Crypto Art

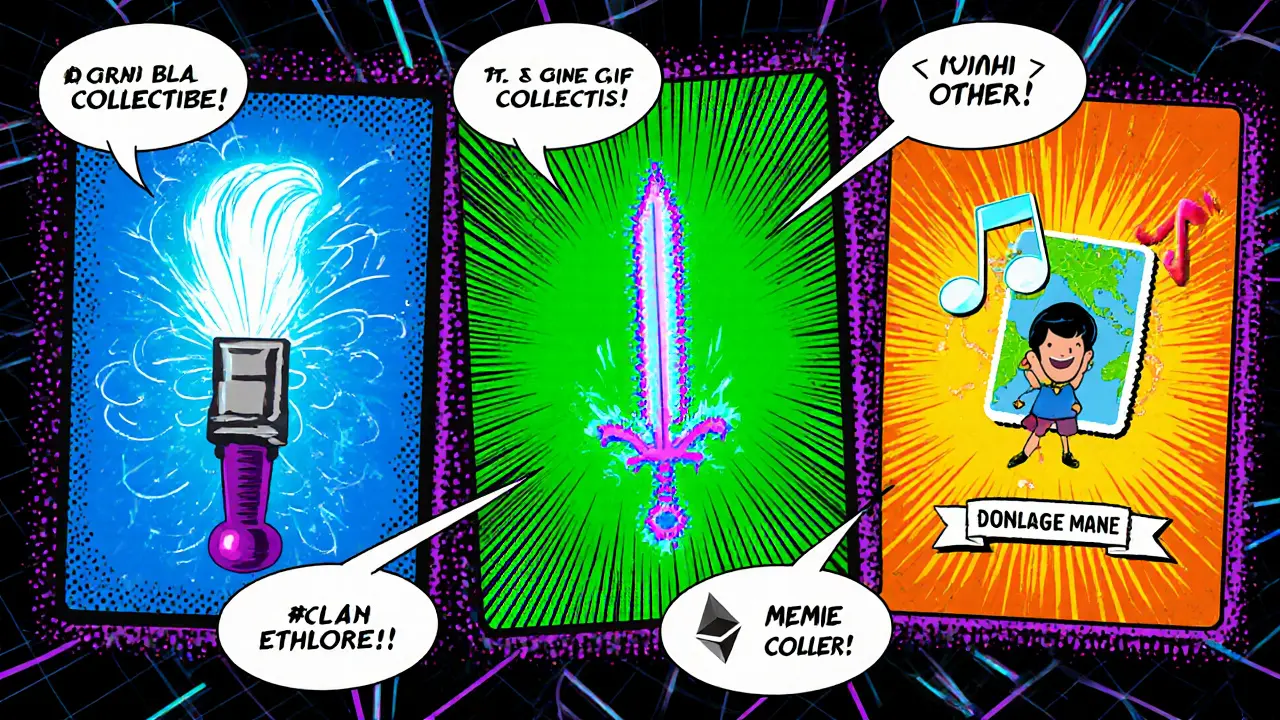

When talking about Crypto Art, digital artwork that lives on a blockchain and can be bought, sold, or traded as a unique token. Also known as digital art, it blends creativity with cryptographic proof of ownership. NFT, a non‑fungible token that represents a single piece of digital content is the most common vehicle for crypto art, while blockchain, a distributed ledger that records transactions in a secure, tamper‑proof way provides the trust layer that makes ownership verifiable. Together they enable digital collectibles, unique digital items that fans can collect, showcase, or trade and open the door to tokenization, the process of converting assets into blockchain‑based tokens. This mix of art, technology, and finance creates a new market where creators can monetize directly and collectors can prove scarcity.

Why does crypto art matter? First, it gives artists a way to earn royalties every time their piece changes hands—something traditional art markets rarely offer. Second, the global reach of the internet means anyone can discover and buy a work without gallery gatekeepers. Third, the transparency of blockchain lets buyers verify provenance instantly, cutting down fraud. These advantages have sparked a surge of projects, from high‑profile collaborations with famous painters to grassroots meme‑driven pieces. The ecosystem is diverse: some creators focus on pure aesthetics, while others embed interactive features or unlockable experiences that evolve over time.

In practice, getting started with crypto art is straightforward. You’ll need a crypto‑compatible wallet—like MetaMask or Phantom—to store the NFTs you purchase. After that, browse a marketplace such as OpenSea, Rarible, or Magic Eden, where each listing shows the token ID, contract address, and royalty terms. When you buy, the transaction is recorded on the blockchain, granting you a tamper‑proof certificate of ownership. If you’re an artist, you can mint your own NFTs by uploading the artwork to a platform, setting the supply (usually one‑of‑a‑kind), and defining royalty percentages. The minting fee, known as “gas,” varies by blockchain; Ethereum often costs more, while alternatives like Polygon or Solana offer cheaper options.

With the basics covered, you’re ready to explore the deeper nuances—how different blockchains affect cost and speed, what legal considerations apply to digital ownership, and which upcoming trends (like generative art and fractional ownership) could reshape the space. Below you’ll find a diverse set of articles that dig into mining difficulty, airdrop strategies, regional regulations, and more, all of which intersect with the world of crypto art. crypto art sits at the crossroads of creativity and technology, and the posts ahead will give you practical insights to navigate this fast‑moving field.

Understanding NFT Digital Art Collectibles: A Beginner’s Guide

Explore what NFT digital art collectibles are, how they work, where to buy them, and the risks involved. This guide covers tech basics, market categories, minting steps, and future trends.

October 21 2024