Crypto AML: How Anti-Money Laundering Rules Shape Your Crypto Experience

When you trade crypto, send a token, or claim an airdrop, you’re not just interacting with blockchain tech—you’re stepping into a system shaped by crypto AML, anti-money laundering rules designed to stop criminals from using digital assets to hide illegal funds. Also known as crypto compliance, it’s no longer a backroom policy—it’s built into every exchange, wallet, and even some airdrop claims you try to access. This isn’t about bureaucracy. It’s about survival. If you don’t understand how crypto AML works, you risk getting locked out of platforms, losing access to funds, or worse—getting flagged for something you didn’t even do.

Behind every KYC crypto, the process where exchanges verify your identity before letting you trade. Also known as crypto identity verification, it’s the frontline of AML enforcement is a network of regulators pushing for transparency. Countries like the U.S., UK, and South Korea now require exchanges to collect your ID, proof of address, and sometimes even your source of funds. Platforms like OKX and Coinstore can’t let you in without it—and that’s why you can’t use a VPN to bypass it. The same rules apply to airdrops. If a project asks for your wallet address but nothing else, be suspicious. Real airdrops tied to regulated entities often require some level of identity check, even if it’s just an email or phone number. And if you’re wondering why some crypto markets thrive underground—like in Algeria or Myanmar—it’s because crypto AML makes legal access hard, pushing users toward riskier, unregulated channels.

It’s not just about exchanges. crypto regulations, the laws that define how digital assets can be used, taxed, and tracked across borders. Also known as blockchain compliance, they’re changing how tokens are designed. New coins now build in tracking features to help exchanges comply. Governance tokens like GRAIL or EDGE might offer perks, but they’re also monitored. Even charity donations on blockchain—like those tracked through smart contracts—are subject to AML scrutiny because regulators want to make sure funds aren’t being laundered under the guise of philanthropy. You can’t ignore this. Whether you’re trading meme coins like DORKY, staking on Arbitrum, or just trying to claim free LGX tokens, you’re part of this system. The good news? Understanding crypto AML helps you avoid scams, pick safer platforms, and protect your assets. The posts below show you exactly how these rules play out in real cases—from fake airdrops that bypass KYC to exchanges that get shut down for ignoring compliance. You’ll see what works, what doesn’t, and how to stay clear of trouble.

OFAC Cryptocurrency Sanctions and Compliance: What Crypto Businesses Must Do in 2025

OFAC cryptocurrency sanctions apply to all digital asset transactions involving U.S. persons or systems. Learn how crypto businesses must screen wallets, block sanctioned addresses, and build compliance programs to avoid massive fines in 2025.

November 14 2025

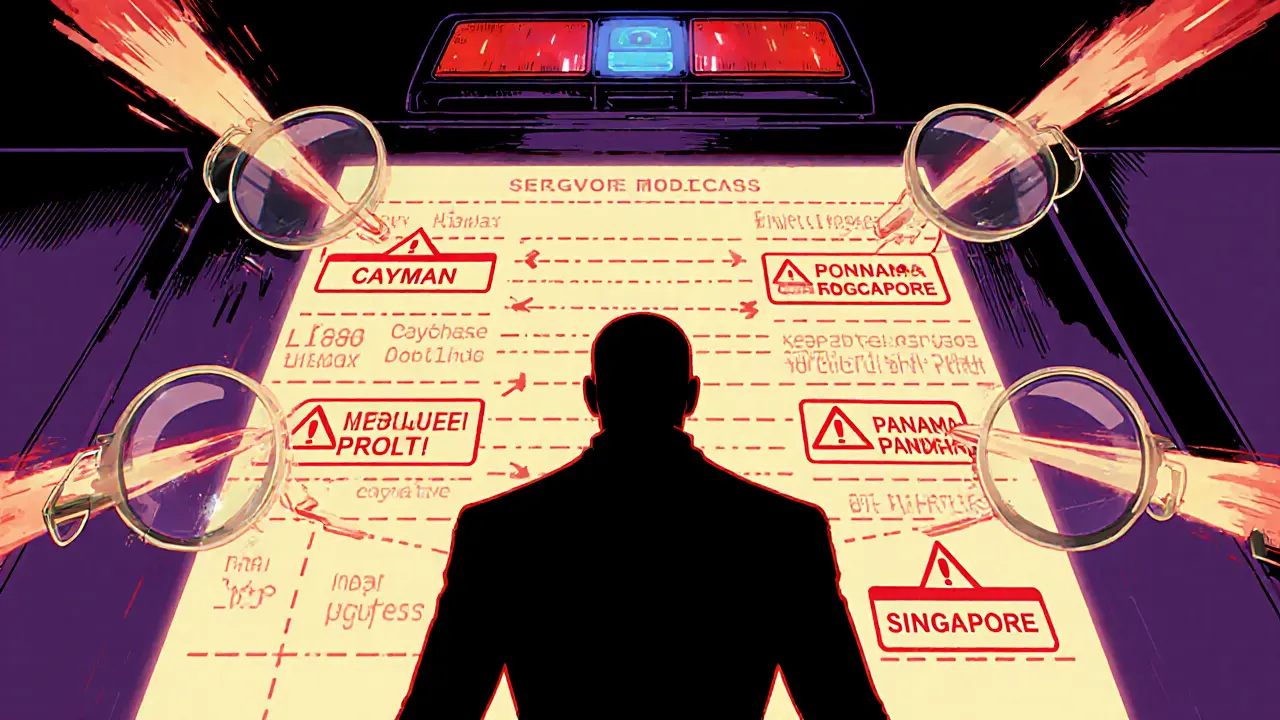

Offshore Crypto Accounts: How Detection Works and What Happens If You Get Caught

Offshore crypto accounts are no longer safe from detection. Learn how blockchain tracing, global regulations, and AI tools make hiding crypto risky-and what legal consequences you could face if caught.

November 5 2025