Blockchain Licensing Requirements Calculator

This tool assesses your blockchain business model against current US regulatory requirements. Input your business details to determine which licenses you need and potential penalties for non-compliance.

Your Business Model

Compliance Assessment

Important Compliance Note

Remember: The SEC and other regulators use blockchain analytics to track transactions and identify violations. Ignorance is not a defense. Consult a blockchain attorney before launching.

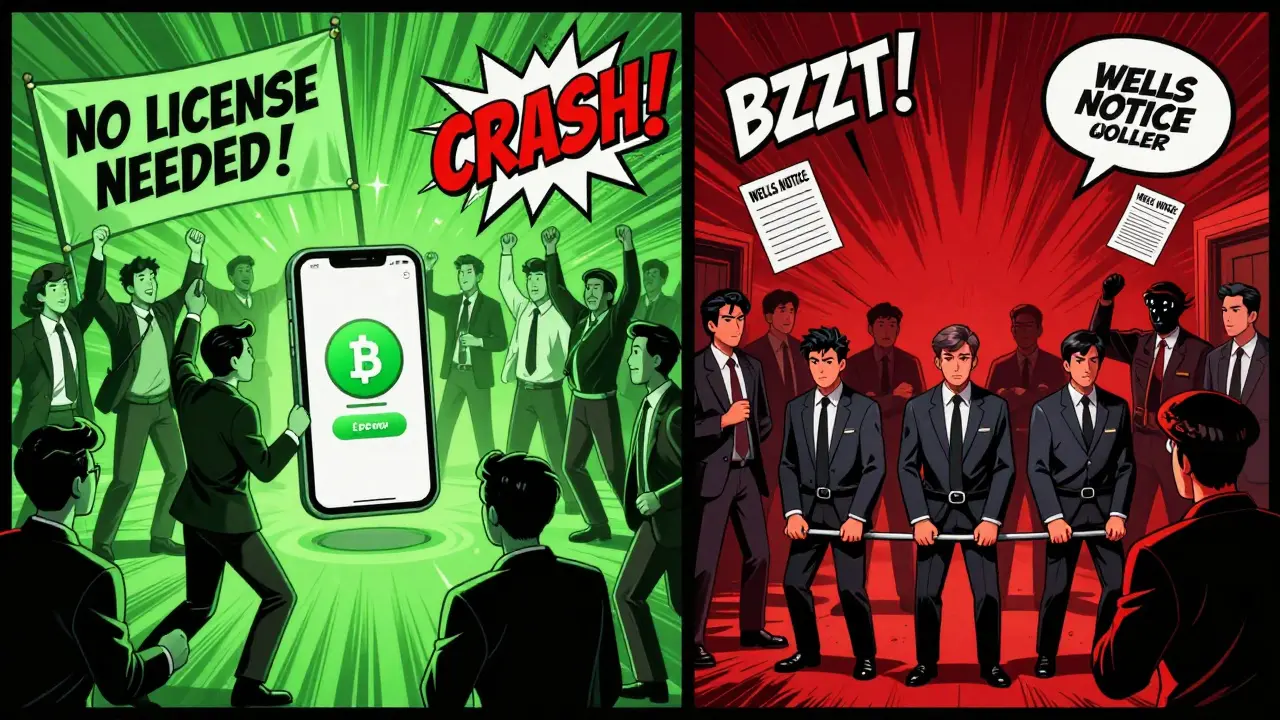

Running a blockchain project without proper licensing isn’t just a technical misstep-it’s a legal minefield. Whether you’re launching a crypto exchange, offering tokenized asset services, or operating a decentralized finance (DeFi) platform, skipping the paperwork doesn’t make you innovative. It makes you vulnerable. And in 2025, regulators aren’t just watching-they’re actively hunting.

What Counts as Operating Without a License in Blockchain?

"A blockchain startup isn’t exempt from the law just because it’s decentralized. If you’re handling money, assets, or financial services, you’re a financial institution under the law." - U.S. Securities and Exchange Commission, 2024 Enforcement GuidanceIn blockchain, operating without a license typically means one or more of these violations:

- Running a cryptocurrency exchange without a Money Services Business (MSB) registration with FinCEN

- Offering token sales without registering as a securities offering under SEC Rule 506 or filing a Reg A+ exemption

- Providing custodial wallet services without a BitLicense (New York) or equivalent state money transmitter license

- Operating a DeFi protocol that facilitates lending, borrowing, or trading without complying with anti-money laundering (AML) and know-your-customer (KYC) rules

- Marketing a blockchain product as an investment without disclosing material risks or registering as an investment advisor

Who Enforces Blockchain Licensing Rules?

Unlike traditional business licensing, blockchain oversight is fragmented across federal, state, and even international agencies:- FinCEN (Financial Crimes Enforcement Network): Requires all crypto exchanges and money transmitters to register as MSBs. Failure to register is a felony under 31 U.S.C. § 5312.

- SEC (Securities and Exchange Commission): Treats most utility tokens as securities if they meet the Howey Test. Unregistered offerings can trigger civil penalties and asset freezes.

- CFTC (Commodity Futures Trading Commission): Regulates crypto derivatives and futures. Unlicensed trading platforms face fines and shutdown orders.

- State Regulators: New York’s BitLicense, Wyoming’s crypto-friendly laws, and California’s DFPI all impose unique licensing rules. A company operating in 5 states may need 5 different licenses.

- OFAC (Office of Foreign Assets Control): Blocks transactions with sanctioned entities. Blockchain firms that fail to screen users can be fined for facilitating illegal transfers.

Penalties for Unlicensed Blockchain Operations

The consequences aren’t just financial-they’re existential.For businesses:

- FinCEN violations: Up to $1 million in civil penalties per violation, plus criminal charges for willful non-compliance. In 2023, a Texas-based crypto firm was fined $3.8 million for operating as an unregistered MSB.

- SEC violations: Asset freezes, injunctions, disgorgement of profits, and lifetime bans for founders. The $1.2 billion settlement with Ripple Labs in 2023 set the precedent.

- State-level fines: New York’s BitLicense violation can cost up to $100,000 per day of operation without a license.

- Reputational damage: 68% of users abandon platforms that are flagged for regulatory non-compliance, according to Chainalysis’ 2024 Trust Index.

For individuals:

- Founders can be personally liable. In 2024, a London-based crypto developer was extradited to the U.S. and sentenced to 4 years for unlicensed trading operations.

- Employees who knowingly participate in unlicensed activity can face fines, job loss, and barred从业 in financial services.

And unlike a traffic ticket, there’s no easy fix. Once flagged, you can’t just pay a fine and keep going. Regulators require full compliance audits, third-party attestations, and often a complete restructuring of your tech stack.

Why Do People Skip Licensing?

Most blockchain founders think they’re exempt because:- "We’re decentralized." → But if you control the wallet, the smart contract, or the fee structure, you’re not decentralized-you’re in charge.

- "No one told us we needed a license." → Ignorance isn’t a defense. The SEC’s 2023 guidance explicitly states that "lack of awareness does not excuse non-compliance."

- "We’re just a tool." → If your tool is used to trade securities, lend money, or move value across borders, you’re a financial intermediary under U.S. law.

A 2024 survey by the Blockchain Association found that 52% of early-stage crypto startups believed they didn’t need licenses because they "didn’t touch fiat." That’s false. Even pure crypto-to-crypto trading platforms must register with FinCEN if they act as intermediaries.

What’s Required to Get Licensed?

Getting licensed isn’t a formality-it’s a process. Here’s what it looks like in practice:| Agency | Requirement | Cost | Processing Time | Key Documentation |

|---|---|---|---|---|

| FinCEN (MSB) | Registration + AML/KYC program | $0 (federal), but $5K-$20K for compliance setup | 6-12 weeks | Business plan, AML policy, ownership disclosures |

| SEC (Securities Offering) | Reg D, Reg A+, or S-1 filing | $15K-$150K (legal + audit fees) | 3-9 months | Prospectus, financial statements, investor disclosures |

| New York BitLicense | State-specific money transmitter license | $5K application + $25K annual fee | 6-18 months | Background checks, cyber insurance, audit reports |

| CFTC (Derivatives) | Designated Contract Market or Swap Dealer registration | $50K-$200K | 12-24 months | Trading rules, risk controls, position limits |

Many startups use compliance platforms like Chainalysis KYT or ComplyAdvantage to automate screening. These tools reduce licensing risk by 63%, according to a 2024 Deloitte audit of 120 blockchain firms.

What Happens If You Get Caught?

The process isn’t pretty:- You receive a Wells Notice from the SEC or a cease-and-desist order from a state regulator.

- Your bank freezes your accounts. Payment processors like Stripe and PayPal shut you down.

- Your website is taken offline by hosting providers under pressure from regulators.

- Your team is forced to halt development while legal teams negotiate settlements.

- You pay fines, restructure your business, and submit to ongoing audits for 3-5 years.

In 2023, a DeFi startup in Austin tried to "go dark" after receiving an SEC notice. They deleted their website, moved servers offshore, and claimed they were "not subject to U.S. law." The SEC traced their founder’s identity through blockchain metadata, subpoenaed his personal crypto wallets, and froze his home in Texas. He’s now under federal indictment.

How to Stay Compliant (Without Going Broke)

You don’t need to hire a law firm in D.C. to stay legal. Here’s what works:- Start with FinCEN. Register as an MSB first-it’s free and covers the most common violation.

- Use licensed custody providers. Instead of holding users’ keys, partner with Coinbase Custody or Anchorage Digital.

- Don’t promise returns. Avoid language like "guaranteed yield" or "investment opportunity." Use "utility token" and "access rights" instead.

- Run KYC on every user. Even if you’re "decentralized," if you onboard users, you’re responsible for screening them.

- Consult a blockchain attorney early. A $5K legal review now saves you $2M later.

Companies like Uniswap and Aave now operate under legal frameworks that treat them as open-source protocols with no central operator. That’s the future. But you can’t get there by ignoring the rules-you get there by building within them.

What’s Changing in 2025?

New rules are rolling out fast:- The U.S. is finalizing the Stablecoin Transparency Act, requiring all stablecoin issuers to hold 100% reserves and obtain a federal charter by July 2025.

- The Digital Asset Market Structure Act will require all crypto exchanges to obtain a federal license by January 2026.

- 32 states now require blockchain firms to disclose their legal jurisdiction and licensing status on their websites.

- The EU’s MiCA regulation (effective June 2024) now applies to any firm serving EU users-even if based in Texas.

By 2026, the global blockchain compliance market will be worth $4.1 billion. The winners won’t be the ones who avoided regulation. They’ll be the ones who built their business on it.

Can I operate a blockchain business without a license if I’m outside the U.S.?

No. If your service is accessible to U.S. users, you’re subject to U.S. law. The SEC has pursued companies from Singapore, Switzerland, and Nigeria for serving American customers without proper licensing. Jurisdiction isn’t about where you live-it’s about where your users are.

Are NFTs exempt from licensing rules?

Not necessarily. If an NFT represents a share in a company, a revenue stream, or a right to future profits, the SEC treats it as a security. In 2024, the SEC fined an NFT project $1.7 million for selling fractionalized NFTs as unregistered securities.

Can I get a license after I’ve already been operating?

Yes-but you’ll pay for it. Retroactive licensing is allowed, but regulators impose higher penalties for past violations. You’ll need to file a voluntary disclosure, pay back taxes or fines, and submit to a full compliance audit. It’s expensive, but better than being sued.

Do I need a license to run a blockchain wallet app?

If your app holds users’ private keys or converts fiat to crypto, you need a money transmitter license. If it’s a non-custodial wallet (users control their keys), you don’t. But you must clearly state that you don’t hold funds, and you can’t offer trading or staking services without additional licenses.

What’s the cheapest way to get licensed?

Start with FinCEN MSB registration ($0) and use a third-party compliance provider like Chainalysis or Elliptic. Avoid offering securities or custodial services until you’re licensed. Focus on utility-based products first. Many startups begin with a simple token for access to a service-not for investment.

Abhishek Bansal

December 12, 2025 AT 23:14Candace Murangi

December 13, 2025 AT 13:37Bridget Suhr

December 14, 2025 AT 02:23Jessica Petry

December 14, 2025 AT 17:09Ike McMahon

December 14, 2025 AT 21:39JoAnne Geigner

December 16, 2025 AT 06:27Anselmo Buffet

December 17, 2025 AT 07:10Patricia Whitaker

December 18, 2025 AT 23:46Kathleen Sudborough

December 20, 2025 AT 03:20Vidhi Kotak

December 21, 2025 AT 08:20Kim Throne

December 22, 2025 AT 03:58Caroline Fletcher

December 22, 2025 AT 22:52Heath OBrien

December 23, 2025 AT 03:30Taylor Farano

December 24, 2025 AT 12:01Toni Marucco

December 26, 2025 AT 03:19Kathy Wood

December 26, 2025 AT 08:21Rakesh Bhamu

December 26, 2025 AT 12:52Hari Sarasan

December 27, 2025 AT 01:13Stanley Machuki

December 28, 2025 AT 21:53