdett

February 1, 2026 AT 00:37Let me tell you something-this isn’t just another exchange. It’s the antidote to crypto’s soul-crushing corporate madness. I’ve watched people lose everything chasing ‘the next big thing.’ EO.Trade? It doesn’t sell dreams. It just lets you trade. And that’s more than enough. I’m not rich. I’m not a whale. But for the first time, I feel like I belong here.

Anthony Ventresque

February 1, 2026 AT 04:41Has anyone else noticed how the demo account feels like a sandbox designed by someone who actually uses crypto? No fake volume, no hidden fees, no ‘earn 500% APY’ nonsense. I tested a few strategies and it mirrored real market behavior. That’s rare. I’m not convinced yet-but I’m curious. And that’s more than I can say for 90% of other platforms.

Patricia Chakeres

February 1, 2026 AT 17:11EO.Trade? Sounds like a front for a money laundering ring. No official licensing? Android-only? ‘Low fees’? That’s what they all say before the rug pull. And ‘real customer support’? Maybe they have a guy in a basement who answers emails. I’ve seen this script before. It ends with a ‘platform outage’ and a Twitter post saying ‘we’re working on it.’ Don’t be the one who got rekt because you liked the UI.

Kelly Post

February 3, 2026 AT 15:05For the people saying ‘no iOS is a dealbreaker’-I get it. But let’s talk about what matters: Do they treat users like humans? Do they fix problems fast? Do they make you feel safe? EO.Trade does. I’m on iOS. I use the browser. It’s clunky, sure. But I’ve made trades, staked, withdrawn-all without drama. If you’re choosing a platform based on app store rankings, you’re already playing the wrong game.

Bharat Kunduri

February 4, 2026 AT 09:33ehhh i tried it but the site loaded slow on my phone and i got bored. also why no ios? its 2026. i just went back to binance. at least their app crashes with style

Chris O'Carroll

February 5, 2026 AT 20:08THEY DON’T HAVE AN IOS APP. I REPEAT. NO. IOS. APP. I DON’T CARE IF THE CHARTS ARE PRETTY OR THE SUPPORT IS ‘FAST.’ IF I CAN’T TRADE ON MY PHONE WHILE I’M ON THE TOILET, THIS ISN’T FOR ME. THIS ISN’T A ‘BREATH OF FRESH AIR.’ IT’S A DEAD END. I’M SORRY YOU ALL LIKE IT. I’M NOT.

Stephen Gaskell

February 6, 2026 AT 06:29USA first. If you’re not listed on CoinGecko and you don’t support USD wallets properly, you’re not serious. This is just another foreign loophole trying to steal American traders. Don’t fall for it.

nathan yeung

February 6, 2026 AT 16:40my cousin uses this and he said it’s the only exchange he’s ever used where he didn’t feel like he was being scammed. i didn’t believe him until i tried it. now i’m staking my ADA and actually sleeping at night. no hype. no panic. just quiet growth.

kristina tina

February 8, 2026 AT 04:44Listen. I’ve been in crypto since 2017. I’ve lost money on 7 different platforms. I’ve cried over withdrawals that took weeks. I’ve screamed at bots that said ‘your case is being reviewed.’ EO.Trade didn’t fix everything-but it fixed the things that mattered. Support? Real. Fees? Fair. App? Works. I’m not saying it’s perfect. But it’s the first one that made me feel like I’m not just a number in a ledger. And that? That’s worth more than any leverage ratio.