Crypto Exchange Scam: How to Spot and Avoid the Tricks

When dealing with crypto exchange scam, a fraudulent platform that pretends to be a legitimate cryptocurrency exchange to steal user funds. Also known as exchange fraud, it mimics real sites, harvests login credentials, or promises unrealistic returns. A common off‑shoot is the crypto ATM scam, where attackers tamper with cash‑in machines to skim crypto withdrawals. Likewise, airdrop scam uses fake token giveaways to lure victims into handing over exchange passwords. Strong exchange security practices—two‑factor authentication, withdrawal whitelists, and hardware wallets—can block many of these tricks.

Global regulation, the set of laws and supervisory rules governing crypto services, directly influences how often crypto exchange scams appear. In jurisdictions with clear licensing and consumer‑protection rules, scammers face higher legal risk and tend to operate less openly. Conversely, regions with vague or absent crypto policies become safe harbor for fraudsters, allowing them to set up fake exchanges that look convincing. Understanding which markets enforce strict crypto exchange scam penalties helps users choose platforms that are less likely to be scams.

Detection hinges on a few simple signals. First, check the URL: legitimate exchanges use HTTPS and a domain that matches their brand, while scammers often employ misspelled names or obscure extensions. Second, review the team page; real projects list verifiable identities and links to LinkedIn or GitHub. Third, examine deposit and withdrawal limits—unusually high or instant payouts are red flags. Finally, search community forums or social media for complaints; a flood of negative reports usually points to a scam. These checks form a practical triage that separates trustworthy services from deceptive ones.

Protecting yourself is mostly about layering defenses. Start with a strong password and enable two‑factor authentication on every exchange account. Use a separate, hardware‑based wallet for long‑term storage instead of keeping large balances on an exchange. Set withdrawal whitelists so funds can only move to pre‑approved addresses. Monitor account activity daily and enable email or push alerts for logins and transfers. If you ever suspect a phishing link, close the browser tab, clear cookies, and log in directly from the official site.

Key Warning Signs to Watch

Scammers often exploit human psychology: the promise of fast profits, limited‑time offers, or exclusive airdrops. When a platform pushes you to act immediately, pause and verify. Look for mismatched branding, poor grammar on the website, or missing legal disclosures. If the exchange asks for private keys or seed phrases, walk away—no legitimate service ever needs that information. By treating each of these cues as a data point, you can quickly assess whether an offer is genuine or a trap.

Armed with these insights, you’ll be ready to evaluate any new exchange, spot the red flags that a crypto exchange scam throws your way, and keep your digital assets safe. Below you’ll find a curated list of articles that dive deeper into specific scams, real‑world case studies, and step‑by‑step protection guides.

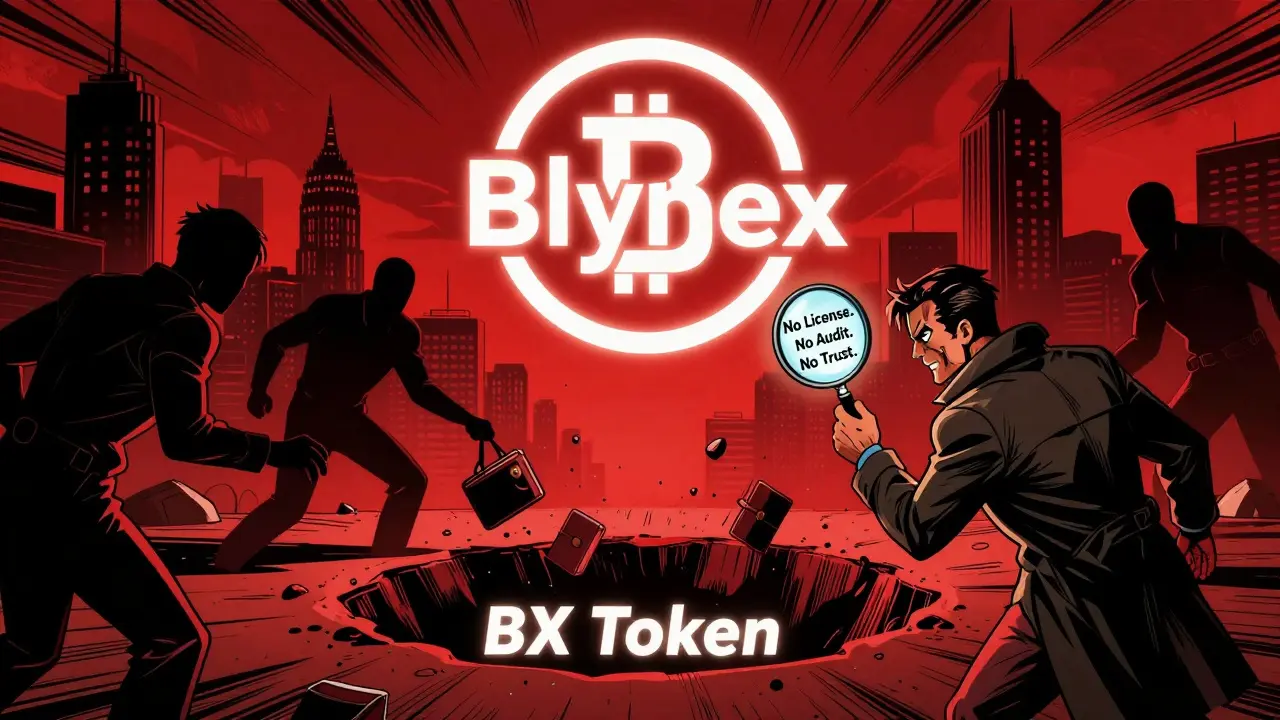

Blynex Crypto Exchange Review: Is It Safe or Just Another Scam?

Blynex crypto exchange is a high-risk platform with a $0.00 market cap, no audits, and a Gmail support address. This review exposes its red flags and warns users to avoid it entirely.

February 15 2026

IVYTEST Crypto Exchange Review: Safety, Fees & How It Stacks Up

A practical review of the obscure IVYTEST crypto exchange, covering safety, fees, red flags, and how it measures up against major platforms like Kraken and Coinbase.

November 16 2024