Mining Difficulty Calculator

How Difficulty Adjusts

Enter values below to see how mining difficulty changes based on hash rate and block time. The calculation uses the Bitcoin adjustment model (every 2,016 blocks).

Key Concept: Difficulty increases when blocks are mined too fast and decreases when they're too slow. The formula is: New Difficulty = Current Difficulty × (Ideal Time / Actual Time)

Adjusted Difficulty Result

Enter values to see calculation...

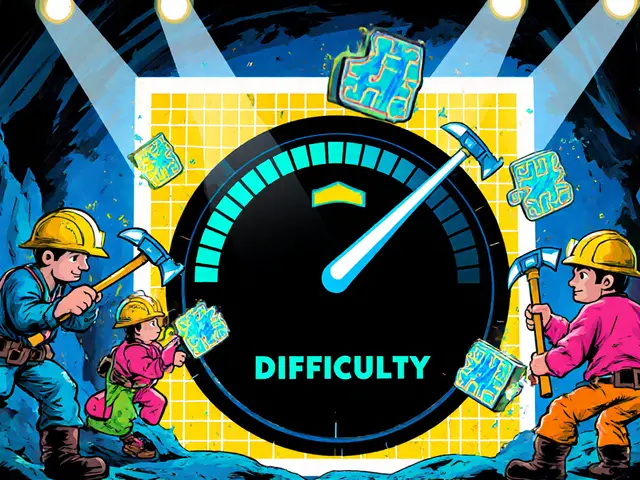

When you hear the term Mining Difficulty is a metric that tells how hard it is to find a valid block hash in a proof‑of‑work blockchain, you probably wonder why it matters. In plain English, mining difficulty is the knob that keeps block creation on schedule, no matter how many miners join or leave the network. If you’ve ever tried to solve a puzzle that gets harder every time you solve it quickly, you already get the idea.

How Mining Difficulty Works

Every PoW blockchain asks miners to hash a block header until the result is lower than a target value. The lower the target, the harder the puzzle. The network measures how fast the last set of blocks were found and tweaks that target, which we call the Proof-of-Work difficulty. When the hash rate spikes, the target drops, making the next hash hunt tougher; when hash power drops, the target rises, easing the hunt.

Why Blockchains Need Difficulty Adjustment

Without a self‑adjusting difficulty, a sudden influx of cheap hardware would flood the system with blocks, shrinking the average block time from, say, ten minutes to a minute. Faster blocks sound good, but they also flood the chain with transactions, increase orphan rates, and raise the chance of centralization. The opposite problem-too few miners-would stretch block times, delaying confirmations and hurting usability. Difficulty acts like an automatic thermostat, aiming for a pre‑set "temperature" of block time.

The Bitcoin Difficulty Formula Explained

Bitcoin recalculates difficulty every 2,016 blocks, roughly every two weeks. The formula compares the actual time taken for those blocks with the ideal 20,160 minutes (2,016 × 10 minutes). If miners took only 15,000 minutes, the network multiplies the previous difficulty by 20,160 / 15,000 ≈ 1.34, raising the bar. The adjustment is capped at a 4× increase or a 0.25× decrease to avoid wild swings.

Factors That Influence Difficulty Changes

- Network hash rate - More computational power means higher difficulty.

- Hardware upgrades - The arrival of new ASIC miners can double the hash rate overnight.

- Cryptocurrency price - Higher prices attract more miners, pushing difficulty up.

- Electricity costs and regulation - Cheaper power zones (e.g., parts of Kazakhstan or Texas) boost participation.

- Miner sentiment - A price crash can force marginal miners offline, pulling difficulty down.

Comparing Difficulty Algorithms Across Coins

| Coin | Adjustment Frequency | Typical Block Time | Adjustment Mechanism |

|---|---|---|---|

| Bitcoin | Every 2,016 blocks (~2 weeks) | 10 minutes | Global average over period, capped at ×4 / ÷4 |

| Ethereum (pre‑PoS) | Every block | ≈15 seconds | Dynamic formula using parent block timestamps |

| Dogecoin | Every 5,000 blocks (~1 hour) | 1 minute | Weighted moving average of recent hash rates |

| Litecoin | Every 2016 blocks (~3.5 days) | 2.5 minutes | Same algorithm as Bitcoin, but shorter period |

The variety shows a trade‑off: frequent adjustments keep block times stable during rapid hash‑rate swings, but they can introduce volatility in difficulty spikes. Longer intervals smooth out the curve but may let block times drift for days.

What Difficulty Means for Miners and Users

For a miner, higher difficulty translates directly into more hashes needed per block, which means higher electricity bills and a longer payback period for equipment. Mining pools-collectives of many miners-smooth out this variance by sharing rewards proportional to each participant’s contributed hash power. The pool’s payout model often references the current difficulty to estimate expected earnings.

For everyday users, difficulty indirectly affects transaction fees and confirmation speed. When difficulty climbs quickly, hash rate may temporarily lag, leaving fewer blocks available for transactions. Users then compete by raising fees, pushing the average fee market higher. Conversely, a dip in difficulty can free up block space, easing fee pressure.

Future Trends and Research on Difficulty

Researchers are probing ways to make difficulty adjustment more responsive without causing instability. Some proposals suggest hybrid models that blend Bitcoin’s two‑week window with Ethereum’s per‑block tweaks. Others explore 51% Attack mitigation techniques that tie difficulty to real‑world energy consumption, encouraging greener mining practices.

Environmental concerns are also nudging the ecosystem toward alternatives. Ethereum’s 2022 move to proof‑of‑stake eliminated difficulty entirely, shifting the security model to staking. Still, dozens of smaller PoW chains remain, and their difficulty mechanisms will continue to evolve as hardware improves and regulatory landscapes shift.

In short, mining difficulty is the silent regulator that keeps blockchains functional, secure, and economically viable. Whether you’re a hobbyist miner, a pool operator, or just a crypto user, understanding how this number moves helps you read the health of the network.

What exactly does mining difficulty measure?

It measures how many hashes, on average, a miner must compute to find a block that meets the network’s target. The higher the number, the harder the puzzle.

Why does Bitcoin adjust difficulty only every 2,016 blocks?

A two‑week window smooths out short‑term fluctuations in hash power, preventing sudden swings that could destabilize the network.

Can difficulty ever drop below 1?

No. The baseline difficulty of 1 was the starting point in 2009. All subsequent values are multiples of that base.

How does difficulty affect transaction fees?

When difficulty spikes, block production can lag, leaving fewer slots for transactions. Users raise fees to get priority, so average fees tend to climb during high‑difficulty periods.

Is mining difficulty the same for all proof‑of‑work coins?

No. Each coin defines its own adjustment interval and formula. Bitcoin uses a 2,016‑block window, Ethereum (pre‑PoS) adjusted per block, Dogecoin uses a 5,000‑block window, and so on.

What role does difficulty play in network security?

Higher difficulty usually means higher total hash rate, making a 51% attack more costly. The difficulty‑hash‑rate relationship is a core part of the economic security model for PoW blockchains.

Rebecca Kurz

October 19, 2025 AT 08:21Wow, the whole difficulty thing is like a secret hand‑shake, only the elite know the real numbers, right??? They’re probably hiding something behind those numbers, something the mainstream won’t tell you!!!

Nikhil Chakravarthi Darapu

October 25, 2025 AT 08:21Let me be crystal clear: the difficulty adjustment is a testament to our nation's engineering might. Precise algorithms keep our blockchain secure and performant, reflecting disciplined governance.

Tiffany Amspacher

October 31, 2025 AT 07:21Ah, the dance of difficulty! Like a tragic hero stumbling through the fog of hashes, only to rise again when the network sighs. It’s poetic, yet brutally practical - a drama of numbers that decides who lives and who watches in the dark.

Lindsey Bird

November 6, 2025 AT 07:21Honestly, this whole difficulty thing is just a boring thermostat for computers. I could care less.

john price

November 12, 2025 AT 07:21Look, the difiiculty alogrithem is so simple, even a child could unnderstand it, but you lot act like its some magick. Get real and stop complaing.

Ryan Steck

November 18, 2025 AT 07:21The real reason they keep tweaking difficulty is to keep the big guys in power, man. They don’t want small miners getting any traction, you feel me?

James Williams, III

November 24, 2025 AT 07:21The mining difficulty metric functions as a feedback control loop, analogous to a proportional‑integral‑derivative (PID) controller in process engineering. By measuring the elapsed time to mine a predefined window of blocks, the network computes a deviation from the target block interval. This deviation is then used to adjust the difficulty target upward or downward, aiming to nullify the error over the subsequent interval. In Bitcoin, the adjustment window is 2,016 blocks, which translates to roughly two weeks of real‑time operation. The formula isolates the ratio of actual elapsed minutes to the ideal 20,160 minutes and applies this scaling factor to the previous difficulty value.

Crucially, the design includes caps: a maximum four‑fold increase or a quarter‑fold decrease per adjustment period. These caps prevent runaway volatility, ensuring that any single shock to hash rate does not destabilize the network. Other PoW chains adopt different schedules; Ethereum (pre‑PoS) adjusts every block using the timestamp of the parent block, resulting in a more responsive but potentially noisier system.

From a security perspective, higher difficulty correlates with higher aggregate hash power, raising the economic cost of a 51% attack. Conversely, a prolonged dip in difficulty can signal reduced miner participation, possibly exposing the chain to greater attack vectors. For miners, difficulty directly influences expected revenue: the expected number of hashes per block is proportional to the difficulty target, meaning a higher difficulty translates to more electricity consumption and longer ROI periods for hardware.

Pool operators mitigate variance by distributing rewards proportionally to contributed hash power, smoothing the earnings curve for individual participants. End‑users feel the impact indirectly: as difficulty spikes, block production may lag temporarily, prompting users to increase transaction fees to secure faster confirmations. When difficulty eases, block space becomes abundant, and fee pressure eases accordingly. Understanding these dynamics is essential for assessing network health, miner profitability, and fee market behavior.

Patrick Day

November 30, 2025 AT 07:21People think difficulty is just a number, but it’s really a way for the “deep state” to keep us all in check. Every time you see it go up, it’s a sign they’re tightening the grip.

Scott McCalman

December 6, 2025 AT 07:21Obviously, the difficulty algorithm is just a glorified thermostat. 😏

PRIYA KUMARI

December 12, 2025 AT 07:21Really? You think that thermostat is a masterpiece? It’s a primitive tool, and anyone pretending otherwise is just feeding the hype.

Jon Miller

December 18, 2025 AT 07:21Well, I guess if you’re into drama, you can call it a thermostat, but the reality is a lot more intricate than that.

del allen

December 24, 2025 AT 07:21lol omg u r sooo right 😂 the real story is hidden behind all this math 😅

Tom Grimes

December 30, 2025 AT 07:21Look, I’m not trying to be a buzzkill, but the whole difficulty thing is basically a big, boring thermostat that keeps the blockchain from exploding or freezing. First, miners throw a massive amount of hash power at the network. When the network sees blocks coming in faster than the target time-say, ten minutes-it decides, “Hey, we’re going too fast,” and it raises the difficulty. That means each miner now has to do more work per block, which slows things down. Conversely, if miners quit or hardware fails and blocks start taking longer than ten minutes, the network lowers the difficulty, making it easier to find a valid hash. This push‑pull continues forever, keeping the block interval relatively stable. It’s simple in theory, but the real world has spikes-like when a new ASIC drops, the hash rate can double overnight, and the difficulty has to catch up in the next adjustment period. If it didn’t, the chain would get flooded with blocks, orphan rates would spike, and transaction fees would plummet, causing miners to quit-a cascading failure. So, in a nutshell, difficulty is the silent regulator; it’s not glamorous, but without it the blockchain would be chaotic. That’s all there is to it.

Paul Barnes

January 5, 2026 AT 07:21Everyone loves to praise difficulty as the ultimate guard, but what if the adjustment window itself is the Achilles’ heel?

John Lee

January 11, 2026 AT 07:21Interesting point! If the window is too long, sudden hash‑rate swings can cause temporary block‑time drift, affecting user experience. Shortening the window makes the system more responsive but may introduce volatility.

Jireh Edemeka

January 17, 2026 AT 07:21Ah, the classic trade‑off: speed versus stability. It’s like trying to keep a cat happy while also feeding it on a schedule-sometimes you just can’t have both without a mess.

Joy Garcia

January 23, 2026 AT 07:21Honestly, the whole difficulty narrative is just a grand illusion fed to us by the mining oligarchs. They want us to think it’s fair, but it’s just a control mechanism to keep power in the hands of a few.

mike ballard

January 29, 2026 AT 07:21🚀 It’s fascinating how cultural adoption of PoW differs worldwide, yet the difficulty algorithm remains a universal bridge across borders.

Molly van der Schee

February 4, 2026 AT 07:21Even though I don’t love emojis, I can see the optimism in your point - a bright future for global cooperation in securing blockchains.

Mike Cristobal

February 10, 2026 AT 07:21Let’s be honest: the difficulty adjustment is a moral test for the community - it forces us to choose between profit and principle.

Erik Shear

February 16, 2026 AT 07:21Effective adjustment is critical but should be balanced without overcomplicating consensus.

Tom Glynn

February 22, 2026 AT 07:21Exactly! A supportive environment, where miners can grow, benefits the entire ecosystem. Keep pushing forward! 👍

Johanna Hegewald

February 28, 2026 AT 07:21Difficulty is a simple concept, but it’s essential for anyone using PoW.