Digital Assets

When talking about digital assets, any token, coin, or digital representation of value that lives on a blockchain. Also known as crypto assets, they let you store, transfer, and earn value without a traditional bank. Cryptocurrency, a type of digital asset that uses cryptography to secure transactions is the most common form, but the umbrella also covers stablecoins, NFTs, and utility tokens. In short, digital assets are the building blocks of the new internet of finance.

How Blockchain Powers Digital Assets

The engine behind every digital asset is blockchain, a decentralized ledger that records every transaction in an immutable way. Because the ledger is distributed across many nodes, no single party can rewrite history, which gives users confidence that their holdings are safe. This trust layer enables tokenomics, the economic design of a token’s supply, distribution, and incentives to be transparent and programmable. When a project promises a limited supply, a built‑in burn mechanism, or staking rewards, all of that is enforced by the blockchain’s code.

One practical outcome of transparent tokenomics is the rise of airdrops, free token distributions used to bootstrap a community or reward early supporters. Airdrops lower the entry barrier, give users a chance to test a new platform, and often create buzz that drives wider adoption of the underlying digital asset. For example, a project might airdrop a portion of its supply to wallets that have interacted with a partner protocol, effectively linking two digital ecosystems together.

All this makes digital assets a versatile tool. They can serve as a store of value, a medium of exchange, a governance right, or even a ticket to exclusive services. Companies use them to raise capital through token sales, developers embed them in decentralized applications, and everyday users trade them on exchanges to capture price moves. The mix of blockchain security, tokenomics design, and airdrop incentives forms a feedback loop that continuously expands the digital‑asset landscape.

Below you’ll find a hand‑picked collection of articles that dive deeper into each of these areas – from crypto tax rates in South Korea to the mechanics of mining difficulty, from zero‑tax crypto countries to the latest meme‑coin analyses. Explore the posts to see how the concepts we just covered play out in real‑world scenarios and to get actionable insights you can apply right away.

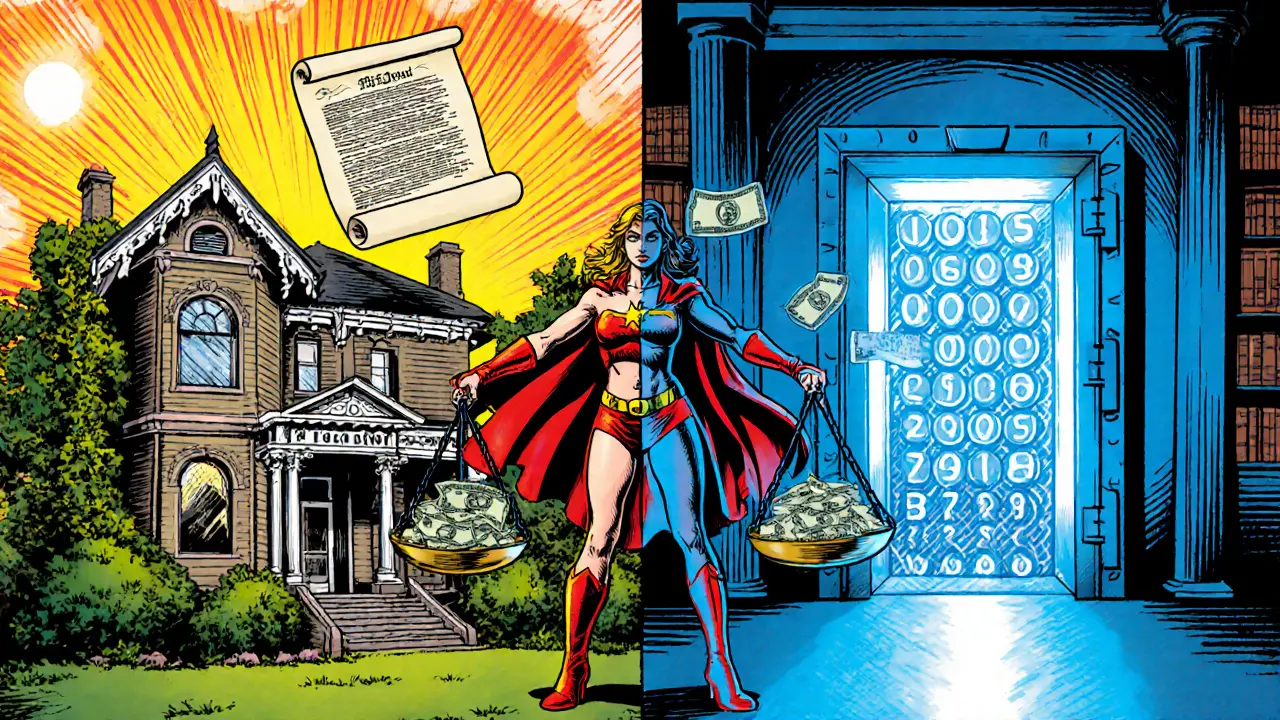

Property vs Currency Legal Classification: Key Differences for Digital Assets

Explore how the law separates property and currency, see the tax and legal implications for real, personal, and digital assets, and get a practical checklist for classifying crypto and other blockchain assets.

October 25 2025