India Crypto Tax Calculator

Tax Breakdown

Gain:

Base Tax (30%):

Surcharge & Cess (12%):

Effective Tax Rate:

Total Tax Payable:

1% TDS (if applicable):

18% GST on Exchange Fees:

Net Profit After Taxes:

India slapped a flat 30% crypto tax on all gains from virtual digital assets (VDAs) starting April12022, and traders are still figuring out what that means for their Bitcoin profits. This guide breaks down the rule, shows you how to calculate the liability, walks through the extra 1% TDS and the new 18% GST, and compares India’s regime with a few other jurisdictions. By the end you’ll know exactly what to report, how much you owe, and which compliance steps you can’t skip.

TL;DR - Quick Takeaways

- Flat 30% tax on any Bitcoin gain - no short‑term vs. long‑term split.

- Only the purchase price is deductible; transaction fees, storage costs, or other expenses can’t be claimed.

- Losses cannot be offset against gains from other crypto or carried forward.

- 1% Tax Deducted at Source (TDS) kicks in on transfers above ₹50,000 per year.

- Since July2025, exchange fees attract 18% GST, adding a third tax layer.

What the 30% Crypto Tax Actually Is

India’s 30% crypto tax is a flat income‑tax rate applied to all gains from Virtual Digital Assets (VDAs) under Section115BBH of the Income Tax Act. It was announced in the 2022 Union Budget by Finance Minister Nirmala Sitharaman the then‑Finance Minister of India and became effective on April12022.

The tax sits in the highest income‑tax bracket (30% plus surcharge and 4% health & education cess), which means the effective rate for most individuals is about 31.2%. Unlike traditional capital‑gains rules, there is no distinction between holding periods - a Bitcoin sold after one day or after two years is taxed at the same flat rate.

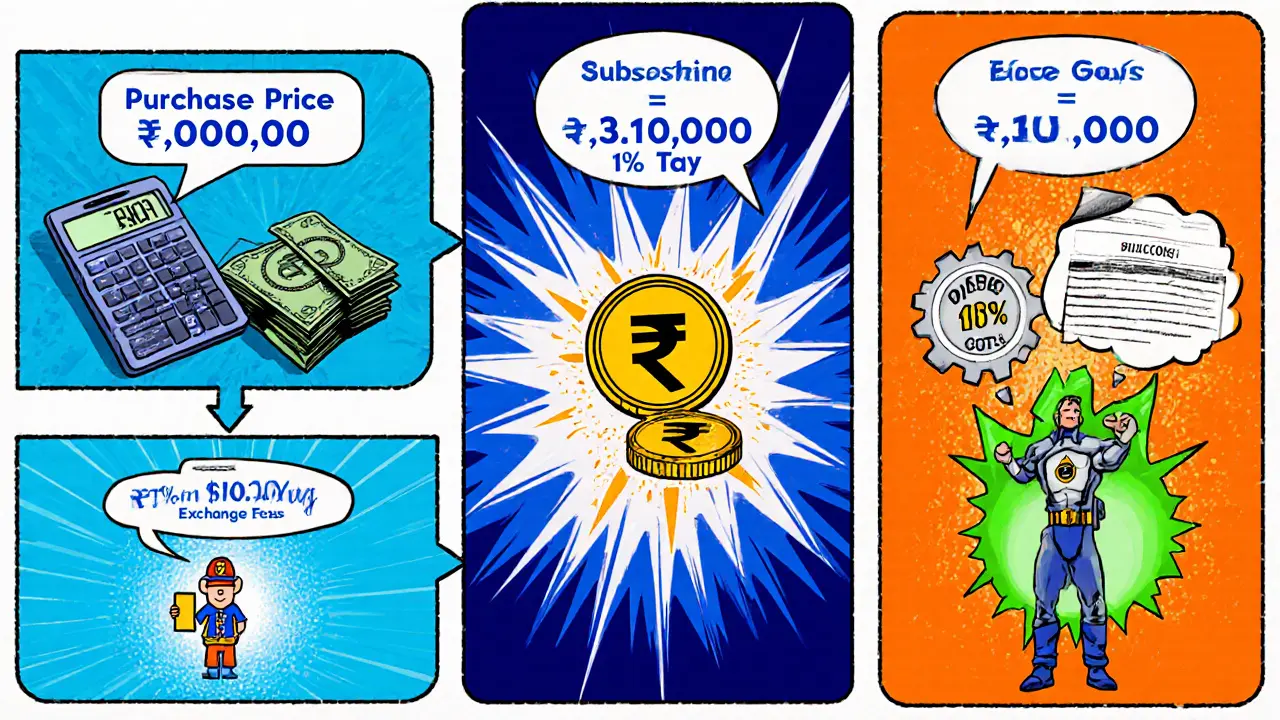

How to Calculate Your Bitcoin Tax Liability

The formula is deliberately simple:

(Selling Price - Purchase Price) × 30% = Tax Payable

Only the purchase price (the cost of acquisition) is allowed as a deduction. No other expenses - exchange fees, network transaction costs, custodial fees, or even the cost of a hardware wallet - can be claimed.

Let’s run a concrete example:

- You bought 0.5BTC on Jan152023 for ₹2,00,000.

- You sold the same 0.5BTC on Sep102024 for ₹3,10,000.

- Gain = ₹3,10,000 - ₹2,00,000 = ₹1,10,000.

- Tax = ₹1,10,000 × 30% = ₹33,000.

If you incurred a loss on a different crypto, say ₹30,000 on Ethereum, you still owe the ₹33,000 because India disallows loss offsetting across assets.

Compliance Checklist - What Records You Must Keep

Because the tax authority can audit any crypto transaction, you need a solid paper trail:

- Date of purchase and sale.

- Quantity of Bitcoin bought or sold.

- INR value at the time of each transaction (exchange rate used).

- Exchange or wallet name where the transaction occurred.

- Proof of purchase (bank statement, receipt, or transaction hash).

Most Indian traders spend 10‑15hours a year on record‑keeping if they only buy‑and‑hold. Active day‑traders can easily reach 40‑50hours, especially when juggling multiple exchanges.

Dedicated crypto tax softwares such as Koinly a tax‑calculation platform that supports Indian VDA reporting or ClearTax an Indian tax‑filing service with built‑in crypto modules can automate much of the data import and generate the ScheduleVDA required in your ITR.

The 1% TDS Layer - What It Means for You

Starting July12022, the Income Tax Department introduced a 1% Tax Deducted at Source (TDS) on crypto transfers that exceed ₹50,000 in a financial year. The rule is codified under Section194S. The exchange deducts the TDS before crediting your account, and you receive a Form16A showing the amount paid.

Key points:

- If you sell Bitcoin worth ₹60,000 in a year, the exchange withholds ₹600.

- The TDS is creditable against your final tax liability; you claim it as a pre‑payment in the ITR.

- If your total tax (30% on gains) is lower than the TDS, you can claim a refund.

Compliance headache: not all overseas exchanges automatically deduct TDS, so you may need to self‑assess and pay the 1% directly to the tax department.

GST on Crypto Platform Services - The Third Tax Layer

In July2025 the government clarified that services provided by crypto exchanges (including trading fees, wallet fees, and API usage) attract 18% Goods and Services Tax (GST). The GST is levied on the exchange, which usually passes the cost onto the user as higher fees.

Effectively, a trader paying a 0.25% trading fee now faces:

Trading fee = 0.25% of transaction value GST = 18% of the fee Effective fee = 0.25% × (1 + 0.18) ≈ 0.295%

While GST doesn’t directly increase your taxable income, it reduces net profit and adds another compliance line - you must ensure the exchange provides a GST invoice for your records.

How India Stacks Up Against Other Jurisdictions

| Country | Rate on Bitcoin gains | Loss offset | TDS / Withholding | GST / VAT on exchange fees | Holding‑period distinction |

|---|---|---|---|---|---|

| India | 30% (31.2% effective) | No | 1% TDS ≥₹50,000 | 18% GST | No - flat rate |

| UnitedStates | 0‑20% (long‑term) | Yes | None | Varies by state | Yes - short vs. long term |

| Germany | 0% after 1yr hold | Yes | None | 19% VAT on services | Yes |

| Singapore | 0% (no capital‑gains tax) | N/A | None | 7% GST on services | N/A |

| UnitedKingdom | 10% or 20% (CGT) | Yes | None | 20% VAT on services | Yes - CGT thresholds |

India’s regime is among the harshest because it combines a high flat rate, forbids loss offsetting, and adds both TDS and GST. Traders from other countries often cite the U.S. long‑term capital‑gains break or Germany’s one‑year exemption as far more friendly.

Practical Strategies to Keep Your Tax Bill Manageable

Because the law leaves little room for classic tax planning, most advice revolves around record‑keeping and timing:

- Consolidate exchanges. Fewer platforms mean a cleaner audit trail and fewer chances of double TDS.

- Hold through the fiscal year‑end. If you anticipate a loss, try to sell before March31 so the loss shows up in the same FY (even though it can’t offset gains, it still reduces your overall taxable income by not creating a gain).

- Use a dedicated Indian crypto‑tax software. Tools like Koinly automatically generate ScheduleVDA and calculate the 1% TDS credit.

- Consider gifting. Under Section56(2) you can gift assets up to ₹50,000 per year without tax, but the recipient must still report any future gains.

- Stay on top of GST invoices. Verify that your exchange provides a GST‑compliant invoice; otherwise you may face difficulty claiming input tax credit if you’re a GST‑registered business.

Remember: these aren’t loopholes - they’re simply ways to stay compliant while minimizing administrative pain.

Future Outlook - Will the Rules Change?

Since July2025 the government has kept the 30% rate, 1% TDS, and 18% GST untouched. However, there are signals of possible tweaks:

- The Reserve Bank of India and SEBI are drafting a broader digital‑asset regulatory framework; tax provisions may eventually be aligned with those rules.

- Industry groups have repeatedly asked for loss‑offsetting to be re‑introduced. If the government decides the tax base is too punitive, a modest amendment could appear in the 2026 budget.

- The TDS threshold of ₹50,000 has been discussed in Parliament as potentially too low for casual investors; raising it could reduce compliance burden.

Until any amendment is officially published, the safest bet is to assume the current regime will stay in place for the next few fiscal years.

Quick Reference Checklist for Bitcoin Traders

- Calculate gain = Sale₹ - Purchase₹.

- Apply 30% flat tax; add surcharge and cess (≈31.2%).

- Report loss separately - cannot offset.

- Check if 1% TDS was deducted; claim as pre‑payment.

- Obtain GST invoice for exchange fees.

- File ScheduleVDA in ITR‑2/ITR‑3 before July31.

Frequently Asked Questions

Is the 30% crypto tax the same as regular income tax?

Yes. The 30% rate is applied under the highest income‑tax slab of the Income Tax Act, plus surcharge and health‑education cess, so the effective rate is about 31.2% for most taxpayers.

Can I offset a loss on Ethereum against a Bitcoin gain?

No. Indian law forbids loss offsetting across different virtual digital assets. Each asset’s gain is taxed separately, and losses cannot be carried forward.

Do foreign exchanges have to deduct the 1% TDS?

Only Indian‑registered exchanges are mandated to withhold TDS. If you trade on a non‑Indian platform, you must self‑assess the 1% and pay it directly to the tax department.

How do I claim the GST paid on exchange fees?

If you are a GST‑registered business, you can claim input tax credit against the 18% GST shown on the exchange’s invoice. Individual investors cannot claim a credit but should retain the invoice for audit purposes.

What form do I use to report crypto gains?

You must fill ScheduleVDA (Virtual Digital Assets) in ITR‑2 or ITR‑3, attaching the computed tax liability and any TDS credit. The schedule became mandatory from FY2022‑23 onward.

Brooklyn O'Neill

February 10, 2025 AT 21:30Thanks for putting together this thorough guide; it really demystifies the Indian crypto tax landscape for newcomers and seasoned traders alike. The step‑by‑step breakdown of the 30% flat rate, the 1% TDS, and the 18% GST makes it easier to estimate the actual take‑home after taxes. I especially appreciate the practical checklist at the end – having a clear to‑do list before filing can save a lot of last‑minute stress. Keeping a tidy spreadsheet of purchase dates, amounts, and exchange fees is something I now do religiously. If you’re using Koinly or ClearTax, make sure you double‑check that the exchange fees are mapped correctly, otherwise the GST portion can get missed.

Patrick MANCLIÈRE

February 13, 2025 AT 06:03One thing that often trips people up is the distinction between Indian‑registered exchanges and international platforms when it comes to TDS. Indian exchanges automatically deduct the 1% before crediting your wallet, which shows up on your Form 16A, but foreign exchanges leave the onus on you to self‑assess and remit that amount. It’s worth setting a reminder each quarter to calculate any extra TDS due if you’ve been trading on Binance or Kraken. Also, the GST on exchange fees, while not directly taxable income, reduces your net profit, so keep those invoices handy for potential input‑tax credit if you’re a GST‑registered business. Finally, remember that the 30% rate applies to the entire gain irrespective of how long you held the asset – there’s no short‑term/long‑term split in India.

Ciaran Byrne

February 15, 2025 AT 14:35The 30% flat tax applies to every crypto gain.

Carthach Ó Maonaigh

February 17, 2025 AT 23:07Yo, if you thought that 30% was a punchline, think again – it’s a tax hammer that smashes any hope of a sweet profit. The government nailed down the TDS at a measly ₹50k threshold, so even a modest swing gets taxed at the source. And don’t even start on the GST; it’s like a tax‑on‑tax that eats into your margins while you’re busy watching the charts. Bottom line: crypto in India feels like a relentless tax treadmill, and you either jump in or stay on the sidelines.

Marie-Pier Horth

February 20, 2025 AT 07:39In the grand theatre of fiscal policy, the Indian government's imposition of a 30% levy on crypto gains stands as a stark reminder of the ever‑shifting sands upon which modern finance is built. One might argue that such a directive is not merely a revenue‑capturing mechanism, but a philosophical statement about the state's relationship with digital assets that defy traditional categorisation. The tax, layered with a 1% TDS and an 18% GST on exchange services, creates a triadic structure that challenges the simplistic narratives often propagated in popular media. While critics lament the lack of loss offsetting, the policy underscores an intention to treat virtual digital assets on par with conventional income streams. Moreover, the absence of a holding‑period distinction eliminates any ambiguity surrounding the classification of short‑term versus long‑term gains. From a compliance standpoint, the requirement to file Schedule VDA within ITR‑2 or ITR‑3 reflects an evolving legal architecture that seeks to integrate crypto into the broader tax ecosystem. The mandatory reporting threshold of ₹50,000 for TDS, though seemingly modest, signals a proactive stance against potential evasion. Simultaneously, the GST on exchange fees, albeit indirect, serves as a subtle instrument to ensure that ancillary services are not exempt from fiscal contribution. Practically, traders must now arm themselves with meticulous record‑keeping, documenting every transaction's INR value, date, and platform. Tools such as Koinly or ClearTax become indispensable allies in this administrative battlefield. In the larger macro‑economic tableau, the Indian approach may appear austere, yet it provides a clarity that many jurisdictions still lack. As the regulatory sands continue to shift, one can only anticipate that future amendments may introduce nuanced mechanisms, perhaps a re‑introduction of loss offsetting or a recalibrated TDS ceiling. Until then, the prudent path lies in diligent compliance, strategic timing of trades, and a keen awareness of the multi‑layered tax implications that define the contemporary crypto journey in India.

Gregg Woodhouse

February 22, 2025 AT 16:11meh, another tax. just do the math and move on.

F Yong

February 25, 2025 AT 00:43Sure, the government says it's all above board, but have you considered that the 1% TDS might actually be a subtle way to funnel crypto earnings into shadow accounts? It's not just about tax compliance; it's about control.

Sara Jane Breault

February 27, 2025 AT 09:16Keep a simple spreadsheet with columns for date purchase sale amount fee and INR value it makes filing way easier and you won’t miss the GST invoice from your exchange

Andrew McDonald

March 1, 2025 AT 17:48While the guide is comprehensive, it's worth noting that the effective tax rate can climb above 31% when surcharge thresholds are breached – a nuance often overlooked in generic overviews. 😉

Latoya Jackman

March 4, 2025 AT 02:20The information presented is clear and well‑structured; adhering to the checklist should help avoid any unexpected liabilities during filing.

Rachel Kasdin

March 6, 2025 AT 10:52Yo, why should we let some foreign tax office dictate our crypto profits? India’s rules are fine – we just gotta hustle and pay the man.

Nilesh Parghi

March 8, 2025 AT 19:24Adding to Patrick’s point, many Indian traders find it useful to batch their transactions near the fiscal year‑end to smooth out volatility in reported gains. This can make the 30% calculation feel a bit less brutal, especially if you’re planning to hold through the March deadline. Also, if you happen to be a GST‑registered business, don’t forget that you can claim input credit on the 18% GST charged by exchanges, which effectively reduces your overall tax outlay.

C Brown

March 11, 2025 AT 03:56Honestly, the whole 30% flat tax is just a band‑aid on a broken system. If you’re serious about crypto, you’ll find loopholes or move to jurisdictions that actually respect digital assets instead of squeezing every last rupee.

Noel Lees

March 13, 2025 AT 12:28Great overview! 🌟 Remember to set reminders for quarterly TDS payments if you trade on non‑Indian platforms – staying ahead of the deadline keeps the stress low.

Adeoye Emmanuel

March 15, 2025 AT 21:01From a coaching perspective, the most empowering habit is to automate data capture: use API exports from your exchange to feed directly into tax software. This not only reduces manual errors but also creates a living ledger that can be reviewed at any time, fostering confidence in your compliance journey.

Raphael Tomasetti

March 18, 2025 AT 05:33On the technical side, remember that the GST is applied on the net fee amount, so the effective cost is fee × 1.18. If your exchange shows a 0.25% fee, the real charge becomes roughly 0.295% of the transaction value.

Jenny Simpson

March 20, 2025 AT 14:05While many praise the clarity of the guide, I’d argue that the lack of a loss‑offset mechanism actually pushes traders toward more speculative behavior, which isn’t exactly a healthy market signal.