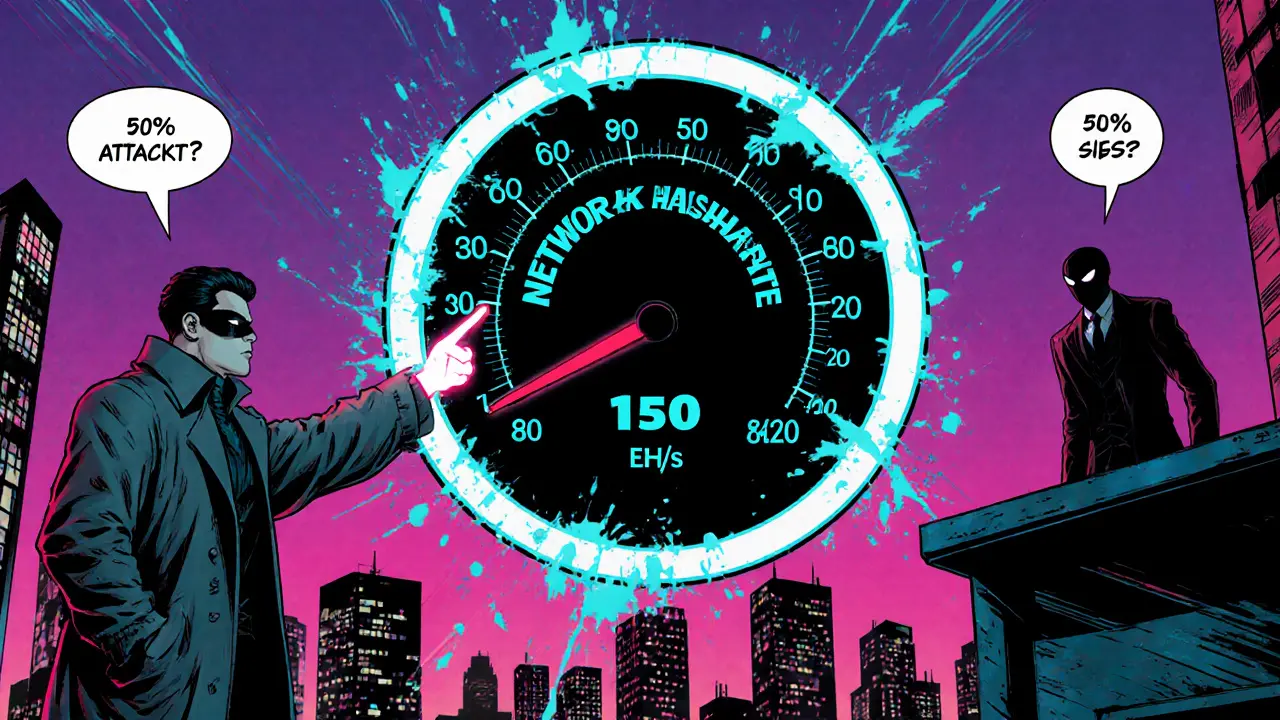

Bitcoin 51% Attack Cost Explained

When looking at Bitcoin 51% attack cost, the amount of money needed to control more than half of the network's hash power and potentially rewrite transaction history. Also known as majority hash power attack cost, it directly ties to the economics of mining. Understanding this number means digging into mining difficulty, the algorithmic measure that keeps block times stable, the overall hash rate, total computational power securing the Bitcoin network, and the underlying proof‑of‑work, consensus mechanism that forces miners to solve cryptographic puzzles. These three entities form the core of any cost estimate: higher difficulty or a larger hash rate pushes the price up, while proof‑of‑work defines the type of hardware you need.

The first major component of the attack cost is hardware investment. To reach 51% of today’s hash rate you’d need thousands of ASIC miners, each costing anywhere from $2,000 to $12,000. Multiply that by the quantity required and you instantly see a multi‑hundred‑million‑dollar barrier. The second component is electricity. Mining rigs consume megawatts of power, and global average electricity rates add up fast—running a 100‑MW operation for a year can cost over $30 million. Add cooling, facility leasing, and maintenance, and the ongoing operational expense becomes a sizable recurring outflow. Finally, you have to factor in market dynamics: a sudden surge in hardware demand can inflate prices, while a drop in Bitcoin’s price reduces the expected return on the attack, making it less attractive.

Key Factors Shaping the Attack Cost

One crucial factor is the network’s hash rate growth, the rate at which new miners join and existing miners upgrade equipment. As the hash rate climbs, the number of machines needed for a 51% takeover rises proportionally, which directly increases the capital outlay. Another factor is mining difficulty adjustments, the periodic recalibration that keeps block times around ten minutes. When difficulty spikes, each ASIC contributes less share of the total hash power, meaning you need more devices to hit the same percentage.

Economic incentives also matter. The reward for mining a block—currently 6.25 BTC plus transaction fees—creates a built‑in payoff that attackers hope to capture. However, a successful 51% attack would likely cause a sharp price drop, eroding the value of any stolen coins. This risk‑reward balance acts as a natural deterrent and is part of why the attack cost remains astronomically high. In addition, regulatory pressure and the potential for legal consequences add an intangible cost that smart attackers factor into their calculations.

All these elements—hardware, electricity, hash‑rate growth, difficulty changes, and economic risk—interlock to form the overall Bitcoin 51% attack cost. Below you’ll find deep‑dive articles that break each piece apart, from how mining difficulty keeps block times stable to the latest trends in network security and the real-world price of hash power. Dive in to see concrete numbers, practical examples, and the latest expert analysis that will help you grasp why hijacking Bitcoin remains a near‑impossible feat.

How Much Does a 51% Attack on Bitcoin Really Cost?

Explore why a 51% attack on Bitcoin costs billions, how hashpower, hardware, and economics shape the barrier, and why attackers are deterred.

September 15 2025