Decentralized Exchanges (DEX) Overview

When working with Decentralized Exchange (DEX), a peer‑to‑peer platform that lets users trade crypto assets directly from their wallets without a central intermediary. Also known as DEX, it relies on automated smart contracts to match orders, manage liquidity and settle trades on‑chain. Decentralized Exchanges have become the backbone of modern crypto trading because they combine security, privacy and open access. In simple terms, a DEX enables token swaps (Subject‑Predicate‑Object), while smart contracts power the execution (Subject‑Predicate‑Object), and liquidity pools provide the capital (Subject‑Predicate‑Object) that makes every trade possible.

Key Concepts That Power DEXs

One of the most important building blocks is Decentralized Finance (DeFi), the ecosystem of financial services that run on blockchain without banks. DeFi feeds DEXs with yield‑bearing strategies and creates new ways to earn on idle assets. Another core element is Smart Contracts, self‑executing code that enforces trade rules once conditions are met. Without smart contracts, a DEX couldn’t lock funds, verify signatures or distribute rewards automatically. Then there are Liquidity Pools, collections of token pairs supplied by users that enable instant swaps. Pools solve the order‑book problem by letting anyone trade against the pool’s balance, and they reward contributors with a share of the trading fees. Finally, Cross‑Chain Bridges, protocols that move assets between different blockchains let DEXs operate beyond a single network, turning a Bitcoin‑only swap into a multi‑chain experience. Together, these entities create a web where you can trade, earn, and move assets without ever handing over your private keys.

What does all this mean for you? Below you’ll find a curated set of articles that break down the practical side of DEXs. From a high‑level look at why traders love the low fees and privacy of DEXs in 2025, to deep dives on specific platforms like Turtle Network and their security nuances, the collection covers both the big picture and the nitty‑gritty. Want to understand how liquidity mining works, how to avoid common scams, or which DEX offers the best token‑swap experience? The posts under this tag answer those questions and more, giving you actionable insights you can apply right away. Dive in and discover how decentralized exchanges are reshaping crypto trading today.

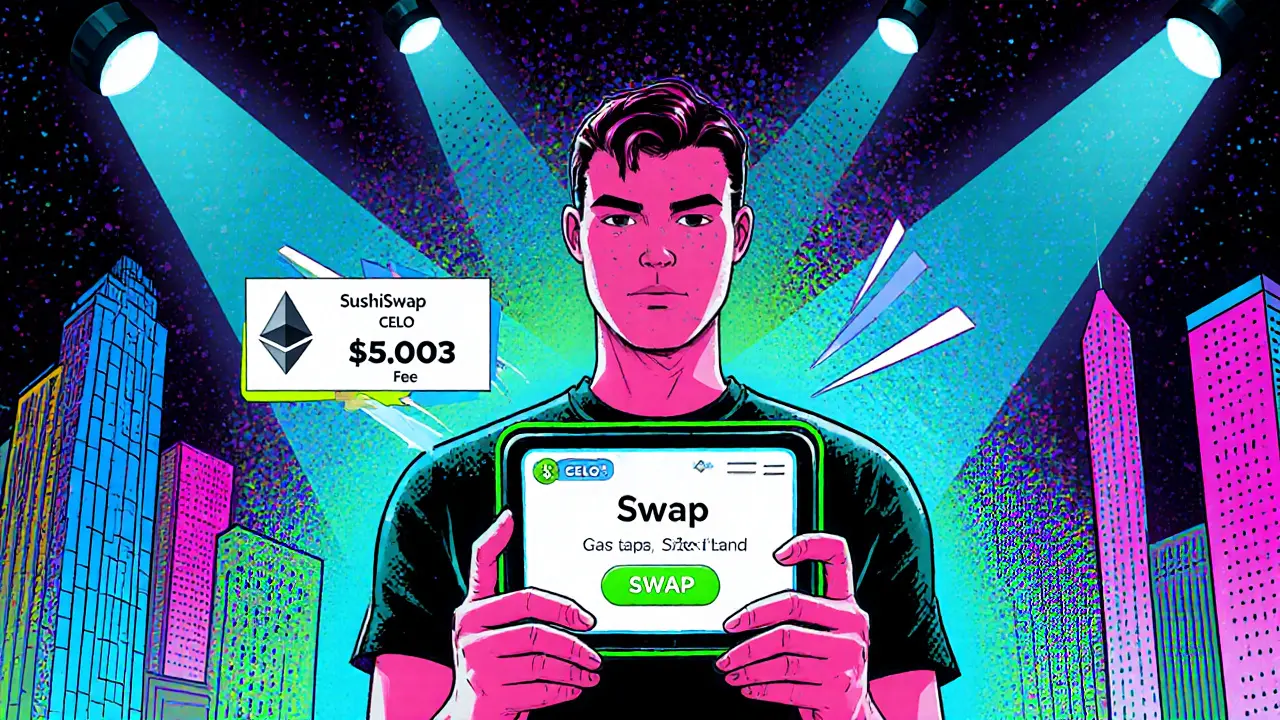

SushiSwap on Celo: In‑Depth Crypto Exchange Review

A detailed review of SushiSwap on Celo covering how it works, fees, rewards, security, and whether it's a good fit for traders and liquidity providers.

January 18 2025