Legal Classification in the Crypto World

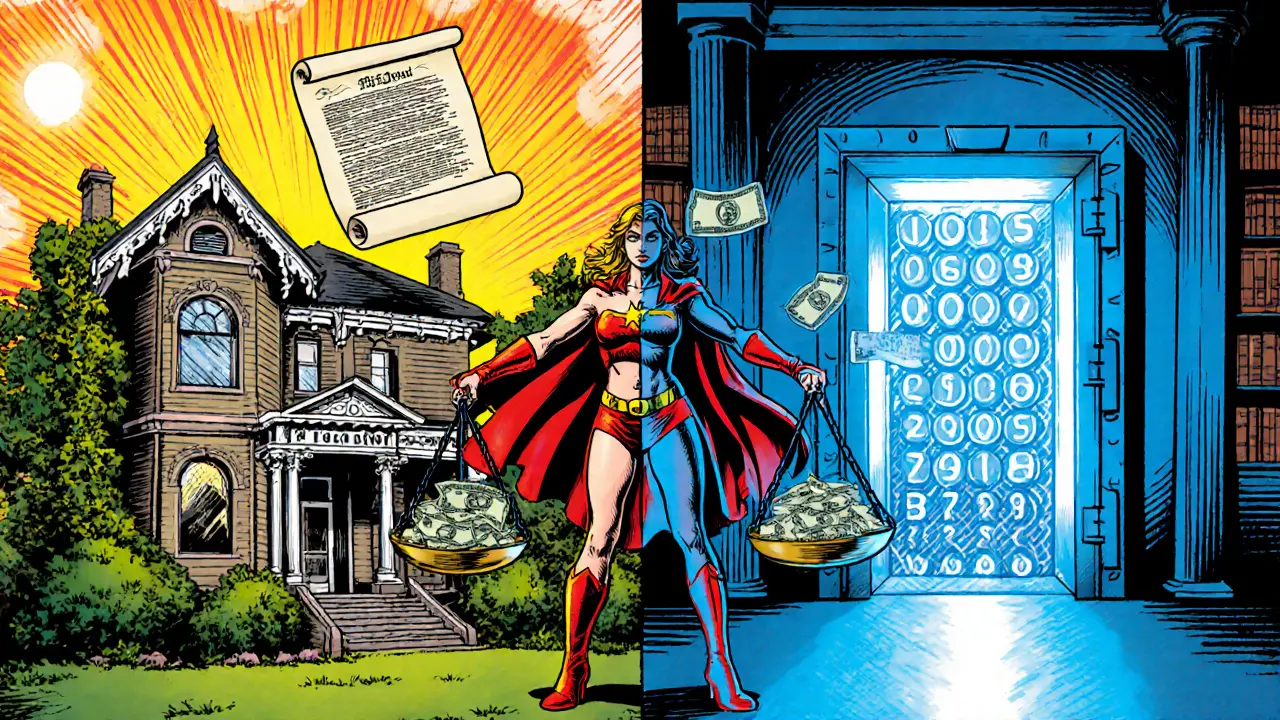

When working with Legal Classification, the way governments label digital assets determines tax rates, trading permissions, and even criminal exposure. Also known as regulatory status, it decides whether a coin is treated as property, currency, or a security. Cryptocurrency Taxation, the set of rules that turn gains into taxable events and Regulatory Bans, government prohibitions that can shut down exchanges or penalize users are two of the most common classifications you’ll encounter.

Understanding these labels matters because they affect everything from the paperwork you file to the wallets you can safely use. For example, a country that classifies crypto as a taxable asset will often impose capital‑gain rates ranging from 5% to 45%, as seen in South Korea’s tiered system. In contrast, jurisdictions that call crypto a “digital commodity” may offer zero‑tax incentives, attracting residents who want to relocate for a friendlier fiscal environment. Meanwhile, places that impose a total ban create underground markets where price premiums skyrocket—think of the hidden premiums in China or Myanmar.

Key Elements You’ll See Across Our Guides

Our collection breaks down the most relevant pieces of legal classification:

- Tax regimes – from capital‑gain calculations to income‑tax ceilings, we show how different countries tax crypto and what forms you’ll need to submit.

- Regulatory frameworks – we explain how blockchain‑as‑a‑service (BaaS) providers navigate compliance, and why some nations flip from a ban to a regulated market, like Pakistan’s 2025 Virtual Assets Bill.

- Residency & citizenship pathways – the Crypto Residency, process of moving to a low‑tax or tax‑free jurisdiction guides detail the paperwork, costs, and pitfalls of setting up a legal foothold.

- Underground market dynamics – we dive into how illegal bans fuel hidden exchanges, price premiums, and heightened security risks.

Below you’ll discover plain‑English breakdowns of tax rates in South Korea, step‑by‑step guides to zero‑tax crypto countries, risk assessments of banned jurisdictions, and practical advice on using VPNs where crypto is restricted. Each piece ties back to the core idea that how a regulator classifies crypto determines your next move. Ready to see the specifics? Scroll down for the full list of guides.

Property vs Currency Legal Classification: Key Differences for Digital Assets

Explore how the law separates property and currency, see the tax and legal implications for real, personal, and digital assets, and get a practical checklist for classifying crypto and other blockchain assets.

October 25 2025