Currency Classification Explained

When talking about currency classification, the systematic way of grouping digital assets based on purpose, legal treatment, and technical design. Also known as crypto asset categorization, it helps investors, regulators, and developers speak the same language about what a token actually does.

Why Understanding Currency Classification Matters

One of the most common related groups is payment cryptocurrencies, tokens built primarily for buying goods, sending money, or settling invoices. Think Bitcoin or Litecoin – they aim for low fees and fast confirmations. Knowing that a coin falls under this category tells you it’s likely to face different regulatory scrutiny than a utility token. Another key piece is crypto tax regimes, the set of rules each country applies to classify, tax, and report digital asset gains. A country might view payment cryptocurrencies as taxable income, while treating staking rewards from a utility token as capital gains. This classification directly influences how you report earnings and what paperwork you need.

Beyond those, mining difficulty, the algorithmic measure that keeps proof‑of‑work block times stable plays a hidden role. Higher difficulty usually signals a mature, secure network, which often pushes a coin into the “store of value” classification rather than a simple utility token. Finally, blockchain regulation, laws and guidelines that dictate how different asset classes are treated can re‑define a token overnight – a meme coin may become a security if a regulator decides it was marketed as an investment. In short, currency classification encompasses payment cryptocurrencies, requires understanding crypto tax, and is influenced by mining difficulty and blockchain regulation. Below you’ll find a curated set of articles that dive deeper into each of these angles, from tax guides in South Korea to mining difficulty breakdowns, so you can see how classification shapes real‑world decisions.

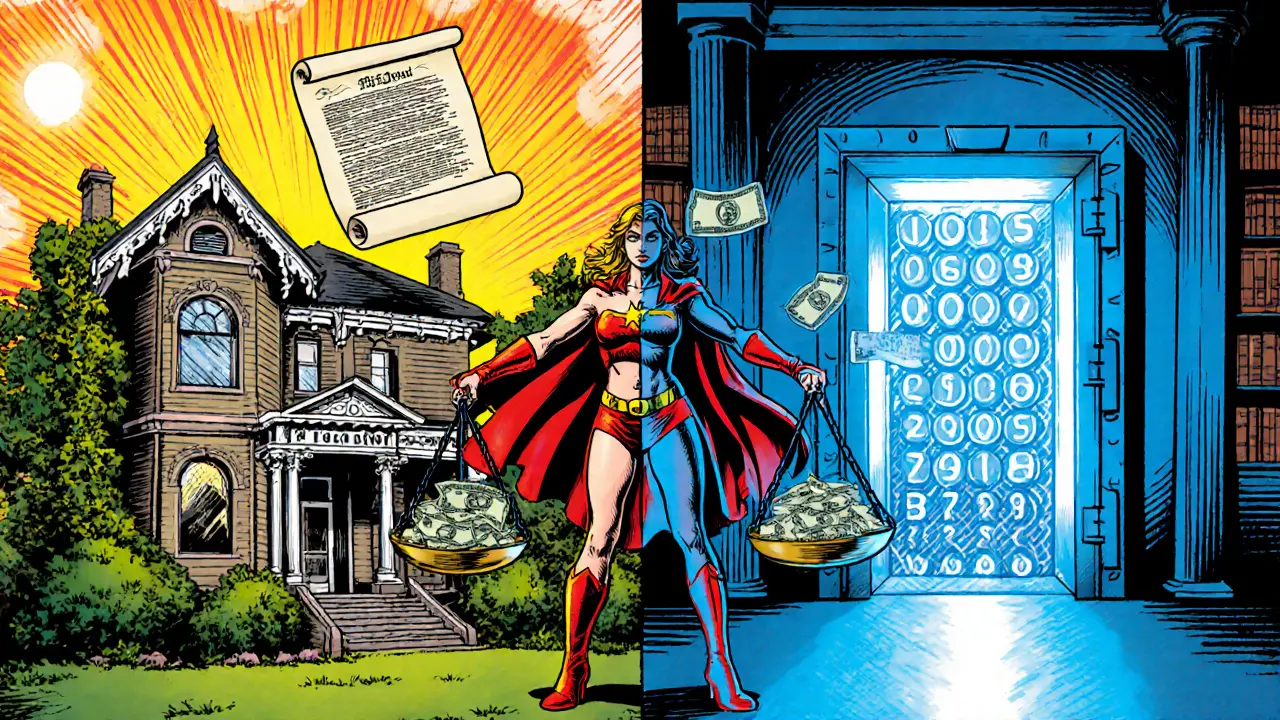

Property vs Currency Legal Classification: Key Differences for Digital Assets

Explore how the law separates property and currency, see the tax and legal implications for real, personal, and digital assets, and get a practical checklist for classifying crypto and other blockchain assets.

October 25 2025