Celo – Mobile‑First Blockchain Overview

When working with Celo, a mobile‑first, carbon‑negative blockchain platform that enables fast, low‑cost transactions. Also known as Celo Platform, it powers stablecoins and decentralized apps tailored for smartphones. Celo was built to let anyone with a phone join the crypto economy, so you don’t need a laptop or pricey hardware to send value. The network uses a proof‑of‑stake model that keeps energy use low while keeping security high, which means the platform can stay affordable even as more users join.

Why Celo matters for everyday crypto users

The heart of the ecosystem is the Celo Dollar (cUSD), a fiat‑backed stablecoin that stays pegged to the US dollar on the Celo blockchain. Also called a stablecoin, cUSD lets you move dollar‑value across borders in seconds, without the fees typical of banks or other blockchains. Because cUSD runs on Celo, it inherits the same low‑cost, fast settlement that the base layer provides.

Another core piece is the Celo Wallet, a mobile‑first app that stores Celo assets, lets you stake, and interacts with decentralized applications. The wallet’s design assumes you’re on a phone, so the UI is simple, QR code scanning is built‑in, and you can start staking with just a few taps. This lowers the barrier for new users and fuels network security through broader participation.

Beyond stablecoins, Decentralized Finance (DeFi), a suite of financial services built on public blockchains without intermediaries thrives on Celo. DeFi protocols on Celo borrow, lend, and trade assets using cUSD and other native tokens, allowing you to earn yields without leaving your phone. The network’s fast finality means you can swap tokens or take out a loan in under a minute, which is a big win compared to older platforms that can take 10‑30 minutes.

Putting these pieces together forms a clear chain of relationships: Celo encompasses a mobile‑first blockchain, Celo requires cUSD for stable, low‑fee payments, and Celo supports DeFi applications that bring traditional finance to the palm of your hand. The platform also integrates with other ecosystems via interoperable bridges, so assets can move in and out of Celo while keeping transaction costs minimal.

Below you’ll find a curated set of articles that dig deeper into each of these topics. Whether you’re curious about how mining difficulty works on other chains, want to spot legitimate airdrops, or need safety tips for crypto ATMs, the collection gives you practical insights that complement the Celo ecosystem. Dive in to see how the concepts we just covered play out in real‑world guides and analysis.

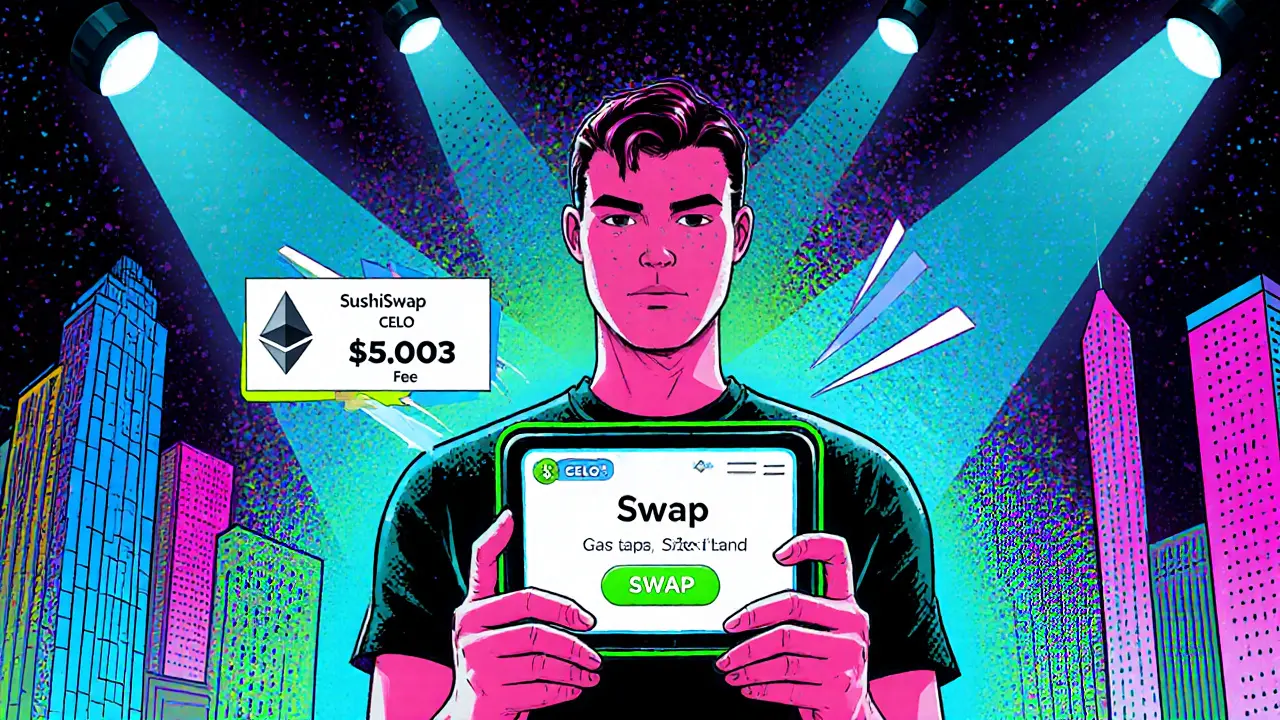

SushiSwap on Celo: In‑Depth Crypto Exchange Review

A detailed review of SushiSwap on Celo covering how it works, fees, rewards, security, and whether it's a good fit for traders and liquidity providers.

January 18 2025