SushiSwap Fee Calculator

Estimated Transaction Costs

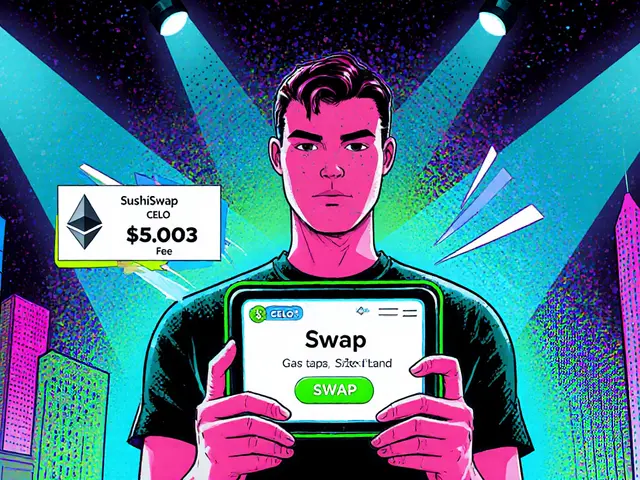

Ever wondered whether a decentralized exchange built for Ethereum can actually work on Celo? SushiSwap (Celo) promises the same low‑fee swaps, liquidity mining rewards and community governance you love on Ethereum, but with the ultra‑fast, low‑cost vibes of the Celo network. This review breaks down the platform’s tech, fees, user experience and the pros and cons of using it on Celo, so you can decide if it’s worth adding to your DeFi toolbox.

Key Takeaways

- SushiSwap runs on Celo as a fully functional AMM, keeping the core SUSHI token and governance model.

- Transaction fees are roughly 1/10 of Ethereum’s, thanks to Celo’s low‑gas design.

- Liquidity pools on Celo are smaller than on Ethereum, which can mean higher slippage for big trades.

- The platform offers the same SushiBar staking and Sushi Academy learning resources on Celo.

- Regulatory uncertainty and limited token listings are the biggest trade‑offs.

What is SushiSwap?

SushiSwap is a decentralized exchange (DEX) that uses an automated market maker (AMM) model to let users swap tokens without an order book. Launched in August2020 as a fork of Uniswap, it adds community‑driven governance, yield farming and the native SUSHI token for staking and voting. Over $3.9billion in liquidity across multiple chains makes it one of the top DEXs by volume.

Why Celo?

Celo was created to bring crypto to mobile‑first users, offering fast finality and near‑zero gas fees. Its proof‑of‑stake consensus keeps transaction costs around a few cents, which is a huge draw for traders who keep getting hit by Ethereum’s high fees. By deploying SushiSwap on Celo, the team aims to combine DeFi’s flexibility with Celo’s user‑friendly economics.

Technical Architecture on Celo

On Celo, SushiSwap retains the same smart‑contract suite you’d find on Ethereum - the Router, Factory and individual Pair contracts - but they’re compiled to Celo’s compatible EVM. This means every feature you know (swap, add/remove liquidity, staking SUSHI in the SushiBar) works the same way, just with cheaper gas.

Key components include:

- Automated Market Maker a pricing algorithm that adjusts token prices based on pool balances, eliminating order books.

- Liquidity Provider any user who deposits equal values of two tokens into a pool and earns a share of swap fees.

- SushiBar, where you can stake SUSHI tokens to earn xSUSHI and a slice of the protocol’s revenue.

How to Get Started on Celo

- Install a Celo‑compatible wallet (e.g., Valora, MetaMask with Celo network added).

- Buy CELO or a stablecoin (cUSD, cEUR) on an exchange and send it to your wallet.

- Navigate to SushiSwap’s web app and click “Connect Wallet”. Choose the Celo network.

- Pick a pool - the most popular ones are CELO/cUSD and SUSHI/CELO - and add liquidity.

- Enter the amount of each token. The UI shows the required ratio automatically.

- Confirm the transaction in your wallet. Gas will be a few cents.

- Start swapping or stake the SUSHI you earned in the SushiBar for additional rewards.

Fees and Rewards

Standard swap fees on SushiSwap are 0.30% of the trade value. Of that, 0.25% goes to liquidity providers and 0.05% is sent to the protocol treasury. On Celo, the fee is the same percentage, but the absolute cost is dramatically lower because gas is cheap.

Liquidity providers on Celo also receive SUSHI rewards on top of the fee share. These rewards are distributed in the same way as on Ethereum, but the total SUSHI pool is smaller, meaning early providers can earn higher APY - often 30‑50% annually for the CELO/cUSD pool, according to recent data from the SushiSwap dashboard.

Token Selection and Liquidity Depth

The biggest limitation on Celo is the number of available tokens. While Ethereum hosts thousands of ERC‑20 assets, Celo’s ecosystem is still growing, with roughly 150 listed tokens. This results in lower total liquidity - the CELO/cUSD pool holds about $120million, compared to Ethereum’s $2billion for the ETH/USDC pair. The practical effect is higher slippage for large orders. If you trade under $5,000, you’ll barely notice; above that, you may want to split the order or use a higher‑liquidity chain.

Comparing SushiSwap on Celo vs. Ethereum and Other DEXs

| Feature | SushiSwap on Celo | SushiSwap on Ethereum | Uniswap on Ethereum |

|---|---|---|---|

| Avg. gas cost (USD) | $0.03 | $4‑$7 | $4‑$7 |

| Liquidity (Top pool) | $120M (CELO/cUSD) | $2B (ETH/USDC) | $2.3B (ETH/USDC) |

| Swap fee | 0.30% | 0.30% | 0.30% |

| SUSHI rewards | Yes, higher APY for early LPs | Yes, standard APY | No |

| Governance token | SUSHI (ERC‑20, bridged to Celo) | SUSHI (ERC‑20) | UNI (ERC‑20) |

| Supported wallets | Valora, MetaMask (Celo), Trust Wallet | MetaMask, Ledger, WalletConnect | MetaMask, Ledger, WalletConnect |

Learning Resources: Sushi Academy

The Sushi Academy a free education hub offering guides, videos and interactive tutorials on swapping, liquidity provision and staking now includes a Celo‑specific section. It walks beginners through wallet setup, gas‑fee estimation and how to read pool metrics. Many users say the step‑by‑step screenshots saved them hours of trial‑and‑error.

Security and Risks

Because SushiSwap is non‑custodial, you keep full control of your private keys. That eliminates the risk of a central exchange hack, but it also means you’re responsible for safeguarding your seed phrase. Smart‑contract bugs are another concern - while the core contracts have been audited, the Celo deployment is newer and hasn’t been tested as extensively as the Ethereum version.

Regulatory uncertainty is a real factor. Since SushiSwap operates without a corporate entity, it isn’t covered by the same consumer‑protection rules that apply to centralized exchanges. If a jurisdiction cracks down on DeFi protocols, Celo users could face sudden restrictions or loss of access.

Pros and Cons Summary

- Pros

- Very low transaction fees - ideal for small swaps.

- Higher APY for early liquidity providers.

- Full SUSHI governance and staking features are present.

- Integrated learning material via Sushi Academy.

- Mobile‑first wallets like Valora make Celo very accessible.

- Cons

- Smaller token list and liquidity pools increase slippage.

- Fewer third‑party integrations compared to Ethereum.

- Smart‑contract audit coverage on Celo is less mature.

- No dedicated customer support - you rely on community channels.

- Regulatory gray area could affect future usability.

Future Outlook

Roadmap updates from the SushiSwap DAO indicate plans to launch a cross‑chain bridge that will let Celo LP tokens be moved to other ecosystems without withdrawing liquidity. If delivered, this could solve the liquidity‑depth problem by allowing “pooled” liquidity across chains.

Additionally, the Celo Foundation is funding DeFi education, which may bring more assets and users to Celo‑based DEXs. Expect token listings to grow steadily over the next 12‑18months.

Bottom Line: Should You Use SushiSwap on Celo?

If you’re a trader who values ultra‑low fees, want to experiment with yield farming, and are comfortable managing your own keys, SushiSwap on Celo is a solid addition to your toolkit. It won’t replace Ethereum for large‑scale swaps, but for everyday trades and small‑to‑medium LP positions, the cost savings are hard to ignore.

Next Steps & Troubleshooting

New to Celo? Start with a tiny amount (e.g., $20) to get a feel for the wallet connection flow. If a transaction fails, double‑check that you’re on the Celo mainnet and that your gas fee limit covers the network’s current base fee (usually under $0.01). For slippage issues, open the “Advanced” settings on the swap page and set a reasonable slippage tolerance (0.5%‑1%).

Frequently Asked Questions

Can I use the same SUSHI token on both Ethereum and Celo?

Yes. The SUSHI token is an ERC‑20 asset that is bridged to Celo’s EVM, so your holdings are recognized on both chains. You’ll need a bridge (e.g., Optics) to move SUSHI between them.

What wallets work with SushiSwap on Celo?

Valora is the flagship mobile wallet, but MetaMask (with the Celo network added), Trust Wallet and the Celo CLI also connect seamlessly.

How do I claim SUSHI rewards on Celo?

After adding liquidity, go to the “Earn” tab, select the pool, and click “Harvest”. Rewards appear as SUSHI in your wallet, ready to stake in the SushiBar.

Is there a demo or test mode for trying SushiSwap on Celo?

No official demo exists. However, you can use Celo’s Alfajores testnet with a small amount of test CELO to practice swaps without real risk.

What are the main security risks?

Key risks include smart‑contract bugs specific to the Celo deployment, loss of private keys, and potential future regulation that could limit access. Using a hardware wallet for large amounts mitigates key‑loss risk.

Brooklyn O'Neill

January 18, 2025 AT 12:49Hey folks, great overview! I’ve been experimenting with SushiSwap on Celo for a few weeks now, and the low‑fee swaps really make a difference when you’re moving small amounts daily. The mobile‑first experience with Valora feels smooth, and the community tutorials helped me get started without any hiccups. If anyone’s still on the fence, giving it a try with a modest amount (like $10‑$20) is a low‑risk way to see the benefits firsthand.

Ciaran Byrne

January 25, 2025 AT 12:49Low gas fees on Celo make tiny trades practically free.

Patrick MANCLIÈRE

February 1, 2025 AT 12:49SushiSwap on Celo keeps the familiar AMM interface you know from Ethereum, so you don’t have to relearn anything new. First, connect a Celo‑compatible wallet like Valora or MetaMask with the Celo network added. Once your wallet shows a CELO balance, head to the SushiSwap web app and click “Connect Wallet”. The UI automatically switches to the Celo chain, and you’ll see the pool list. Choose a popular pool such as CELO/cUSD or SUSHI/CELO, then click “Add Liquidity”. The platform will calculate the required token ratio and display the amount of each token you need to deposit. Confirm the transaction in your wallet – the gas cost will be just a few cents, often under $0.05. After the transaction is mined, you’ll receive LP tokens representing your share of the pool. You can now earn a portion of the 0.30% swap fee plus SUSHI rewards that are automatically distributed. To claim rewards, go to the “Earn” tab, select your pool, and click “Harvest”. The harvested SUSHI appears in your wallet and can be staked in the SushiBar for extra yield. When you want to exit, simply click “Remove Liquidity”, specify how much LP you’d like to withdraw, and confirm. The underlying assets plus any accrued fees are sent back to your wallet. Remember to set a reasonable slippage tolerance (0.5%‑1%) in the advanced settings if you’re making larger trades; otherwise you might see a slight price impact. Finally, keep an eye on the pool’s depth – Celo pools are smaller than Ethereum’s, so very large trades could suffer higher slippage. Overall, the experience mirrors Ethereum’s but at a fraction of the cost, making Celo a compelling option for frequent, small‑scale swaps.

Carthach Ó Maonaigh

February 8, 2025 AT 12:49Yo, let’s be real – the gas on Celo is so cheap it’s practically a joke. You can swap tokens while sipping a latte and not even notice the fee. The only downside? You’ll sometimes run into those tiny pools that look like a puddle compared to Ethereum’s ocean. Still, if you’re not moving millions, Celo’s the sweet spot. Just don’t expect the same depth; you might get burned on slippage if you go too big.

Marie-Pier Horth

February 15, 2025 AT 12:49Behold, the grand tapestry of decentralized finance unfurls upon the Celo network, where SushiSwap emerges as a phoenix reborn from the ashes of exorbitant fees. One cannot help but marvel at the elegance of near‑zero gas, a veritable symphony of efficiency that whispers promises of prosperity to the discerning trader. Yet, as we bask in this luminous glow, we must also acknowledge the shadows – the modest liquidity that lingers like a shy debutante at a lavish soiree. In the end, the dance between cost and depth defines our devotion to this wondrous platform.

Gregg Woodhouse

February 22, 2025 AT 12:49i tried it but the gas is so cheap i almost forgot im paying anything lol. the pools are small tho could be better.

F Yong

March 1, 2025 AT 12:49Sure, the low fees look great until the next regulatory crackdown forces all DeFi platforms to shut down overnight. One day you’re swapping CELO for cUSD, the next you’re left holding a worthless token because the government decided to “protect” consumers. It’s a classic “too good to be true” scenario – enjoy the savings while they last.

Sara Jane Breault

March 8, 2025 AT 12:49Totally get the worry about regulations, but remember the community is pretty proactive about security. Keeping your keys safe and using a hardware wallet for larger amounts can mitigate many of those risks. Plus, the SushiAcademy guides are super helpful for newbies.

Ally Woods

March 15, 2025 AT 12:49Honestly, I’m not impressed. The UI feels half‑baked and the pool list is tiny. If you’re already on Ethereum, just stick there.

Kristen Rws

March 22, 2025 AT 12:49Hey! I think it’s actually pretty cool – the fees are low and the learning curve isn’t that steep. Gives u a chance to try deFi without breaking the bank :)

Fionnbharr Davies

March 29, 2025 AT 12:49SushiSwap on Celo offers a compelling blend of accessibility and cost‑efficiency. By leveraging Celo’s proof‑of‑stake architecture, transaction fees drop dramatically, which benefits regular traders. At the same time, the platform retains all core features – AMM swaps, liquidity provision, and SUSHI rewards – ensuring users don’t miss out on functionality. The trade‑off lies in liquidity depth; smaller pools can lead to higher slippage for larger trades. Nonetheless, for everyday swaps and modest LP positions, the savings outweigh the drawbacks. The community resources, such as Sushi Academy, further lower the barrier to entry, making it easier for newcomers to navigate. Overall, Celo presents a viable alternative for cost‑conscious DeFi participants.

Narender Kumar

April 5, 2025 AT 13:49In the annals of distributed finance, the migration of SushiSwap to the Celo network shall be recorded as a momentous stride toward egalitarian accessibility. The diminution of transaction charges, a mere paltry sum, heralds a new epoch wherein the quotidian participant may partake without pecuniary hindrance. Yet, let it be known that the paucity of liquidity may yet cast a shadow upon the lofty aspirations of this venture.

Sabrina Qureshi

April 12, 2025 AT 13:49Wow!!! The elegance of Celo's low‑fee structure is simply breathtaking!!! It makes every swap feel like a victory!!!

Rahul Dixit

April 19, 2025 AT 13:49Listen, the whole thing is a scam orchestrated by the global elite to keep us divided. They’ll let you think you’re saving on fees while they siphon off the real value. Wake up!

CJ Williams

April 26, 2025 AT 13:49🤔💡 Even if you’re skeptical, the community is working hard to bring more assets to Celo. More liquidity means less slippage, and that’s a win for everyone! 🚀

mukund gakhreja

May 3, 2025 AT 13:49Alright, let’s cut the drama – SushiSwap on Celo actually works and the fees are tiny. If you’re serious about DeFi, give it a shot; the learning curve isn’t that steep.

Michael Ross

May 10, 2025 AT 13:49Thanks for the clarification. I’ll test it with a small amount first.