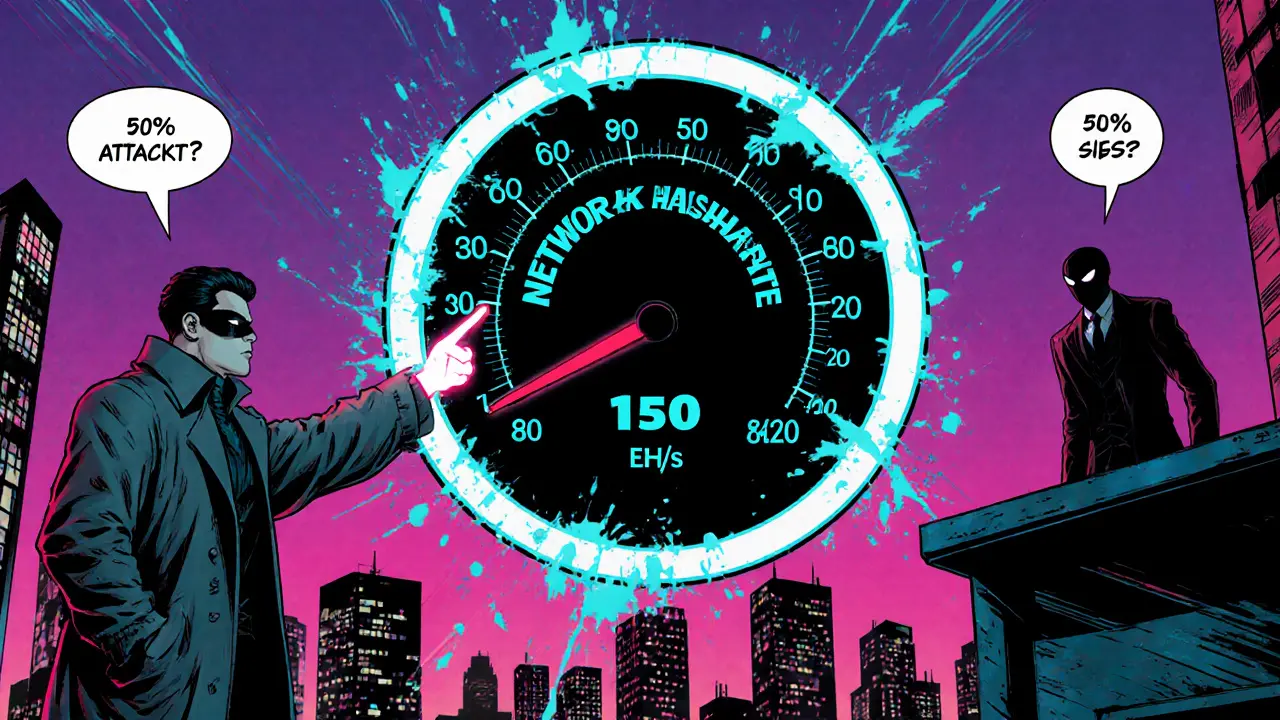

51% Attack Economics Explained

When working with 51% attack economics, the study of costs, rewards, and incentives tied to gaining majority control of a blockchain's mining power. Also known as majority hash power attack economics, it helps investors, developers, and miners gauge how vulnerable a network really is.

At its core, 51% attack economics hinges on three variables: the price of hash rate, the current mining difficulty level that dictates how many hashes are needed for a block, and the underlying proof of work mechanism that secures the chain. The relationship can be expressed as a simple triple: *51% attack economics* requires *high hash rate acquisition*; *high hash rate acquisition* is influenced by *mining difficulty*; and *mining difficulty* adjusts based on *network hash power*. If the cost to buy enough hash power exceeds the expected block rewards, rational attackers walk away.

These economics don’t exist in a vacuum; they directly affect blockchain security, the overall health of a decentralized network. A cheap hash rate means an attacker can cheaply amass 51% of the power, making double‑spend attacks or censorship cheaper. Conversely, a high mining difficulty raises the entry barrier, forcing attackers to invest heavily in hardware or cloud contracts. That financial hurdle creates a natural defense: the more valuable the network, the higher the difficulty, and the steeper the economic hill an attacker must climb.

Key Components of 51% Attack Economics

Understanding the cost side starts with the acquisition price of hash power. This includes equipment purchase, electricity, and maintenance. For example, mounting a 1 PH/s operation on a Bitcoin‑style network can run into millions of dollars annually. The second piece is opportunity cost: miners could be earning regular block rewards instead of sitting idle waiting for an attack to succeed. Third, the potential revenue from a successful attack—double‑spending a few high‑value transactions—must outweigh both acquisition and opportunity costs. If the expected gain is lower than the outlay, the attack is economically irrational.

On the reward side, block rewards and transaction fees play a crucial role. As a network matures, block rewards decline (think Bitcoin halving), leaving fees as the primary incentive. Lower rewards shrink the profit margin for honest miners, which can unintentionally lower the overall hash rate and make a 51% attack cheaper. This dynamic creates a feedback loop: reduced rewards → lower hash rate → lower difficulty → cheaper attack → potential loss of confidence → even lower hash rate.

From a practical standpoint, developers can engineer economic deterrents. One approach is to implement checkpointing, where the chain’s history is periodically hard‑coded, making deep reorganizations costly. Another is to raise transaction fees during periods of low hash power, incentivizing miners to stay online and keep the difficulty high. Some projects even explore hybrid consensus models, blending proof of work with proof of stake to split the economic burden across different resource types.

Investors also need to read these economics like a balance sheet. Before allocating capital to a new PoW coin, ask: what is the current hash rate, how fast does difficulty adjust, and what are the projected rewards over the next few years? If the numbers suggest a low barrier to majority control, the risk premium should be reflected in the token price. In contrast, a network with robust difficulty adjustments and high miner participation offers a safer long‑term bet.

Finally, community actions can shift the economics dramatically. Coordinated mining pools can deter attackers by pooling resources, effectively raising the price of a 51% takeover. Likewise, transparent reporting of hash power distribution helps users spot centralization early, prompting corrective measures before an attack becomes feasible.

All these angles—cost of hash power, difficulty dynamics, reward structures, and community defenses—paint a comprehensive picture of 51% attack economics. Below you’ll find a curated set of articles that dive deeper into each piece, from mining difficulty mechanics to real‑world case studies of attacks and mitigations.

How Much Does a 51% Attack on Bitcoin Really Cost?

Explore why a 51% attack on Bitcoin costs billions, how hashpower, hardware, and economics shape the barrier, and why attackers are deterred.

September 15 2025