DeFi: Decentralized Finance Explained

When working with DeFi, a system of financial services built on public blockchains that removes traditional intermediaries. Also known as Decentralized Finance, it lets anyone lend, borrow, trade, or earn yield without banks. DeFi also includes Decentralized Applications, software that runs on smart‑contract platforms and provides finance‑related features, which are the front‑end tools for everyday users.

One of the biggest building blocks behind DeFi is the ability to verify identity without a central authority. Decentralized Identity, a self‑sovereign model where users control their own credentials on‑chain is gaining traction because it reduces KYC friction for lending and stable‑coin platforms. When you combine DID with DeFi, you get frictionless onboarding, which is why many new protocols are integrating it directly into their smart contracts.

Another force that shapes token distribution in DeFi is Crypto Airdrops, free token giveaways that reward early adopters or community participants. Airdrops often seed liquidity for new DeFi projects, making them an essential marketing tool. Because airdrops can jump‑start a token’s market, they directly influence DeFi’s liquidity mining and yield farming strategies.

Key Concepts Connecting DeFi to the Wider Ecosystem

At its core, DeFi requires smart contracts to automate trust‑less transactions, which means any change in blockchain scalability impacts it. For example, blockchain sharding splits data across multiple chains, boosting throughput and reducing fees—both critical for high‑volume DeFi apps. Likewise, cross‑chain bridges let assets move between ecosystems, expanding the pool of liquidity that DeFi protocols can draw from.

Security is another pillar. Decentralized finance platforms inherit the security properties of the underlying blockchain, but they also need robust audit practices. The rise of multisig wallets—like 2‑of‑3 or 3‑of‑5 setups—adds an extra layer of protection for treasury funds, especially in community‑governed DeFi projects.

Regulatory landscapes also intersect with DeFi. Countries that ban or heavily regulate crypto can still see DeFi activity through VPNs or offshore services, which adds a layer of risk for users. Understanding these legal nuances helps you navigate DeFi safely, whether you’re staking, swapping, or participating in a governance vote.

From a user experience perspective, DeFi dashboards aggregate data from multiple protocols, making it easier to track yield, portfolio performance, and governance proposals in one place. These tools often rely on APIs that pull real‑time on‑chain data, and they highlight how DeFi is becoming more accessible to non‑technical investors.

As you explore the articles below, you’ll see practical guides on mining difficulty, airdrop verification, VPN risks in restrictive regions, and detailed token analyses. Each piece ties back to how DeFi functions in the real world—whether you’re chasing an airdrop, assessing a new cross‑chain token, or learning to protect your assets.

Ready to dive deeper? Below you’ll find a curated list of posts that break down the most relevant DeFi topics, from technical fundamentals to the latest market moves. Let’s get started.

How Flash Loans Work Without Collateral in DeFi

Flash loans let you borrow crypto without collateral, but only for the duration of a single blockchain transaction. Learn how they work, their real-world uses, and why they're both powerful and risky in decentralized finance.

February 6 2026

Use Cases for Flash Loans in DeFi: Arbitrage, Liquidations, and More

Flash loans let you borrow crypto without collateral - if you repay it in the same transaction. Discover how they're used for arbitrage, liquidations, and automated trading in DeFi - and why they're both powerful and risky.

December 7 2025

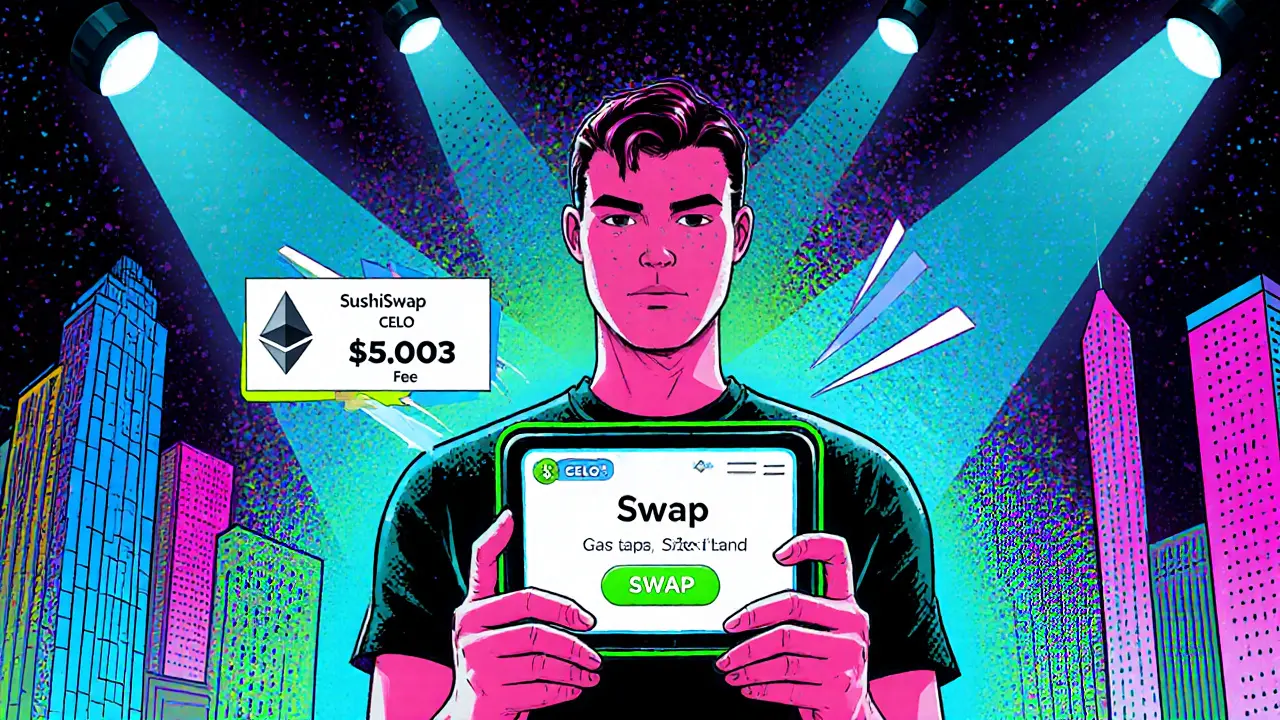

SushiSwap (HAQQ) Crypto Exchange Review: Features, Fees, and Real-World Performance in 2025

SushiSwap is a top decentralized exchange offering fee-sharing rewards through its SUSHI token. With HAQQ integration, it now provides low-cost trading in Asia. Learn how it compares to Uniswap, earns passive income, and handles gas fees in 2025.

November 25 2025

Top Benefits of Trading on Decentralized Exchanges (DEX) in 2025

Discover why decentralized exchanges are reshaping crypto trading in 2025-learn about security, privacy, fees, DeFi tools, and how to get started safely.

February 12 2025

SushiSwap on Celo: In‑Depth Crypto Exchange Review

A detailed review of SushiSwap on Celo covering how it works, fees, rewards, security, and whether it's a good fit for traders and liquidity providers.

January 18 2025