Bitcoin Tax India: What You Need to Know

When dealing with Bitcoin tax India, the set of rules that govern buying, holding, selling, or earning Bitcoin for Indian residents. Also known as BTC tax India, it dictates how crypto activity appears on your tax return. Bitcoin tax India encompasses capital gains tax, which means every profit you make from a Bitcoin trade is treated like a short‑term or long‑term gain depending on how long you held the asset. The framework also requires accurate record‑keeping; without proper transaction logs, the tax calculation becomes a guesswork exercise. The Indian tax authority influences crypto reporting by mandating that exchanges share user data, so the moment you sell on a platform, the numbers show up in your Form 26AS. This creates a direct link between your on‑chain activity and the income‑tax department, making compliance more than a best practice—it’s a legal necessity.

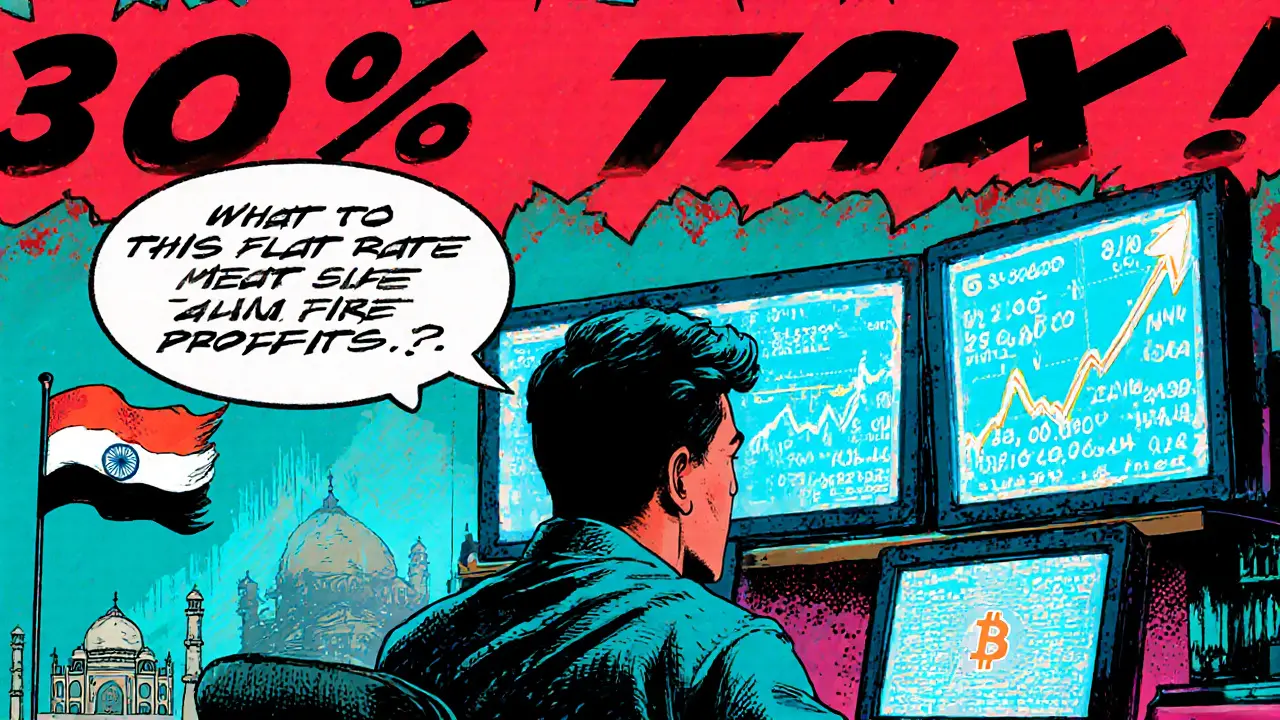

India's 30% Crypto Tax Explained: Bitcoin Traders Guide 2025

A 2025 guide that explains India's 30% crypto tax for Bitcoin traders, covering calculation, TDS, GST, compliance steps, and international comparison.

February 10 2025