Ethereum token: What They Are, How They Work, and What You Need to Know

When you hear Ethereum token, a digital asset built on the Ethereum blockchain that can represent anything from currency to ownership rights. Also known as ERC-20 token, it’s the backbone of most decentralized apps, from lending platforms to meme coins. Unlike Bitcoin, which is mainly a store of value, Ethereum tokens are tools—they do things. They let you trade, stake, vote, or even own a piece of a game character. That’s why over 90% of new crypto projects don’t launch their own blockchain. They just build a token on Ethereum.

Most Ethereum tokens follow the ERC-20 standard, which means they play nice with wallets, exchanges, and DeFi apps. But there are others: ERC-721 for NFTs, ERC-1155 for mixed digital assets, and newer ones like ERC-4626 for yield-bearing tokens. You don’t need to memorize all of them, but you should know this: if a token claims to be "Ethereum-based" but doesn’t show up in your MetaMask or isn’t listed on Uniswap, it’s probably fake. Scammers love to copy names like SAKE, NEKO, or MCASH and slap them on useless tokens with zero code behind them. Real tokens have transparent contracts you can check on Etherscan.

What makes Ethereum tokens powerful is what they enable. Take DeFi tokens, tokens that give users control over decentralized finance protocols. They’re not just for trading—they let you vote on changes to a lending platform or earn interest just for locking up your coins. That’s why projects like Camelot’s GRAIL or Sake’s SAKE exist. They’re not random coins. They’re governance tools. Then there’s blockchain tokens, digital assets tied to real-world utility like gaming, identity, or data storage. Some, like LICO or ZWZ, promised big things and vanished. Others, like Sentio AI’s SEN or Autonomys’ AI3, are trying to solve actual problems—AI agents running on-chain, or storing data permanently. The difference? One has a team, code, and updates. The other? Silence.

Here’s the truth: most Ethereum tokens fail. But that doesn’t mean they’re all scams. It means you need to look past the hype. A token isn’t valuable because it’s trending on Twitter. It’s valuable if it’s used. If people are trading it, staking it, or building on top of it. Check the contract address. See if there’s real liquidity. Look for updates from the team. If you’re chasing airdrops like LGX or RACA, make sure you’re interacting with the real project—not a phishing site pretending to be it.

You’ll find posts here that cut through the noise. Some explain how tokens like GRAIL work under the hood. Others reveal why tokens like NEKO or SUKU NFTs are fake. You’ll see how airdrops really work—and why most are just marketing tricks. There’s no fluff. Just what you need to know before you send any ETH to a contract. Whether you’re new or have been holding crypto for years, understanding Ethereum tokens means you won’t get fooled by the next shiny thing. What’s real? What’s dead? What’s worth your time? That’s what’s below.

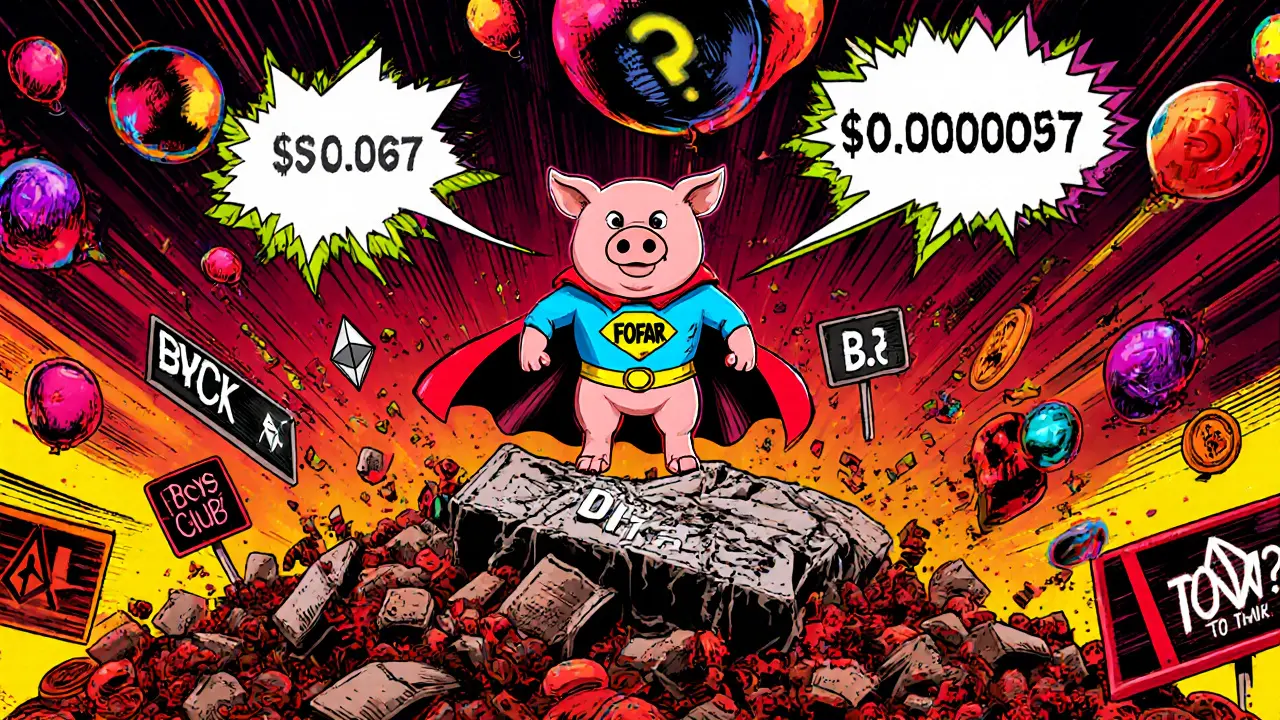

What is Fofar (FOFAR) Crypto Coin? The Truth Behind the Meme Token

Fofar (FOFAR) is a meme coin tied to the Pepe the Frog universe, but it lacks transparency, liquidity, and real utility. With conflicting blockchain data, zero team info, and extreme price inconsistencies, it's a high-risk gamble with little chance of long-term survival.

November 22 2025