Nigeria doesn’t have a list of banned crypto exchanges like a blacklist you can print out. Instead, it has a license-or-stop system. If a crypto exchange doesn’t have permission from the Securities and Exchange Commission (SEC), it’s effectively banned from operating in Nigeria. That’s the rule. No license? No Naira deposits. No withdrawals. No local customer support. No legal protection for users.

How Nigeria’s Crypto Rules Changed in 2025

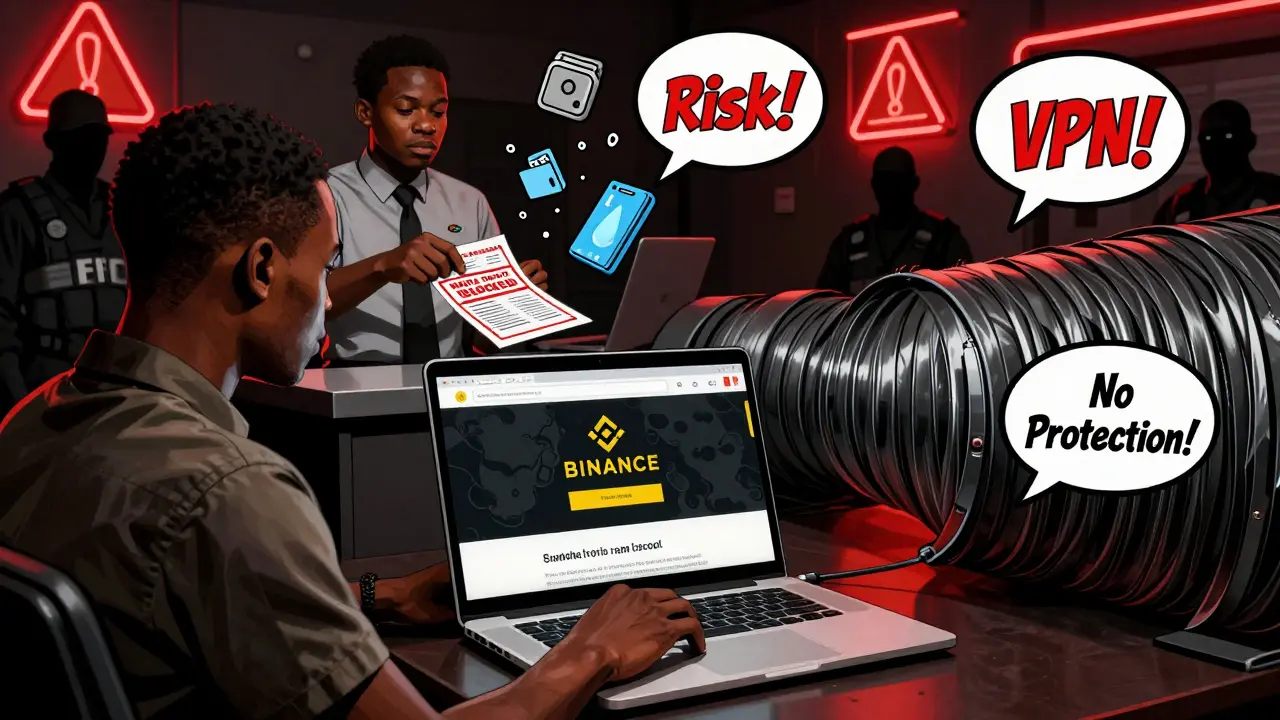

Before March 2025, Nigeria’s crypto scene was chaotic. Banks were told not to work with crypto companies. Exchanges got blocked. People used VPNs just to log in. But in March 2025, President Bola Ahmed Tinubu signed the Investments and Securities Act (ISA 2025). This wasn’t just a tweak-it rewrote the rules. Digital assets are now legally classified as securities. That means crypto exchanges are treated like stockbrokers. They need a license. No exceptions.The old ban from 2021, when the Central Bank of Nigeria (CBN) told banks to cut off crypto firms, was officially lifted in late 2023. But the real shift came with ISA 2025. Now, it’s not about blocking websites-it’s about controlling who gets to play. The SEC became the gatekeeper. If you want to serve Nigerian customers, you apply. If you don’t, you’re out.

Which Exchanges Are Actually Banned?

There’s no official list of banned names. But here’s what you can be sure of: any exchange that hasn’t applied for or received an SEC license is operating illegally in Nigeria. That includes most international platforms that haven’t jumped through Nigeria’s hoops.Binance is the biggest example. In February 2024, Binance stopped Naira trading on its peer-to-peer platform. Nigerian telecom providers blocked access to binance.com. But here’s the catch: you can still log into your Binance account. You can still trade Bitcoin for Ethereum. You can still withdraw crypto to your wallet. You just can’t deposit or withdraw Naira. That’s not a full ban-it’s a restriction. Binance still has Nigerian users, but they’re stuck in a gray zone. To access the site, many use VPNs, which violates Nigeria’s new rules.

Other international exchanges like Kraken, Coinbase, and Bybit haven’t applied for Nigerian licenses. So technically, they’re banned from offering Naira services. You won’t find them listed on the SEC’s approved platforms. If you try to deposit Naira through them, your bank will likely block it. And if you get caught using them for large-scale trading without a license, you could face penalties under the new Nigeria Tax Administration Act (NTAA 2025).

Which Exchanges Are Legal?

Only two exchanges have received full SEC approval as of early 2026: Quidax and Busha. These are Nigerian-based platforms that built their systems to meet the SEC’s strict standards. They’ve implemented full KYC (Know Your Customer), AML (Anti-Money Laundering), and transaction monitoring. They report to regulators. They’ve hired compliance officers. They’re auditable.Because they’re licensed, users can deposit and withdraw Naira directly. Customer support works within Nigerian time zones. Disputes can be escalated to the SEC. Many users report better service on these platforms compared to the chaos of unregulated exchanges before 2025.

Other local platforms like Luno and Coinmama are rumored to be in the licensing pipeline, but as of now, only Quidax and Busha are confirmed. If you want to trade legally in Nigeria, these are your only two options.

What Happens If You Use a Banned Exchange?

Using an unlicensed exchange isn’t a crime for the average user. But it’s risky. If you deposit Naira into a platform like Kraken or Binance (for trading), your bank might freeze the transaction. If you’re doing large-volume trades, the Economic and Financial Crimes Commission (EFCC) could investigate. Under NTAA 2025, which kicks in fully in 2026, you could be fined if you fail to report crypto income.For exchanges, the penalties are brutal. Unlicensed operators face immediate shutdown. The SEC can freeze assets, seize equipment, and refer cases to law enforcement. The first month of non-compliance costs ₦10 million ($6,693). Each month after that? Another ₦1 million ($669). That’s not a warning-it’s a death sentence for small operators.

Why Nigeria Chose This Path

Nigeria received $92.1 billion in cryptocurrency value between July 2024 and June 2025. That’s more than any other African country. Trying to ban crypto entirely was impossible. People were already using it to send money, pay bills, and protect savings from inflation.So instead of fighting adoption, Nigeria decided to regulate it. The goal? Protect users, stop scams, and bring crypto into the formal economy. The new rules ban Ponzi schemes outright. Regulators can now access telecom records to track fraud. They can freeze accounts linked to illegal activity. And they’re working with banks to make compliance easier for legitimate businesses.

This isn’t about stopping crypto. It’s about controlling it. Nigeria wants to be a fintech hub, not a black market. The licensed exchanges are proof that it’s possible to have innovation without chaos.

What About VPNs and Workarounds?

Many Nigerians still use VPNs to access Binance or other unlicensed platforms. It’s common. It’s easy. But it’s not legal. The SEC has made it clear: using a VPN to bypass restrictions violates the ISA 2025. While individual users aren’t being arrested for this, the message is loud: if you’re using an unlicensed exchange, you’re doing so at your own risk.Some users say they prefer Binance because it’s faster and cheaper. But they’re trading without legal protection. If Binance freezes your account or loses your funds, there’s no Nigerian authority to appeal to. With Quidax or Busha, you can file a complaint and get a response within days.

The Future of Crypto in Nigeria

More exchanges are applying for licenses. The SEC is reviewing dozens of applications. International platforms are starting to see Nigeria as a real market-not just a loophole. The licensing process takes 6 to 12 months. It’s expensive. It’s complex. But for those who make it through, the payoff is huge.By 2027, Nigeria could have 10 or more licensed exchanges. Stablecoins, DeFi protocols, and even NFT marketplaces might get their own rules soon. The framework is already in place. The regulators are learning. The market is growing.

For Nigerian crypto users, the choice is clear: use a licensed exchange and get protection, or use an unlicensed one and take your chances. The law isn’t going away. It’s getting stronger.

Pamela Mainama

February 2, 2026 AT 06:13Legal or not, if you're sending remittances or saving in crypto, you're doing what the system failed to do.

Richard Kemp

February 4, 2026 AT 00:54so binance still works if you use a vpn? weird that they just block naira but not the rest lol