Crypto Detection: How to Spot Scams, Fake Airdrops, and Unsafe Exchanges

When you hear about a crypto detection, the process of identifying fraudulent crypto projects, fake airdrops, or unsafe exchanges before you lose money. Also known as crypto scam detection, it’s not about fancy tools—it’s about asking the right questions before you click, connect your wallet, or send any funds. Most people get burned not because they’re careless, but because they don’t know what to look for. A fake airdrop doesn’t always scream "scam." Sometimes it looks like a real opportunity—clean website, professional logo, even a YouTube video. But behind it? Zero team info, no audit, and a wallet address that doesn’t match any official source.

That’s where fake crypto airdrop, a deceptive promotion offering free tokens that don’t exist or require you to pay fees or hand over private keys comes in. Look at posts like the E2P Token airdrop claim on Coinstore and CoinMarketCap—no such thing exists. CoinMarketCap doesn’t run airdrops. Coinstore doesn’t partner with random tokens. If someone says otherwise, they’re lying. Then there’s scam exchange, a platform with no public audits, no user reviews, no customer support, and no transparency about who runs it. YEX is one example. It looks like a real exchange, but it’s built on silence—no team, no security docs, no history. Real exchanges like Coinbase or Kraken don’t hide. They publish audits, licenses, and team names.

And it’s not just about exchanges and airdrops. blockchain security, the practice of protecting your assets through verified contracts, secure wallets, and verified platforms means checking if a token has a locked liquidity pool, if the team has done a live AMA, or if the contract has been verified on Etherscan. If you can’t find a single real person behind a project, walk away. You don’t need to be a coder to spot this. Just ask: Who’s behind this? Where’s the proof? Why would they give away free tokens without asking for anything in return? The answers are usually right in front of you—if you know what to look for.

The posts below cover real cases—like the LGX airdrop that’s actually real, and the Dork Lord token that’s pure hype with zero utility. You’ll see how Algeria’s crypto ban created underground markets, how Myanmar’s users trade despite the ban, and why using a VPN in China for crypto can land you in legal trouble. You’ll learn how to verify a ZKSwap airdrop, avoid the YEX trap, and understand why KYC is now unavoidable on legitimate platforms. This isn’t theory. It’s what people are facing right now. And if you don’t know how to detect the difference between real and fake, you’re already at risk. Let’s get you protected.

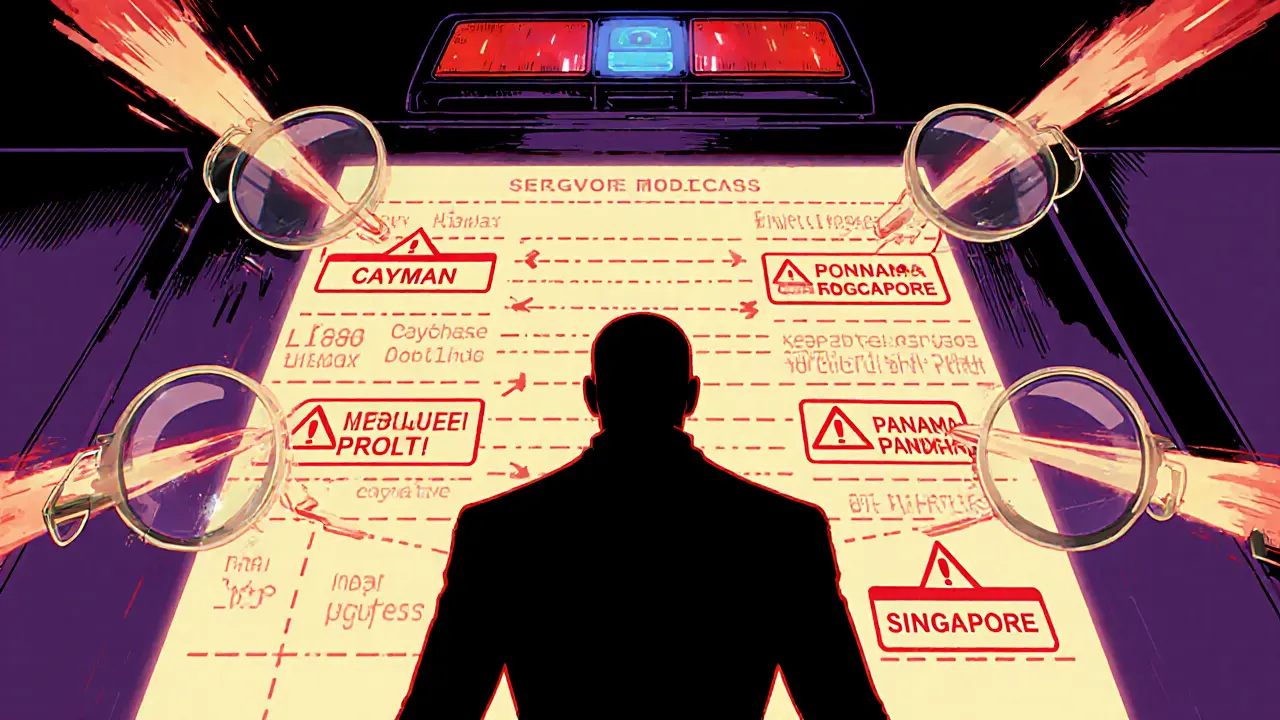

Offshore Crypto Accounts: How Detection Works and What Happens If You Get Caught

Offshore crypto accounts are no longer safe from detection. Learn how blockchain tracing, global regulations, and AI tools make hiding crypto risky-and what legal consequences you could face if caught.

November 5 2025