Cryptocurrency Security

When dealing with cryptocurrency security, the practice of safeguarding digital assets against theft, loss, and unauthorized access, you quickly realize it’s more than just a buzzword. Keeping your assets safe means mastering cryptocurrency security strategies. One core piece is wallet protection, methods like hardware wallets, seed‑phrase backups, and encryption that keep private keys out of bad hands. Another vital tool is multisig wallets, accounts that require multiple signatures before a transaction can be executed, adding a layer of collective approval. Emerging decentralized identity, or DID systems, let users prove who they are without exposing secret keys, reducing phishing risk. Together these elements form a security stack: wallet protection secures the key, multisig enforces consensus, and DID verifies the user, all of which are essential for a robust crypto safety posture.

Key Areas of Focus

Even with a solid stack, attackers keep inventing tricks. Crypto ATM scams have surged, with fraudsters tampering with machines to skim funds – a reminder that physical points of sale need the same vigilance as online platforms. Airdrop scams also proliferate; false promises lure users into revealing seed phrases or paying bogus fees. VPN usage in restrictive regions, like China, introduces legal risk: while it can bypass censorship, authorities may penalize crypto activity conducted through anonymizing tools. On the network side, mining difficulty adjustments act as an implicit security mechanism, making it harder for malicious actors to rewrite history by increasing the computational effort required. Understanding how these vectors interact helps you prioritize defenses: secure your wallet first, then audit the services you use, and finally stay aware of regulatory and protocol‑level protections.

All of these topics weave together into a practical roadmap. Below you’ll find deep dives into each facet – from how multisig wallets operate, to spotting a fake airdrop, to the legal nuances of crypto access in different countries. Use the guides to tighten your own security posture, avoid common pitfalls, and stay ahead of emerging threats as the crypto landscape evolves.

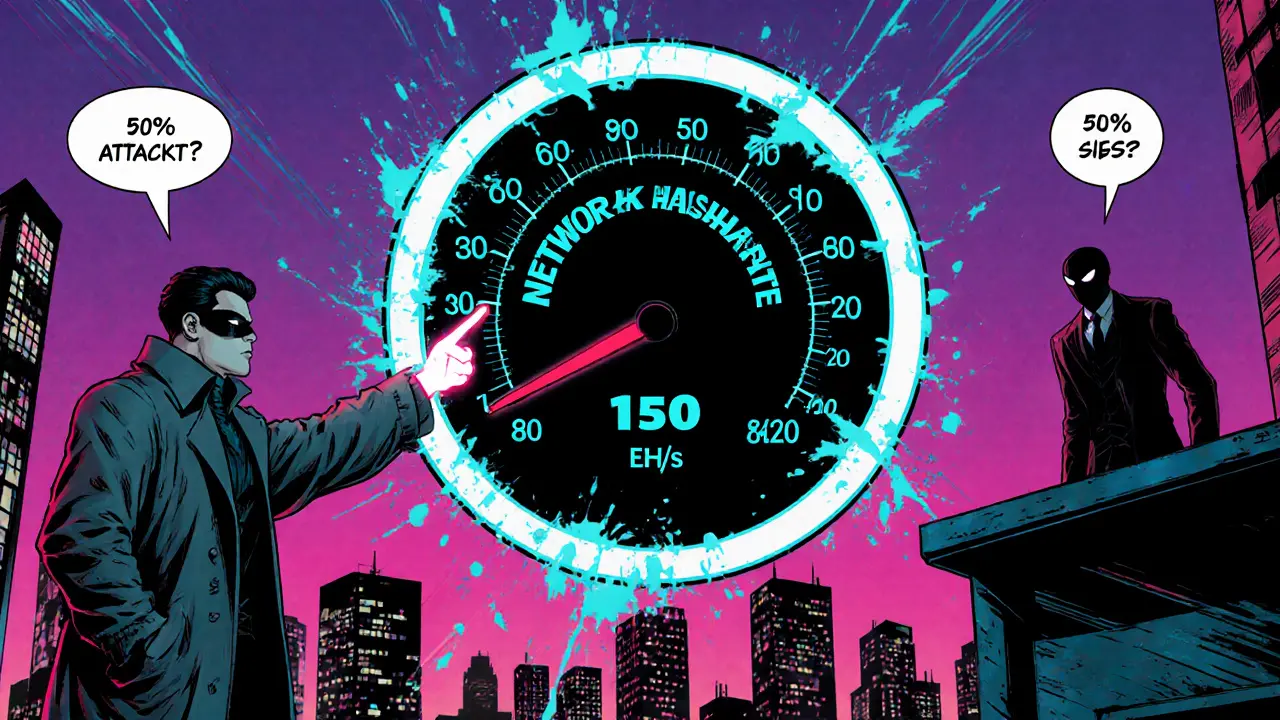

How Much Does a 51% Attack on Bitcoin Really Cost?

Explore why a 51% attack on Bitcoin costs billions, how hashpower, hardware, and economics shape the barrier, and why attackers are deterred.

September 15 2025