Most people think investing in real estate means buying a house, signing papers, waiting months for closing, and tying up tens of thousands of dollars. But what if you could trade the price of Miami apartments or Paris condos like you would Bitcoin - without owning a single brick? That’s exactly what Parcl (PRCL) does. It’s not another meme coin. It’s a real infrastructure for trading real estate markets using crypto - and it’s built on Solana.

Parcl isn’t a company that sells property. It’s a decentralized exchange where you can go long or short on housing prices in major cities. Think of it like betting on whether New York rents will rise or fall over the next six months - but instead of a bookie, it’s a smart contract on the blockchain. And the native token that powers it all? PRCL.

How Parcl Turns Real Estate Into Tradeable Assets

Parcl doesn’t own buildings. It doesn’t manage leases. It doesn’t even have a single property on its balance sheet. Instead, it creates synthetic indices for real estate markets. Each index tracks the median price per square foot in a specific city - like Los Angeles, Austin, or Berlin - using real data from Parcl Labs, the platform’s official data provider.

These indices become the basis for perpetual futures contracts. That means you can open a position that never expires, unlike traditional options or futures. Want to bet that Toronto housing will go up 15% next year? You go long on the Toronto index. Think prices will crash after interest rates rise? Short it. You can even use up to 10x leverage, meaning a $100 bet could control $1,000 worth of exposure.

What makes this different from regular trading platforms? Every trade is fully collateralized. No borrowing. No credit checks. No counterparty risk. If you lose, your collateral gets liquidated. If you win, you get paid out directly from the pool. There’s no middleman. No bank. No broker. Just code running on Solana.

Why Solana? Speed, Cost, and Scale

Parcl runs entirely on the Solana blockchain. That’s not random. Solana handles over 65,000 transactions per second with fees under $0.00025. For a platform where traders might open and close positions dozens of times a day - especially during market-moving news like a city’s rent control vote - speed and cost matter more than anything else.

Compare that to Ethereum, where gas fees can spike to $10 or more during congestion. Or Bitcoin, which can’t even process smart contracts natively. Solana lets Parcl execute trades in under 400 milliseconds. That’s faster than your phone loads a webpage. And it keeps the entire system running smoothly even when thousands are trading at once.

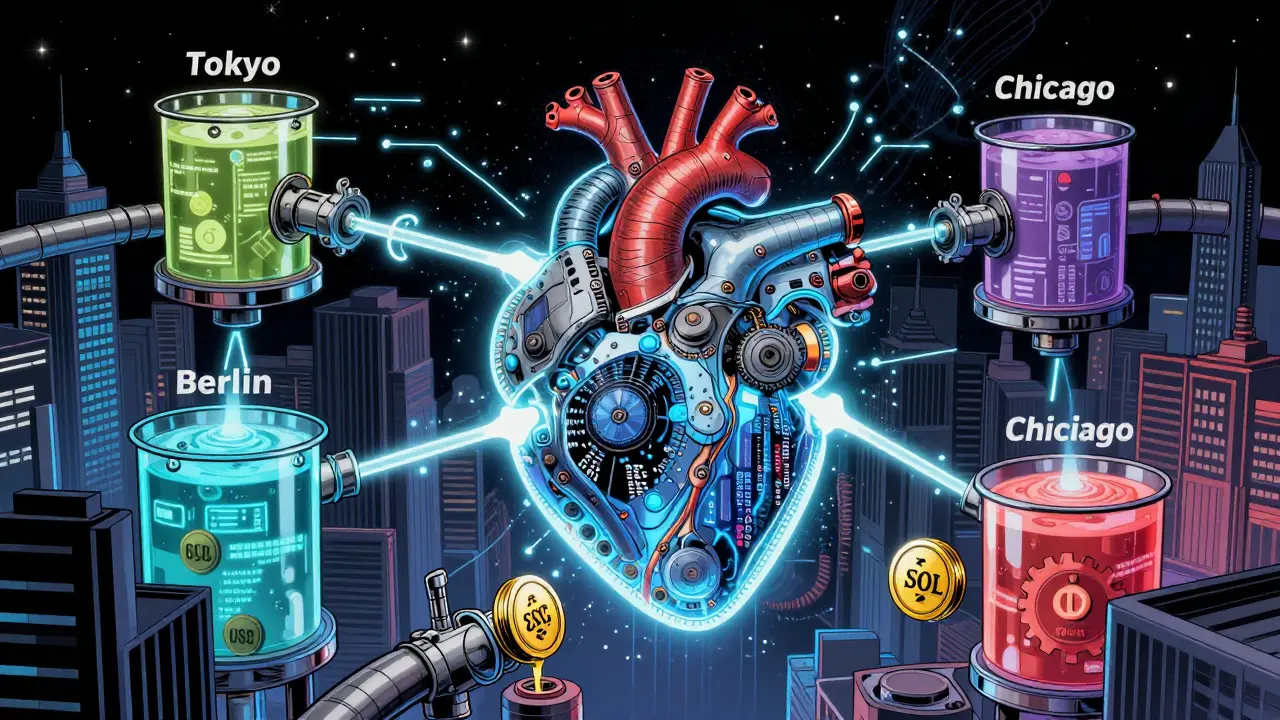

The platform also uses isolated liquidity pools. That means the market for Tokyo real estate has its own pool of collateral - separate from Chicago, from London, from Sydney. If prices crash in one city, it doesn’t drag down the others. This design prevents systemic risk. It’s like having 20 different mini-exchanges inside one platform.

What Is PRCL Actually Used For?

The PRCL token isn’t just a way to pay for trades. It’s the backbone of the whole ecosystem. Here’s what it actually does:

- Governance: Holders vote on new city listings, fee changes, protocol upgrades, and risk parameters. If you own PRCL, you help decide whether to add Dubai or Berlin next.

- Fee Discounts: Using PRCL to pay trading fees gives you up to 30% off compared to paying in USDC or SOL.

- Liquidity Rewards: When you deposit collateral into a city’s market pool, you earn a share of trader fees - and you get extra PRCL as a bonus for providing liquidity.

- Staking: You can lock up your PRCL to earn more PRCL. It’s not mining - Solana uses proof-of-stake, so there’s zero energy waste.

- Access to Data: PRCL holders unlock premium analytics from Parcl Labs: historical price trends, rental yield forecasts, market sentiment scores. This isn’t just charts - it’s institutional-grade real estate intelligence.

- Insurance Fund: A portion of the total PRCL supply is reserved to cover losses during extreme volatility. It’s a safety net built into the tokenomics.

PRCL was officially launched on April 16, 2024 - after three seasons of "Parcl Points" distributed to early users, contributors, and liquidity providers. That wasn’t airdrop chaos. It was a slow, deliberate build to align incentives. People who helped test the platform before the token even existed got rewarded. That’s rare in crypto.

Who Is Using Parcl? And Why Now?

On February 22, 2026, Parcl recorded $1.66 million in 24-hour trading volume. That’s not Bitcoin-level numbers - but it’s significant for a niche product. Most users aren’t day traders. They’re:

- Real estate investors in cities with high barriers to entry (like San Francisco) who want to hedge against price drops without selling their property.

- Remote workers who moved from New York to Atlanta and want to bet on the long-term value of their old city.

- DeFi enthusiasts looking for yield beyond stablecoin farming - with exposure to an asset class worth $300 trillion globally.

- International investors who can’t buy property abroad due to legal restrictions or capital controls.

One user in London told a crypto newsletter: "I’ve been shorting Miami since last summer. My property in Bristol is safe, but I knew Miami prices were overheated. I made a 22% return in three months - without paying a single pound in stamp duty."

That’s the real innovation: you’re not buying a house. You’re betting on the *idea* of a house - and you can do it from anywhere, with any amount of money.

How Risky Is It?

Let’s be clear: this isn’t a savings account. You can lose money fast. But Parcl has layered safeguards:

- Zero credit risk: No loans. No margin calls. You only trade with what you deposit.

- Automated liquidation: If your position goes too far underwater, the system closes it automatically before you go negative.

- Skew balancing: The AMM adjusts pricing to discourage one-sided bets. If everyone goes long on Phoenix, the system makes it more expensive to buy and cheaper to sell - naturally balancing the market.

- Insurance fund: Funded by a portion of PRCL token supply. It covers losses during black swan events - like a sudden city-wide rent freeze.

- Real-time price feeds: Parcl Labs pulls data from 15+ sources: MLS listings, tax assessments, rental platforms, public records. No single source can be manipulated.

There’s still risk - real estate markets can be volatile. But Parcl removes the biggest risks of traditional real estate: illiquidity, high entry costs, and geographic lock-in.

What’s Next for Parcl?

Right now, Parcl focuses on U.S. residential markets. But the roadmap is clear:

- Expanding to commercial real estate (office buildings, warehouses, retail centers)

- Adding international cities - Tokyo, Berlin, Singapore, Sydney

- Integrating with DeFi lending protocols so users can use PRCL as collateral

- Building mobile apps for real-time alerts and one-tap trading

The team behind Parcl - Trevor Bacon, Kellan Genier, Jason Lewris, and Stephen Robinson - have built this slowly. No hype. No influencer campaigns. Just code, data, and community feedback. The fact that they waited until November 2023 to launch v3, and didn’t release PRCL until April 2024, shows they prioritized stability over speed.

They’re not trying to replace Zillow. They’re not trying to be Coinbase. They’re trying to build the first liquid market for the world’s largest asset class - and they’re doing it one city at a time.

Final Thoughts

PRCL isn’t a coin you buy because it’s cheap. It’s a tool you use if you care about real estate - whether you own property, rent, or just want to understand how housing markets move. It turns a slow, opaque, and inaccessible market into something fast, transparent, and open to anyone with an internet connection.

If you’ve ever thought, "I wish I could invest in real estate without buying a house," Parcl is the answer. It’s not perfect. It’s not for everyone. But it’s real. And it’s here.

Is Parcl (PRCL) a good investment?

PRCL isn’t a traditional investment like stocks or Bitcoin. It’s a utility token that gives you access to a real estate trading platform. Its value depends on how much people use the platform - not just speculation. If more traders join, demand for PRCL rises due to fee discounts, staking rewards, and governance power. But if usage stalls, the price could stagnate. Only invest what you’re comfortable losing.

Can I lose more than I deposit on Parcl?

No. Parcl uses a zero-credit-risk model. You can only trade with the collateral you deposit. If your position falls below the liquidation threshold, the system closes it automatically before you go negative. You won’t owe money beyond what you put in.

How does Parcl get real estate price data?

Parcl Labs, the platform’s data arm, aggregates real-time housing data from multiple public and private sources: MLS listings, tax assessments, rental platforms like Zillow and RentCafe, public property records, and government housing surveys. No single source is trusted - data is cross-verified to prevent manipulation.

Do I need to own crypto to use Parcl?

Yes. You need cryptocurrency to trade on Parcl. The platform accepts USDC and SOL as collateral. You can buy PRCL on exchanges like KuCoin or OKX, but you don’t need PRCL to open a position - only to get fee discounts and governance rights.

Is Parcl legal?

Parcl operates as a decentralized platform and does not require users to pass KYC. However, users are responsible for complying with their local laws. In many countries, trading synthetic real estate derivatives may be treated as financial speculation or gambling. Always check your jurisdiction’s rules before trading.

Can I stake PRCL without trading?

Yes. You can stake PRCL tokens directly through the Parcl wallet interface without ever opening a trade. Staking earns you additional PRCL as rewards based on how long you lock your tokens and how much you stake. It’s a way to earn passive income while supporting protocol security.

What cities does Parcl support right now?

As of February 2026, Parcl supports 18 major U.S. cities including Los Angeles, New York, Miami, Austin, Seattle, and Chicago. International markets like Berlin and Tokyo are in testing. New cities are added quarterly based on user votes and data availability.

Parcl (PRCL) doesn’t try to be everything. It doesn’t need to. It just needs to make real estate markets liquid - and so far, it’s working.