Blockchain Tracing: How to Track Crypto Flows and Spot Scams

When you send crypto, it doesn’t vanish—it leaves a permanent, public trail. This is blockchain tracing, the process of following cryptocurrency transactions across public ledgers to verify origins, destinations, and patterns. Also known as transaction monitoring, it’s what lets investigators trace stolen funds, charities prove how donations are used, and users avoid fake airdrops. Unlike bank transfers that hide details behind layers of privacy, every Bitcoin, Ethereum, or Solana move is recorded on a public ledger. You can see exactly where a coin came from, how many times it changed hands, and if it ever touched a known scam wallet.

That’s why blockchain transparency, the open, immutable nature of public ledgers that allows anyone to verify transaction history matters. It’s not just for hackers or cops. If you donate to a charity that uses smart contracts, you can watch your $50 move from your wallet to their project wallet in real time. If you’re considering a new token like GRAIL or LGX, you can check if its supply is being manipulated by whale wallets. And if someone promises you a free E2P Token airdrop on CoinMarketCap, blockchain tracing shows you that no such thing exists—because the wallet address they’re asking you to connect to has been flagged for phishing before.

Tools for crypto tracking, software and platforms that analyze on-chain data to reveal wallet activity, token movement, and network behavior are built into platforms like Etherscan, Solana Explorer, and blockchain analytics firms like Chainalysis. You don’t need to be a coder. Just paste a wallet address or transaction hash, and you’ll see a timeline of every send and receive. You’ll spot if a token’s liquidity was pulled, if a project’s founders moved their holdings before a crash, or if a "free" airdrop is just a trap to steal your private keys.

What makes blockchain tracing powerful is how it connects to real-world risks. In countries like China or Algeria, where crypto is banned, underground markets still run on blockchain—users trade peer-to-peer, and prices spike because everyone knows the funds are traceable. In Pakistan, as new regulations roll out, blockchain tracing helps regulators identify unlicensed exchanges. Even in DeFi, where you think you’re anonymous, your wallet’s history tells a story: Did you interact with a known rug-pull contract? Did you ever send funds to a mixer? That data follows you forever.

You’ll find posts here that show exactly how this works. One breaks down how charity funds move on-chain so you can verify real impact. Another shows you how to spot fake airdrops by checking wallet histories. There’s a guide on how to trace stolen crypto after a hack, and another on why some exchanges like YEX are red flags because their transactions don’t add up. You’ll also see how governance tokens like GRAIL or EDGE are tracked by their holders to influence voting power. This isn’t theory—it’s practical detective work anyone can do.

Whether you’re trying to protect your savings, confirm a donation went where it should, or just avoid getting ripped off, blockchain tracing gives you the power to see what others can’t. You’re not guessing anymore. You’re looking at the truth—written in code, forever.

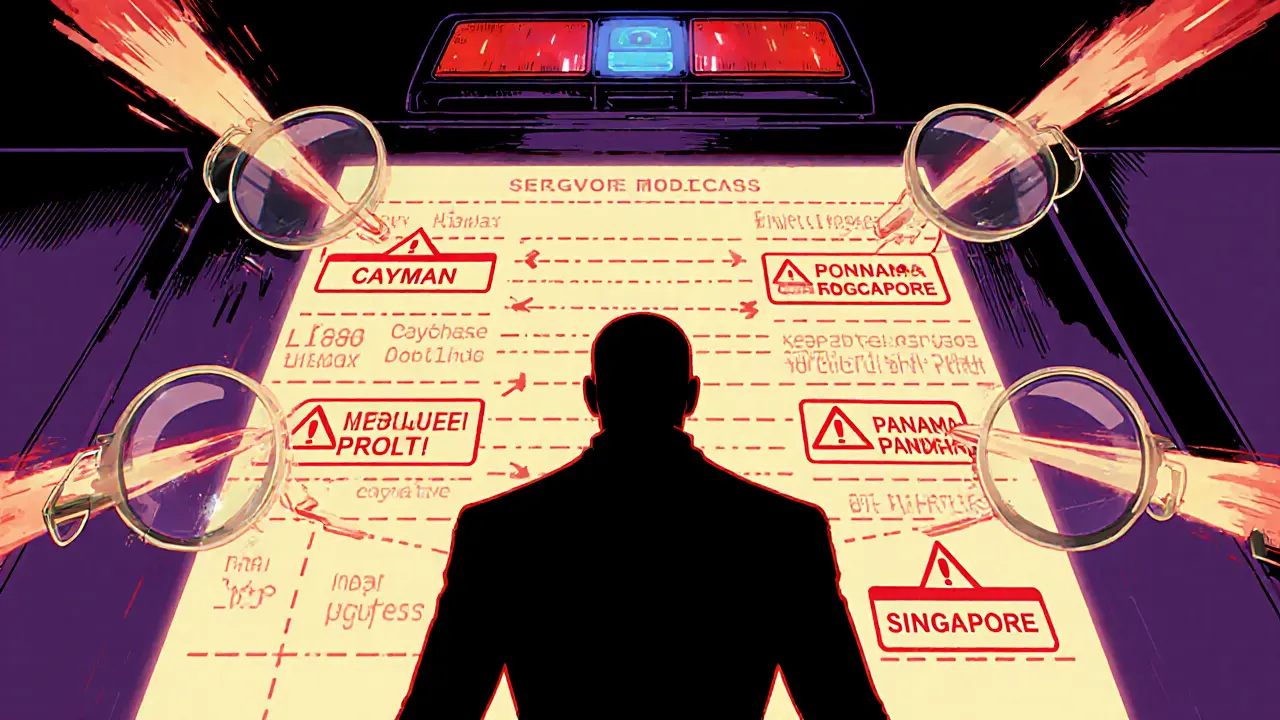

Offshore Crypto Accounts: How Detection Works and What Happens If You Get Caught

Offshore crypto accounts are no longer safe from detection. Learn how blockchain tracing, global regulations, and AI tools make hiding crypto risky-and what legal consequences you could face if caught.

November 5 2025