Swap Cost Calculator

Calculate how many token swaps you can perform on different networks with a given amount of ETH.

Ethereum L1

High Cost$1.50 - $15 per swap

Speed: 15+ seconds

BSC (Binance Smart Chain)

Moderate Cost$0.15 - $0.50 per swap

Speed: 3-5 seconds

Linea

Low Cost$0.0001 - $0.001 per swap

Speed: 1-2 seconds

Results

With 0.01 ETH, you can perform:

- Ethereum L1 0 swaps

- BSC 20 swaps

- Linea 10,000 swaps

Note: These calculations are based on average gas fees. Actual costs may vary during network congestion.

When you want to swap tokens without paying $10 in gas fees, PancakeSwap v2 on Linea might be the answer. It’s not just another copy of the popular BSC version - it’s a faster, cheaper version built on Linea, an Ethereum Layer 2 that cuts costs by 98% and speeds up trades to under two seconds. If you’ve ever been priced out of DeFi on Ethereum or frustrated by slow trades on BSC, this setup could change how you trade.

What Makes PancakeSwap v2 on Linea Different?

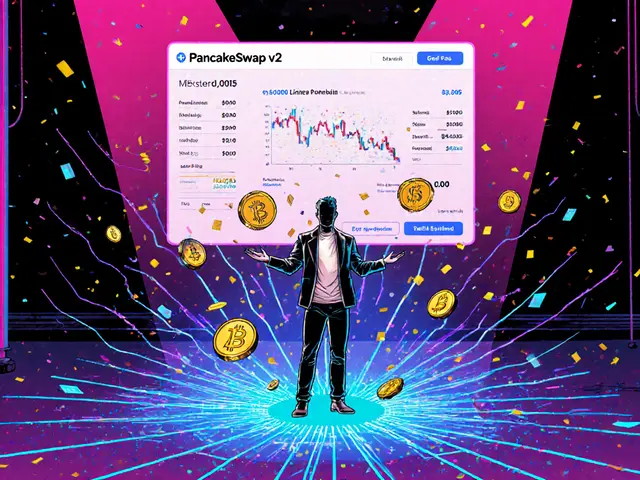

PancakeSwap started on Binance Smart Chain as a simple AMM (Automated Market Maker) DEX. By 2025, it had expanded to nine blockchains. But the Linea version isn’t just another chain plug-in. It’s built on a zkEVM - a system that runs Ethereum-compatible code with near-zero fees and instant finality. Unlike BSC, where gas fees spike to $0.50 during hype cycles, Linea keeps swaps around $0.0005. That’s not a typo. You can make 2,000 trades for the price of one Ethereum transaction. The core mechanics are the same: liquidity pools, yield farming, and CAKE token rewards. But now, tokens are ERC-20, not BEP-20. You still use your MetaMask or Trust Wallet. The interface looks identical to the BSC version - no learning curve. You just switch networks.How It Works: Step by Step

Getting started isn’t automatic. You can’t just connect and start swapping. Here’s what you need to do:- Bridge your ETH from Ethereum L1 to Linea using the official Linea Bridge. This takes 15-30 minutes. Don’t send less than 0.005 ETH - you’ll need gas to trade.

- Add Linea to your wallet. Open MetaMask, click "Add Network," and enter: Chain ID: 59144, RPC URL: https://linea.rpc.blxrbdn.com, Currency Symbol: ETH, Block Explorer: https://explorer.linea.build.

- Go to pancakeswap.exchange/linea. Connect your wallet. You’re in.

Performance: Speed, Fees, and Slippage

Here’s the real advantage:- Transaction speed: 1-2 seconds confirmed. On Ethereum L1? 15+ seconds. On BSC? 3-5 seconds.

- Gas fees: $0.0001-$0.001 per swap. On Ethereum, you’re paying $1.50-$15. On BSC, it’s $0.15-$0.50 during congestion.

- Slippage: Default is 0.8% for stablecoins, 1.2% for volatile tokens. Most users keep it at 1% - enough for meme coins without getting ripped off.

Liquidity: The Big Trade-Off

Here’s the catch: liquidity on Linea is thin. As of February 2025, PancakeSwap’s total value locked (TVL) on Linea is $187 million. Across all chains? $4.2 billion. That means for popular tokens like USDT or WETH, you’ll find fewer buyers and sellers than on BSC or Uniswap on Arbitrum. Compare that to Uniswap on Ethereum L2: $5.3 billion TVL. PancakeSwap on Linea has only 15% of that depth. For small trades under $500? No problem. For larger buys? You’ll see slippage spike. If you’re trying to move $10,000 of a new token, you might get a worse price than on BSC. It’s a trade-off: low fees and fast speed, but less liquidity. That’s why it’s perfect for retail traders, meme coin speculators, and yield farmers with small capital - not for institutions or big players.

Features: More Than Just Swapping

PancakeSwap on Linea doesn’t just let you swap. It’s a full DeFi hub:- Yield farming: Stake CAKE or LP tokens to earn more CAKE. APYs range from 35% to 65%. One user reported 1,247% APY - but that’s rare. Most pools are stable.

- Lottery: Buy tickets with CAKE. Winners get ETH or tokens. It’s a fun side game.

- Prediction markets: Bet on whether ETH will go up or down in 5 minutes. Popular with active traders.

- IFOs: Buy new tokens before they hit exchanges. Early access to new projects.

- NFT marketplace: Available, but limited. Not as robust as the BSC version.

How It Compares to Other DEXs

Here’s how PancakeSwap v2 on Linea stacks up:| DEX | TVL | Avg. Gas Fee | Speed | Unique Features |

|---|---|---|---|---|

| PancakeSwap v2 (Linea) | $187M | $0.0005 | 1-2 sec | Lottery, Prediction, IFOs |

| Uniswap V3 (Arbitrum) | $5.3B | $0.01-$0.05 | 2-5 sec | Concentrated liquidity, deep pools |

| Curve (Optimism) | $1.9B | $0.005 | 2 sec | Optimized for stablecoins |

| SushiSwap (Arbitrum) | $1.1B | $0.008 | 3 sec | Basic swapping only |

| PancakeSwap v2 (BSC) | $3.1B | $0.15-$0.50 | 3-5 sec | Full feature set, high liquidity |

Problems Users Face

It’s not perfect. Here’s what goes wrong:- Bridging fails: 23% of new users get stuck when moving ETH from Ethereum to Linea. Solution? Double-check RPC settings and wait 20+ minutes.

- Failed transactions: If a trade fails, increase gas limit to 1,000,000 units. Default is often too low.

- Limit orders glitch: Sometimes they don’t trigger for tax-on-transfer tokens. Avoid those until fixed.

- Customer support: No live chat. You get help via Telegram or Discord - response time: 3-4 hours.

- Centralized sequencer: Linea still uses a permissioned sequencer. That means Consensys controls transaction ordering. Some DeFi purists hate this.

Who Is This For?

PancakeSwap v2 on Linea is ideal for:- Meme coin traders: Buy and sell Shiba Inu, Dogecoin clones, or new tokens without paying $10 in fees.

- Small yield farmers: Stake $50 in a pool and earn 50% APY - you’ll make more than you spend on gas.

- Active traders: Do 10-20 swaps a day? Linea saves you hundreds per month.

- BSC users looking to cut costs: If BSC gas is rising, Linea is your escape hatch.

- Large investors: Slippage will hurt you on big trades.

- People who need instant support: No phone, no email, no live chat.

- Those who want maximum decentralization: Linea’s sequencer is still centralized.

What’s Next?

PancakeSwap isn’t standing still. The roadmap includes:- Full cross-chain limit orders (Q3 2025)

- Native zk-proof integration for better security (Q4 2025)

- Mobile app for Linea-specific trades (Q1 2026)

- Lowered minimum liquidity to $25 (already live)

Final Verdict

PancakeSwap v2 on Linea isn’t the most powerful DEX. It’s not the most liquid. But it’s the most practical for everyday crypto users who want to trade without paying a fortune. You get the same features as BSC, but with Ethereum-level security and fees 100x lower. It’s not a revolution - it’s an evolution. And for most people, that’s enough.If you’re tired of high fees and slow trades, and you don’t need to move $100,000 in a single trade - try it. Bridge 0.01 ETH, swap a token, and see how cheap and fast it feels. You might never go back.

Is PancakeSwap v2 on Linea safe?

Yes, as long as you use the official site (pancakeswap.exchange/linea). Linea is a zk-rollup built by Consensys, the team behind MetaMask and Ethereum. It inherits Ethereum’s security while using zero-knowledge proofs to verify transactions. However, the sequencer (which orders transactions) is still controlled by Consensys - so it’s not fully decentralized yet. Always double-check URLs and never share your private key.

Do I need CAKE to use PancakeSwap on Linea?

No. You can swap tokens without holding CAKE. But if you want to farm yield, participate in lotteries, or vote in governance, you’ll need CAKE. The token is wrapped and bridged to Linea as an ERC-20 version. You can buy it directly on the DEX or bridge it from BSC.

How do I get ETH on Linea?

Use the official Linea Bridge at bridge.linea.build. Connect your Ethereum wallet, select ETH, and approve the transfer. It takes 15-30 minutes. Alternatively, if you use Coinbase, you can now withdraw ETH directly to Linea - no bridging needed.

Why is my transaction failing on PancakeSwap Linea?

Most failures happen because the gas limit is too low. Increase it to 1,000,000 units in your wallet settings. Also, make sure you have enough ETH for gas (at least 0.005 ETH). Slippage set too low? Try 1% instead of 0.5%. And always check if the token has a transfer tax - those often break limit orders.

Can I use PancakeSwap on Linea with my phone?

Yes, but only through mobile wallets like Trust Wallet or MetaMask. There’s no official PancakeSwap app for Linea yet (expected Q1 2026). Just add the Linea network to your wallet, connect to pancakeswap.exchange/linea, and trade as usual. The interface works fine on mobile.

Is PancakeSwap on Linea better than Uniswap on Arbitrum?

It depends. Uniswap has far more liquidity and deeper pools, so it’s better for large trades and major tokens. PancakeSwap on Linea is cheaper and faster, with extra features like lottery and prediction markets. If you’re trading small amounts, memes, or farming yield - PancakeSwap wins. If you’re swapping ETH for USDC in large volumes, Uniswap is safer.

What’s the future of PancakeSwap on Linea?

Experts predict Linea’s TVL will hit $500 million by end of 2025. If Consensys fully decentralizes the sequencer and adds cross-chain limit orders, PancakeSwap could become one of the top 3 DEXs on Ethereum L2s. Right now, it’s a high-speed, low-cost bridge for retail traders. In 2 years, it could be a core DeFi infrastructure.

Marcia Birgen

November 15, 2025 AT 09:19Just tried this out yesterday with 0.01 ETH and swapped some SHIB - gas was $0.0004. I cried a little. This is what DeFi was supposed to be.

Why is everyone still stuck on BSC? The fees are a joke now.

Also, the lottery ticket I bought for 0.1 CAKE won me 0.03 ETH. Best $0.02 I ever spent 😍

Usnish Guha

November 16, 2025 AT 01:12You think this is revolutionary? It’s just a rebranded BSC with a zkEVM wrapper. The liquidity is pathetic. $187M TVL? That’s a rounding error compared to Uniswap on Arbitrum. You’re trading on a ghost chain with a pretty UI. Don’t fool yourself into thinking this is safe for anything beyond gambling on meme coins.

And yes, I’ve lost money here. Twice. The sequencer is still centralized. That’s not DeFi. That’s a sponsored Ethereum sidequest.

satish gedam

November 17, 2025 AT 05:35Hey newbies - if you’re trying this for the first time, don’t panic if the bridge takes 25 minutes. I thought mine was stuck too. Just wait. It’ll go through.

Also, set your slippage to 1% for meme coins - 0.5% will get you rekt. And yes, you can use Trust Wallet on Android, no app needed.

And if you’re farming CAKE, the 65% APY pool is legit. I’ve been in it for 3 weeks and my returns cover my bridge fees 10x over.

You’re not missing out. You’re just getting started. Welcome to the future 🙌

rahul saha

November 18, 2025 AT 22:39Linea isn’t a chain - it’s a philosophical statement. A quiet rebellion against the gas tax oligarchy. We’re not just swapping tokens, we’re redefining economic sovereignty one 0.0003 ETH transaction at a time.

And yes, the sequencer is centralized. But isn’t that just the first step toward true decentralization? The phoenix must burn before it rises.

Also, I just bought a $500 NFT here. It’s a pixelated cat. It’s beautiful. The gas was less than my coffee this morning.

Ella Davies

November 19, 2025 AT 02:29Used this for a small USDC to DAI swap. Took 1.2 seconds. Gas: $0.0007. No issues.

But I didn’t touch the lottery or prediction markets. Too much noise.

Just the swap. Clean. Fast. Done.

Jerrad Kyle

November 19, 2025 AT 11:40Let me tell you something - this is the real MVP of 2025. Not because it’s fancy, but because it’s stupidly simple.

Bridge. Swap. Repeat. No drama. No overcomplication. No 17-step tutorials.

I used to hate DeFi because it felt like a tech support nightmare. Now? I do 3 swaps a day on my phone while waiting for my coffee to brew.

That’s the win. Not the TVL. Not the zk-proofs. Just the fact that it works. Like a toaster. A crypto toaster.

Usama Ahmad

November 21, 2025 AT 10:51Been using this for a month now. No issues. Just switched from BSC because gas kept hitting $0.40.

Linea is smoother. Faster. Cheaper.

And the interface? Same as before. No learning curve. Just click and go.

Also, the CAKE farming APY is solid. I’m not rich but I’m not losing either.

Henry Lu

November 22, 2025 AT 03:32Linea? More like Line-a-hole. You think you’re saving money but you’re just feeding Consensys’ ego. They control the sequencer, they control the narrative, they control your trades. This isn’t DeFi. It’s a corporate-sponsored scam with a cute UI.

And don’t even get me started on the lottery. It’s a tax on hope. You think you’re playing the game but you’re just funding their marketing budget.

Stick to Ethereum mainnet. At least there, the fees are honest.

Nidhi Gaur

November 23, 2025 AT 10:15Same. Tried this last week. Bridged 0.02 ETH. Swapped $30 of a new memecoin. Gas: $0.0009. Slippage: 1.2%. Got my tokens.

Then I tried to withdraw. Failed. Increased gas limit to 1M. Worked.

So yeah - it’s cheap but it’s not flawless. Just don’t panic when it glitches. It’s still beta.

Rick Mendoza

November 24, 2025 AT 15:23TVL is $187M? That’s cute. Real DeFi doesn’t need to advertise its numbers because it doesn’t have to beg for users. This is a toy for kids with pocket change. If you’re not moving $10k+ in a single trade, you’re not even in the game.

And the lottery? Pathetic. I’ve seen better odds on a 90s arcade claw machine.

Save your CAKE. Buy Bitcoin instead.

nikhil .m445

November 26, 2025 AT 14:09Actually, I find it very impressive. The integration is seamless. The fees are negligible. The interface is identical to BSC. Why are people so negative?

This is the future. Everyone will be on zkEVMs soon. You are just not ready.

Also, I have been using it since launch. No problems. I am very satisfied.

Kelly McSwiggan

November 27, 2025 AT 22:50Low cost? Sure. But at what cost? You’re trading on a chain where a single company decides which transactions get processed first. That’s not decentralization. That’s a private club with a fancy logo.

And the liquidity? Please. You think you’re getting a good price on a new token? You’re getting the last bid before the dev rug pulls.

This isn’t innovation. It’s a slow-motion exit scam with a UX upgrade.

garrett goggin

November 28, 2025 AT 06:19Oh wow. Another ‘low cost’ DeFi miracle. Next they’ll tell me the sequencer is powered by unicorn tears and free market principles.

Consensys runs it. MetaMask runs it. You think you’re decentralized? You’re just a customer in their Web3 mall.

And the lottery? That’s how they monetize your hope. You’re not farming CAKE. You’re funding their IPO.

Wake up. This isn’t crypto. It’s a subscription service with a blockchain sticker.

Mike Gransky

November 28, 2025 AT 21:07Been using this for two months. Bridged ETH, swapped tokens, farmed CAKE. All good.

Only thing I’d say - don’t trust the prediction markets too much. They’re fun but they’re rigged for high-frequency traders.

Stick to swaps and farming. That’s where the real value is.

And yes, it’s faster than BSC. Way faster.

Gaurang Kulkarni

November 30, 2025 AT 00:38Let me break this down for you like you’re five - Linea is not magic. It’s a zkEVM. That means it bundles transactions and proves them on Ethereum. Cheaper because you’re sharing gas. Faster because it doesn’t wait for Ethereum blocks.

TVL is low because nobody’s moved here yet. But that’s changing. Look at the daily volume - up 300% in 60 days.

Also, the gas fee is $0.0005 because it’s not paying miners. It’s paying a sequencer. That’s not bad. That’s just economics.

Stop acting like this is a scam. It’s a transition. And you’re still on the bus that left the station.

Peter Rossiter

December 1, 2025 AT 09:46Same experience. Bridged 0.01 ETH. Swapped $100 of PEPE. Gas $0.0006. Took 1.5 seconds.

Then I did a second swap. Failed. Increased gas limit to 1M. Worked.

Third swap? Perfect.

It’s not perfect. But it’s better than BSC. And that’s all I need.

sandeep honey

December 1, 2025 AT 20:04Anyone else notice the CAKE token on Linea is wrapped as ERC-20? That means if you bridge it back to BSC, you’re paying bridging fees again. So you’re stuck. You can’t easily move between chains.

That’s not interoperability. That’s a trap.

And the IFOs? They’re launching tokens with no audits. I lost $800 on one last week.

Don’t get excited. Be careful.

Cherbey Gift

December 2, 2025 AT 23:17What is freedom? Is it the ability to swap tokens for $0.0003? Or is it the illusion of choice when the sequencer holds the keys?

Linea offers speed, but at the cost of sovereignty. We are trading autonomy for convenience.

And yet… I still use it. Because I am human. And humans love cheap things.

So tell me - is this evolution? Or just another form of surrender?

jesani amit

December 4, 2025 AT 23:07Just want to say - if you’re new to this, don’t be scared. I started with $20. Swapped ETH for USDC. Gas was less than a candy bar.

Then I added liquidity to the USDC/ETH pool. Earned 45% APY. After a month, I made $5 in rewards. Covered my bridge fee and then some.

It’s not a get-rich-quick thing. It’s a get-smart-quick thing.

And the interface? Still looks like the BSC version. No confusion. Just better fees.

You got this. Just take it slow. Watch the slippage. Don’t trust unknown tokens.

And yeah - the lottery is dumb but fun. I bought one. Didn’t win. Didn’t care. It was $0.02.

Bill Henry

December 5, 2025 AT 04:41Just tried it. Bridged ETH. Added Linea to MetaMask. Went to pancakeswap.exchange/linea. Connected wallet. Swapped 0.05 ETH for USDC. Done.

Gas: $0.0004. Time: 1.3 seconds.

That’s it. That’s the whole review.

Why are we writing essays? It’s a DEX. It works. It’s cheap. Try it.

Also, the mobile site works great on my iPhone. No app needed.

Jess Zafarris

December 6, 2025 AT 14:48So you’re telling me this is cheaper than BSC… but still centralized?

And the liquidity is 15% of Uniswap on Arbitrum?

So it’s a low-fee, low-security, low-liquidity playground for retail gamblers.

That’s… honestly just a fancy way to say ‘casino with a blockchain label.’

But hey - if you’re okay with that, go for it. Just don’t call it DeFi. Call it ‘crypto slot machines with gas discounts.’

Nathan Ross

December 7, 2025 AT 08:37It is a technically sound implementation of a zkEVM-based decentralized exchange. The architecture adheres to Ethereum Virtual Machine compatibility standards while achieving significant cost reduction through zero-knowledge proof verification.

However, the centralized sequencer introduces a non-trivial single point of failure. This contradicts the foundational ethos of permissionless systems.

Furthermore, the total value locked remains statistically insignificant relative to established Layer 2 ecosystems.

One might conclude that this is a transitional infrastructure - not yet mature, but demonstrably functional for microtransactions and speculative trading.

It is not a revolution. It is an incremental optimization.

And for the retail user seeking efficiency over ideological purity - it is adequate.

alex piner

December 7, 2025 AT 21:37Just want to say - I was skeptical too. But I tried it. Bridged 0.01 ETH. Swapped a meme coin. Gas: $0.0005. Took less than 2 seconds.

Then I farmed CAKE for a week. Made $3.50 in rewards.

It’s not perfect. But it’s better than paying $1.50 every time I want to swap.

And honestly? I feel like I’m part of something new. Not just another chain. A better way.

Thanks for the guide. I’m sticking with it.

Henry Lu

December 8, 2025 AT 01:28Oh wow. So now we’re pretending low fees mean decentralization? You’re not a trader. You’re a customer. And Consensys is your landlord.

And that ‘lottery’? That’s a tax on delusion. You think you’re playing? You’re just funding their next round of VC money.

And the IFOs? They’re launching tokens with zero audits. You’re not investing. You’re gambling with your life savings.

Stop pretending this is DeFi. It’s Web2 with a blockchain sticker.