Savings Protection Calculator

Protect Your Savings from Inflation

Egypt's inflation rate exceeds 35% annually. Your savings lose value daily. See how crypto could protect your money against economic collapse.

Important: Cryptocurrency is illegal in Egypt. This tool demonstrates economic reality only. Government penalties include prison time and fines up to $320,000.

Protection Analysis

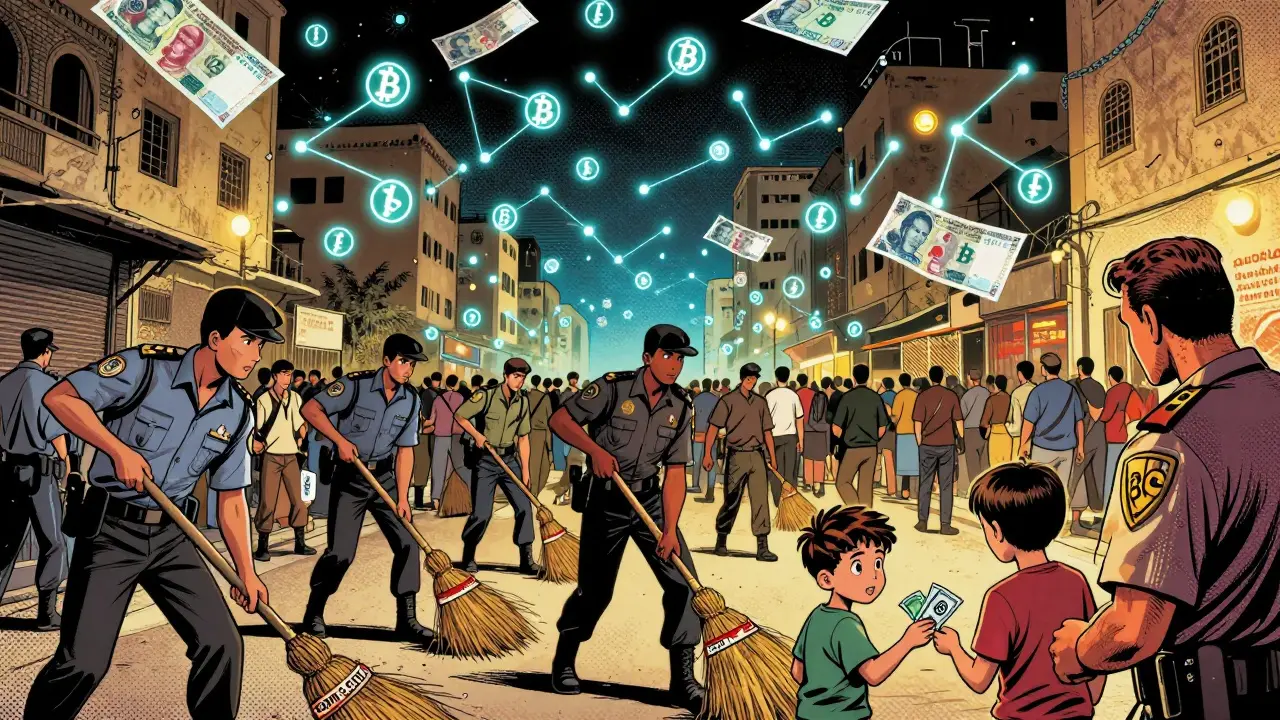

More than three million people in Egypt hold cryptocurrency-even though it’s completely illegal. That’s the startling reality on the ground, despite a law that could land you in prison or force you to pay up to $320,000 in fines. The Central Bank of Egypt banned all crypto activity in 2020, but the ban hasn’t stopped millions from buying, holding, and trading Bitcoin, Ethereum, and other digital assets. How? Because when people want something badly enough, they find a way-even if the government says no.

How Egypt’s Crypto Ban Actually Works

Egypt’s ban isn’t vague. It’s written into law: Article 206 of the Central Bank and Banking System Law No. 194 of 2020. It says no individual, bank, or business can issue, trade, promote, or operate any platform involving cryptocurrency without the Central Bank’s approval. And that approval? It doesn’t exist. Not yet. Not now. So technically, every crypto transaction in Egypt is illegal. The penalties aren’t a slap on the wrist. Violators face prison time and fines between 1 million and 10 million Egyptian pounds-roughly $32,000 to $320,000. That’s more than most Egyptians earn in a decade. Banks are ordered to freeze accounts linked to crypto activity. Payment processors are banned from handling crypto-related transactions. Even advertising crypto services is illegal. The government’s reasons are clear: crypto is too volatile, too untraceable, and too dangerous for the economy. They worry about scams, money laundering, and people losing their life savings overnight. They also don’t want to lose control over the Egyptian pound. If people start using Bitcoin instead of pounds, the central bank loses its grip on inflation, interest rates, and monetary policy.Why Are So Many People Still Using Crypto?

The answer is simple: desperation. Egypt’s economy has been crumbling for years. Inflation hit over 35% in 2024. The Egyptian pound lost more than half its value against the U.S. dollar since 2022. Salaries haven’t kept up. Savings are evaporating. People are looking for any way to protect what little money they have. Crypto isn’t a luxury here-it’s a survival tool. Bitcoin and USDT (Tether) act as digital dollars. People buy them on peer-to-peer platforms like Paxful and LocalBitcoins. They use WhatsApp groups and Telegram channels to find sellers. They pay in cash, meet in coffee shops, or use mobile money apps to transfer funds without touching a bank account. A 2024 survey by a Cairo-based fintech startup found that 1 in 5 Egyptians under 35 have bought crypto at least once. That’s over 8 million people. But not everyone who buys holds on. Many buy just enough to send money abroad or to protect savings for a few weeks. The 3 million figure likely refers to those who actively hold crypto as a long-term store of value-people who’ve converted their life savings into digital assets because they no longer trust the banking system.How Do They Do It Without Getting Caught?

They don’t use banks. They don’t use exchanges registered in Egypt. They use decentralized, off-grid methods. Cash trades are the most common. Someone in Alexandria buys Bitcoin from someone in Cairo by meeting at a mall, handing over cash, and receiving a wallet address. No paper trail. No bank record. Just a QR code and a handshake. Mobile wallets like Apple Pay and Fawry are sometimes used to transfer money to crypto sellers, then the seller sends crypto to the buyer’s private wallet. Since these services aren’t directly linked to crypto, the bank sees only a “payment to merchant,” not “Bitcoin purchase.” Some use VPNs to access foreign exchanges like Binance or Kraken, then withdraw to a personal wallet. They store their keys on hardware wallets or paper wallets-no cloud backups, no phone storage. They don’t talk about it online. They don’t post selfies with their Bitcoin. They know the risks. Enforcement is patchy. The government can’t monitor every WhatsApp group. They can’t track every cash transaction. And even if they shut down one P2P network, three more pop up. The decentralized nature of crypto makes it nearly impossible to fully stop.

The Real Numbers: Is 3 Million Accurate?

No one knows for sure. The Central Bank of Egypt doesn’t track crypto holders. There’s no official data. No census. No registry. So where does the 3 million number come from? It’s an estimate-based on wallet activity, peer-to-peer trade volume, and surveys from crypto platforms operating in the region. A 2024 report from Chainalysis, which tracks crypto adoption in restricted markets, estimated that Egypt had the highest P2P crypto trading volume in Africa. That volume, combined with user growth on platforms like Paxful and Binance P2P, suggests a base of 2.5 to 3.5 million active holders. It’s not perfect data. But it’s the best we have. And it’s backed by real behavior: millions of people are using crypto because they have no other choice.What’s Next? Is the Ban Really Working?

The ban isn’t working. Not really. It’s not about legality anymore. It’s about reality. The government banned crypto, but it didn’t ban the need for it. People still need to save, send money home, and protect their wealth from inflation. And crypto is the only tool that works. There are signs the government is starting to notice. In late 2024, officials from the Central Bank quietly met with blockchain startups in Cairo. Rumors suggest they’re drafting a new law that would allow licensed crypto exchanges to operate under strict oversight. Not legalization-but regulation. That’s a huge shift. From “no crypto ever” to “crypto, but only if we control it.” If that happens, Egypt could become the first major Arab economy to embrace crypto under state supervision. It would mean banks could offer crypto custody. ATMs could dispense crypto-backed vouchers. People could pay bills in USDT. But until then, the law remains harsh-and millions continue to operate in the shadows.

What This Means for the Rest of the Region

Egypt isn’t alone. Algeria and Morocco have similar bans. Tunisia and Nigeria are trying to regulate. But Egypt’s case is unique because of its population size and economic desperation. If Egypt moves toward regulation, other countries will follow. Why? Because you can’t stop people from using technology that protects their money. You can only choose whether to control it-or lose control entirely. Right now, Egypt is caught between two worlds: the old system that’s failing, and the new one that’s illegal. And millions are choosing the new one-even if it means risking prison.What Should You Do If You’re in Egypt?

If you’re thinking about buying crypto in Egypt, understand the risks. The law is clear: it’s illegal. You could lose your money, your account, or your freedom. But if you’re already holding crypto, don’t panic. Millions are. Just be smart:- Never store keys on your phone or cloud.

- Use hardware wallets or paper wallets.

- Don’t talk about it on social media.

- Use cash trades with trusted people.

- Keep your holdings small enough to absorb a loss.

Is it legal to hold cryptocurrency in Egypt?

No, it is not legal. Egypt’s Central Bank banned all cryptocurrency activities under Law No. 194 of 2020. Holding, trading, or promoting crypto is prohibited, and violations can lead to imprisonment or fines up to 10 million Egyptian pounds ($320,000 USD).

How do people in Egypt buy crypto if it’s banned?

People use peer-to-peer (P2P) platforms like Paxful and LocalBitcoins, cash trades, WhatsApp groups, and mobile payment apps. They avoid banks entirely and often meet in person to exchange cash for Bitcoin or USDT. Transactions are conducted off the grid to avoid detection.

Why are so many Egyptians using crypto despite the ban?

Because the Egyptian pound has lost over 50% of its value since 2022, inflation is above 35%, and traditional banks offer no protection. Crypto, especially stablecoins like USDT, acts as a digital dollar-allowing people to save money, send remittances, and avoid currency collapse.

Is the 3 million crypto holders figure real?

There’s no official count, but estimates from blockchain analytics firms like Chainalysis and local fintech surveys suggest between 2.5 and 3.5 million active holders. The number is based on P2P trade volume, wallet activity, and user growth on crypto platforms-despite the ban.

Will Egypt ever legalize cryptocurrency?

There are strong signs it will. In 2024, Central Bank officials met with blockchain firms to discuss licensing frameworks. While no law has passed yet, the shift from total ban to regulated oversight is underway. Egypt may become the first Arab country to allow licensed crypto exchanges under central bank control.

Ian Norton

December 10, 2025 AT 19:54Let me just say this: if you're holding crypto in Egypt, you're not a tech enthusiast-you're a financial refugee. The government's ban is a band-aid on a hemorrhage. People aren't choosing Bitcoin because it's cool-they're choosing it because their savings are turning to dust. This isn't rebellion. It's survival. And the fact that the Central Bank can't stop it? That's the real story.

Sue Gallaher

December 11, 2025 AT 16:56Who cares if they're breaking the law? The Egyptian government is the one that failed. They printed money like it was confetti and now they're mad people found a way out? That's not crypto-it's justice. Let them jail a few million people if they think that'll fix inflation. I'll be over here watching the pound collapse in real time.

Rakesh Bhamu

December 12, 2025 AT 07:43What’s happening in Egypt is a textbook case of monetary desperation meeting technological opportunity. The state tried to control money, but money-real value-doesn’t care about laws. People are using crypto not because they trust it, but because they’ve lost trust in everything else. The real question isn’t ‘how are they doing it?’ It’s ‘why did we let it get this bad?’

And honestly? This isn’t unique to Egypt. Look at Argentina, Lebanon, Nigeria. The pattern’s the same: failed institutions → people turn to decentralized alternatives. The state doesn’t need to ban crypto-it needs to fix the economy.

Hari Sarasan

December 12, 2025 AT 15:58Let’s be brutally analytical here: the 3 million figure is statistically insignificant when compared to Egypt’s 100+ million population. The real metric is velocity of capital flight-not user count. Chainalysis data is flawed because it extrapolates from P2P volume without accounting for wash trading, shell wallets, and bot-driven liquidity. The actual number of active, long-term holders is likely under 800K. The rest are speculators or remittance intermediaries.

Moreover, the Central Bank’s inaction isn’t weakness-it’s strategic. They’re waiting for the bubble to inflate so they can seize assets under anti-money laundering protocols. This isn’t a ban. It’s a trap.

Stanley Machuki

December 14, 2025 AT 08:23People in Egypt aren’t gambling-they’re saving. That’s it. No hype. No moon. Just trying to keep their kids fed. Crypto isn’t the problem. The economy is. And honestly? Good for them for figuring it out before the government did.

Lynne Kuper

December 14, 2025 AT 14:32Oh wow, so the government bans crypto… and people still use it? Shocking. Next you’ll tell me people still use water when the city turns off the pipes. At this point, the real crime isn’t holding Bitcoin-it’s pretending the state has any authority over basic human survival.

John Sebastian

December 16, 2025 AT 10:35I don’t know why anyone would risk prison for crypto. It’s just a digital token. The government has a point. People need to learn responsibility. If you can’t save in your own currency, maybe you shouldn’t be spending so much.

Andy Walton

December 17, 2025 AT 14:54brooo… imagine being so broke you gotta trade cash for btc in a mall like it’s 2008 lol 🤡💸

but also… respect. they’re out here building a new world while the gov’s still arguing over ink on paper 🌍✨

crypto isn’t money… it’s hope with a private key 😭

Candace Murangi

December 19, 2025 AT 05:14I’ve traveled through North Africa, and what’s happening in Egypt isn’t just about tech-it’s about dignity. People aren’t trying to get rich. They’re trying to stay human. The fact that they’ve built this underground network with WhatsApp and cash handshakes? That’s ingenuity. That’s resilience.

And honestly? The world should be watching-not judging.

Albert Chau

December 20, 2025 AT 15:25People who break laws like this don’t deserve sympathy. They’re enabling financial anarchy. If you can’t follow the rules of your own country, you shouldn’t be allowed to hold assets at all. This isn’t freedom-it’s recklessness.

Madison Surface

December 21, 2025 AT 11:52I can’t stop thinking about the mothers in Cairo who trade cash for USDT so their kids can eat. Or the students who use crypto to send money home to their families. This isn’t speculative investing-it’s love in the form of a QR code.

Every time someone says ‘crypto is just speculation,’ I think of those people. And I shut up.

Tiffany M

December 22, 2025 AT 21:21Y’all act like this is some kind of revolution… but let’s be real-this is what happens when you let your currency get destroyed by corruption and incompetence. Crypto isn’t the hero here. The Egyptian Central Bank is the villain. And the people? They’re just trying not to starve. No applause needed. Just stop the madness already.

Eunice Chook

December 24, 2025 AT 07:023 million? That’s cute. But most of them are probably just holding dust. USDT depegging could wipe out half of them in a week. This isn’t a movement-it’s a ticking time bomb. And when it blows, the government will still be there to confiscate what’s left.

Lois Glavin

December 25, 2025 AT 14:56It’s not about the tech. It’s about trust. When your money loses half its value in two years, you don’t need a lecture-you need a lifeline. Crypto isn’t perfect, but it’s the only thing that hasn’t lied to them yet.

Abhishek Bansal

December 26, 2025 AT 20:21Wait, so the government bans crypto… and suddenly everyone’s a crypto bro? That’s not resistance, that’s herd behavior. You think you’re smart for using Bitcoin? Everyone else is too. It’s not innovation-it’s panic. And when the crash comes, guess who’s left holding the bag? The same people who thought this was a hack.

Bridget Suhr

December 27, 2025 AT 13:09theyre using crypto not because they love it… but because they have no other choice. and honestly? that’s kinda beautiful. in a messed up way.

Ian Norton

December 29, 2025 AT 08:45Now the government’s talking about regulation? Classic. They didn’t stop crypto. They just realized they can tax it. Next thing you know, you’ll need a government-approved wallet with KYC and a 20% capital gains tax. They’ll call it ‘financial inclusion.’ It’ll be a prison with a debit card.