Offshore Crypto Accounts: What They Are and How They Work

When you set up an offshore crypto account, a digital asset holding structure located in a foreign jurisdiction with favorable crypto laws. Also known as international crypto wallets, it gives you control over your coins without being tied to your home country’s banking rules or tax systems. This isn’t about hiding money—it’s about choosing where your assets live based on laws, fees, and access. Many people use them to avoid heavy capital gains taxes, bypass banking restrictions, or protect funds in unstable regions.

Offshore crypto accounts don’t require a traditional bank. Instead, they rely on crypto exchanges, platforms that let you buy, sell, and store digital assets. Also known as crypto platforms, they’re often based in places like Malta, Singapore, or the Cayman Islands—jurisdictions with clear rules and low or zero crypto taxes. You might also use non-custodial wallets, wallets where you hold your own private keys and control your funds. Also known as self-custody wallets, they’re essential if you want true independence from any country’s financial oversight. These tools let you store assets like Bitcoin or Ethereum without needing approval from a government or bank.

But it’s not all smooth sailing. Some countries, like the U.S. and UK, still require you to report offshore holdings—even if you’re not living there. If you don’t, you could face penalties. And not every exchange lets you open an account from anywhere. For example, OKX blocks users from certain countries, and YEX has no transparency at all—so you have to pick wisely. The key is matching your location, goals, and risk tolerance with the right jurisdiction. Places like Portugal, Portugal, or El Salvador offer crypto-friendly rules, while others like Algeria or China have outright bans that push users into risky underground markets.

What you’ll find in these posts is real-world insight into how people use offshore crypto accounts today. You’ll see how crypto tax havens operate, why some countries ban crypto entirely, and how blockchain transparency tools can help or hurt your privacy. You’ll learn where you can legally hold crypto without paying taxes, how to avoid scams when using foreign exchanges, and what happens when your country cracks down. Whether you’re thinking about relocating, trying to reduce your tax bill, or just want more control over your money, the guides here give you the facts—not the hype.

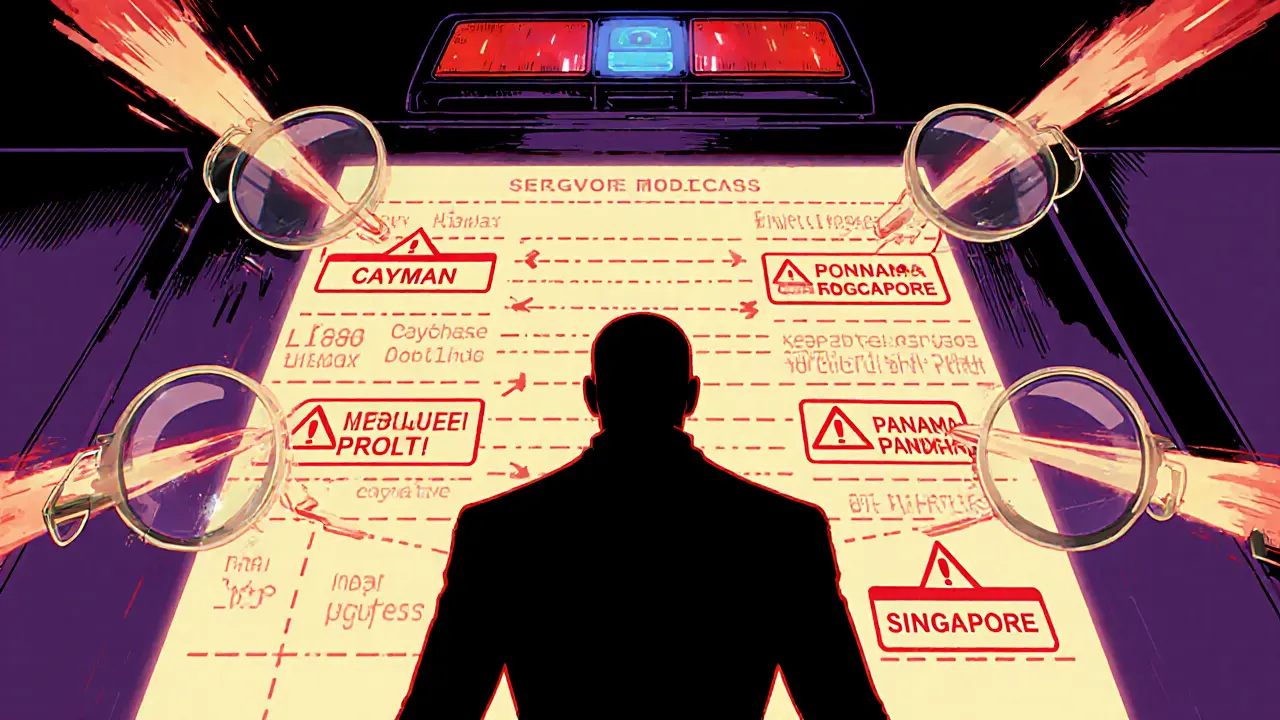

Offshore Crypto Accounts: How Detection Works and What Happens If You Get Caught

Offshore crypto accounts are no longer safe from detection. Learn how blockchain tracing, global regulations, and AI tools make hiding crypto risky-and what legal consequences you could face if caught.

November 5 2025