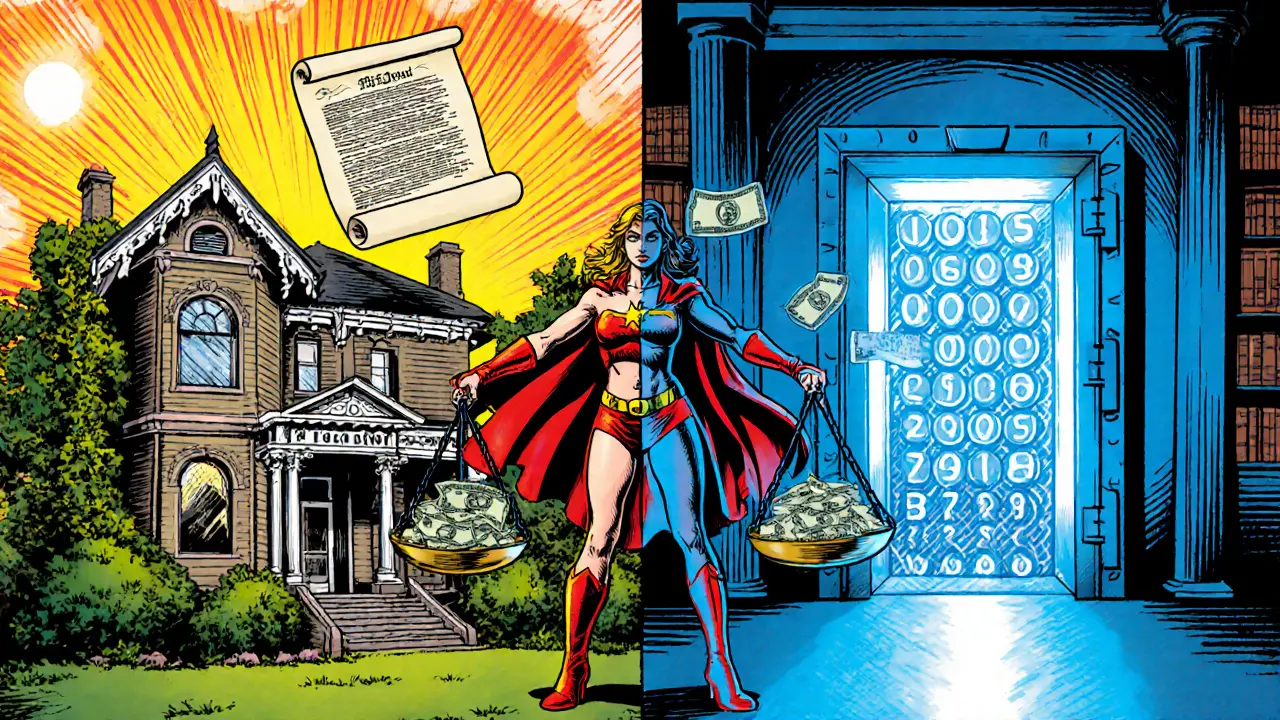

Property Classification in Crypto: What It Means and Why It Matters

When dealing with property classification, the process of assigning a crypto asset to a tax or regulatory category. Also known as asset classification, it helps investors, tax authorities, and exchanges decide how to report, comply, and manage risk.

Understanding property classification starts with a few key concepts. cryptocurrency tax, the set of rules that dictate how crypto gains are taxed in a given country. crypto tax determines whether a coin is treated as capital gain, income, or something else. regulatory jurisdiction, the legal territory whose laws apply to a crypto transaction. jurisdiction influences which tax rates, reporting forms, and licensing requirements apply. Finally, decentralized finance (DeFi), financial services built on blockchain without traditional intermediaries. DeFi often blurs the line between personal property and a financial instrument, making classification even more critical.

Why Property Classification Drives Real Decisions

First, tax compliance. South Korea, for example, imposes a 20% capital‑gains tax that can climb to 45% for high earners. Knowing that a meme coin like Dork Lord falls under the same bracket as a security lets you plan your paperwork and avoid surprises. Second, cross‑border moves. Zero‑tax crypto countries such as the Maldives or Puerto Rico become attractive once you classify your holdings as “personal property” rather than “business income.” Third, risk management. Underground markets in banned jurisdictions – China, Myanmar – often price assets at a premium because users treat them as illicit property. Classifying those tokens correctly helps you assess the premium risk versus potential reward.

Technology also shapes classification. Blockchain‑as‑a‑Service (BaaS) platforms remove the need for deep technical expertise, letting enterprises focus on how their tokenized assets are categorized for accounting purposes. Mining difficulty, a technical metric that keeps block times stable, can affect how miners view the underlying coin: a stable, low‑difficulty coin may be seen as a utility asset, while a high‑difficulty token might be treated as a speculative investment. All these factors tie back to the core idea that property classification is the lens through which tax, regulation, and business strategy align.

Practically, you’ll encounter classification in everyday crypto activities. When you claim an airdrop – say the Velas GRAND drop – you must decide if the received tokens are taxable income or a non‑taxable gift, depending on your jurisdiction’s rules. When you use a VPN to access crypto services in China, you’re navigating a regulatory gray area that treats your connection as a tool for accessing prohibited property. Each scenario forces a classification decision that directly impacts your reporting obligations.

For investors, the classification question appears in portfolio management. A token listed on a decentralized exchange like Turtle Network DEX might be treated as a security in the U.S., triggering different filing requirements than a token traded on a centralized exchange such as Bitbank in Japan. Meanwhile, DeFi protocols that issue liquidity pool tokens create hybrid assets that are part ownership, part debt instrument, demanding a nuanced classification approach.

Regulators are catching up, too. The Virtual Assets Bill in Pakistan redefines how tokens are classified, moving from a blanket ban to a tiered system that distinguishes between payment tokens, utility tokens, and securities. This shift illustrates how property classification evolves with policy and directly influences market access for projects ranging from BIBI on Binance Smart Chain to Elk Finance’s cross‑chain bridge.

In short, property classification is the connective tissue linking tax policy, regulatory landscapes, technical design, and real‑world usage. The posts below explore these links in depth – from South Korean tax brackets to underground market premiums, from BaaS adoption to mining difficulty basics. Dive in to see how each piece fits into the bigger picture of classifying your crypto assets correctly.

Property vs Currency Legal Classification: Key Differences for Digital Assets

Explore how the law separates property and currency, see the tax and legal implications for real, personal, and digital assets, and get a practical checklist for classifying crypto and other blockchain assets.

October 25 2025