Russia doesn’t ban all cryptocurrency exchanges. It bans the ones that don’t play by its rules. If you think it’s about stopping crypto, you’re wrong. It’s about control. The Russian government isn’t trying to kill digital currencies-it’s trying to own them.

It’s Not a Ban, It’s a Filter

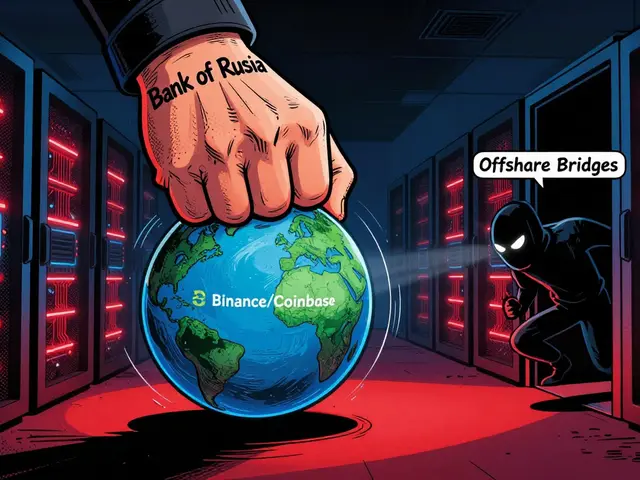

You won’t find a single law that says, "All crypto exchanges are illegal in Russia." That’s not how it works. Instead, the Bank of Russia and Roskomnadzor quietly block platforms that fail to meet strict compliance standards. The goal? Stop money laundering, prevent sanctions evasion, and keep crypto flows under state supervision. International exchanges like Binance, Coinbase, and Kraken aren’t officially banned. But try to deposit rubles or withdraw to a Russian bank account? Good luck. Their payment processors are cut off. Russian banks can’t touch them. Their services are effectively unusable for most locals. It’s a silent blockade. The real targets? Exchanges that help Russia bypass Western sanctions. That’s where the crackdown gets serious.Garantex: The Exchange That Got Taken Down

Garantex was Russia’s biggest homegrown crypto exchange. Founded in 2018, it handled over $1 billion in trades before 2022. Then came the sanctions. In March 2025, U.S. Secret Service agents, working with German and Finnish police, raided its servers. They seized its domain, froze $26 million in crypto, and shut it down. But Garantex didn’t disappear. It just changed shape. Its founder, Sergey Mendeleev, quietly launched Exved-a new payment service based in Moscow’s International Business Center. Exved doesn’t call itself an exchange. It markets itself as "the first exchange for importers and exporters." That’s code. It’s still moving crypto for sanctioned businesses, using shell companies and fake invoices to disguise payments. Russian customs data shows a 40% spike in crypto-linked import transactions since late 2024, mostly routed through Exved. The U.S. Department of Justice indicted two former Garantex executives-Aleksandr Mira Serda and Aleksej Besciokov. Mira Serda is still at large. The State Department is offering $5 million for info leading to his arrest. Besciokov was caught in India. The game isn’t over.Grinex: The Ghost of Garantex

While Garantex was collapsing, its engineers built Grinex. Same team. Same code. Same clients. Just a new name and a new domain. In July 2024, the U.S. Treasury’s Office of Foreign Assets Control (OFAC) added Grinex to its sanctions list. The official reason? "Continuing Garantex’s sanctions evasion infrastructure." By early 2025, Grinex had absorbed over 80% of Garantex’s former user base. It’s not just a copycat. It’s an upgrade. Grinex uses decentralized liquidity pools and cross-chain bridges to hide transaction trails. Russian users still access it through mirrored sites and Telegram bots. The interface looks different, but the backend? Identical. The Russian government hasn’t touched Grinex. Why? Because it’s not operating openly. It’s underground. And as long as it doesn’t trigger domestic banking alerts, it flies under the radar.

What About Binance and Coinbase?

Binance and Coinbase are blocked in Russia-not because Russia ordered it, but because they chose not to comply. Russia demands full KYC: real names, ID scans, phone numbers tied to local SIM cards. It requires transaction monitoring that flags any crypto sent to wallets linked to sanctioned countries. It demands monthly reports to the Bank of Russia. Binance and Coinbase can’t do that without violating EU and U.S. privacy laws. So they don’t try. They don’t offer ruble deposits. They don’t partner with Russian banks. They don’t set up local offices. The result? Russian users can’t use them. Not legally. Not practically. Not without a VPN and a foreign bank account-and even then, withdrawals are risky. It’s not a ban. It’s a design flaw. These platforms were built for global markets. Russia isn’t a global market anymore. It’s a walled garden.BestChange: The One That Got Unbanned

BestChange was blocked in 2023 for listing foreign payment systems like Payeer and AdvCash. It also showed exchange rates between rubles and Kazakhstani tenge-a red flag for the Central Bank, which saw it as a backdoor for capital flight. But BestChange didn’t fight. It adapted. In early 2025, after working with Russian legal teams for nine months, it removed all foreign currency exchange data. It stopped listing non-Russian payment methods. It added mandatory KYC for all users and started submitting daily transaction logs to the Bank of Russia. Roskomnadzor lifted the ban in April 2025. Today, BestChange is one of the few crypto platforms openly operating in Russia. It’s not a crypto exchange-it’s a currency aggregator. But it’s the only one that survived.The New Rules: Who Can Operate?

Russia’s crypto rules are simple if you know the code:- **No foreign payment systems**-PayPal, Wise, Revolut? Blocked.

- **No anonymous trading**-KYC is mandatory. No ID? No trade.

- **No crypto for domestic payments**-You can’t pay for groceries with Bitcoin. Ever.

- **No transactions with sanctioned countries**-If your wallet ever touched Iran, Syria, North Korea, or Crimea? You’re flagged.

- **No offshore ownership**-Exchanges must be legally registered in Russia, with Russian directors and local bank accounts.

The Big Shift: Russia’s State-Controlled Crypto Experiment

In October 2025, Deputy Finance Minister Ivan Chebeskov dropped a bombshell: Russia is building its own crypto infrastructure. It’s not a digital ruble. It’s something else. A state-monitored crypto network where transactions are tracked in real time, taxes are auto-calculated, and only "especially qualified" investors-those with over 50 million rubles ($550,000) in assets-can trade. This isn’t about banning crypto. It’s about turning it into a government tool. Think China’s digital yuan, but with more loopholes for sanctioned trade. The Bank of Russia is already testing it with five banks and three state-owned corporations. By 2026, it could become mandatory for all large crypto transactions. That means the next generation of Russian crypto exchanges won’t be platforms like Binance. They’ll be apps built into Sberbank or Gazprombank. You won’t log into an exchange. You’ll click "Crypto" in your online banking app.What’s Really Happening?

Russia isn’t fighting crypto. It’s absorbing it. The exchanges that got banned? They were threats to control. The ones that survived? They became tools of the state. Garantex? A criminal network now operating in 10 countries. Grinex? A ghost in the system. BestChange? A compliant shell. And the future? A government-run crypto pipeline. If you’re in Russia and you want to trade crypto today, you have two options:- Use Exved or Grinex-risky, underground, but functional.

- Wait for the state’s official platform-safe, legal, but monitored.

What’s Next?

The U.S. and EU will keep sanctioning Russian crypto platforms. Russia will keep adapting. The cycle won’t stop. But here’s what’s changing: crypto is no longer a rebellion in Russia. It’s becoming part of the system. The same people who once used it to escape sanctions are now using it to work within them. The real question isn’t which exchanges are banned. It’s: who’s running them now?Are Binance and Coinbase banned in Russia?

No, Binance and Coinbase aren’t officially banned by Russian law. But they can’t operate there because they don’t comply with Russia’s strict KYC and payment rules. Russian banks can’t process their transactions, and they don’t offer ruble deposits. So while you can technically access their websites, you can’t use them for anything practical inside Russia.

Is crypto legal in Russia?

Yes, but only under strict conditions. You can own and trade crypto, but you can’t use it to pay for goods or services inside Russia. You can only trade it as an asset. Since 2024, crypto can be used in international trade, which opened a backdoor for businesses to move money abroad. All transactions must go through KYC checks, and large traders must report to the Bank of Russia.

Why was Garantex shut down?

Garantex was shut down in March 2025 by U.S. and European law enforcement for helping Russian entities bypass international sanctions. It moved over $26 million in crypto through fake invoices and shell companies. The U.S. Treasury designated it as a sanctions evasion tool. Its founders were indicted, and its domain was seized. It’s now operating under the name Exved, still based in Moscow.

Can I still trade crypto in Russia today?

Yes, but only through Russian-controlled platforms like Grinex or Exved, or by waiting for the state’s upcoming official crypto system. International exchanges like Binance are unusable for most people because of payment and banking blocks. The only legal way to trade is through platforms that report to the Bank of Russia and require full identification.

Will Russia ever fully ban crypto?

No. Russia is moving in the opposite direction. Instead of banning crypto, it’s building its own state-controlled version. The goal is to track every transaction, tax it, and use it to bypass Western financial restrictions. Crypto isn’t being outlawed-it’s being nationalized.

miriam gionfriddo

December 5, 2025 AT 00:54Kenneth Ljungström

December 5, 2025 AT 18:58Barb Pooley

December 6, 2025 AT 21:41Lore Vanvliet

December 7, 2025 AT 00:50Scott Sơn

December 8, 2025 AT 02:38Frank Cronin

December 8, 2025 AT 04:29Nicole Parker

December 8, 2025 AT 07:56Brooke Schmalbach

December 8, 2025 AT 10:09Cristal Consulting

December 8, 2025 AT 14:57Tom Van bergen

December 9, 2025 AT 17:07Sandra Lee Beagan

December 10, 2025 AT 11:06Ben VanDyk

December 11, 2025 AT 21:53michael cuevas

December 12, 2025 AT 21:49Nina Meretoile

December 14, 2025 AT 17:39Joe West

December 16, 2025 AT 08:00Mariam Almatrook

December 16, 2025 AT 09:00Chris Mitchell

December 16, 2025 AT 16:36nicholas forbes

December 18, 2025 AT 01:51Martin Hansen

December 18, 2025 AT 05:28Shane Budge

December 18, 2025 AT 09:15sonia sifflet

December 19, 2025 AT 16:48Richard T

December 20, 2025 AT 17:05jonathan dunlow

December 22, 2025 AT 14:54rita linda

December 24, 2025 AT 11:23Regina Jestrow

December 25, 2025 AT 22:05Stanley Wong

December 26, 2025 AT 21:14justin allen

December 27, 2025 AT 03:23ashi chopra

December 27, 2025 AT 12:04alex bolduin

December 28, 2025 AT 18:49Melinda Kiss

December 30, 2025 AT 04:14miriam gionfriddo

December 31, 2025 AT 18:42