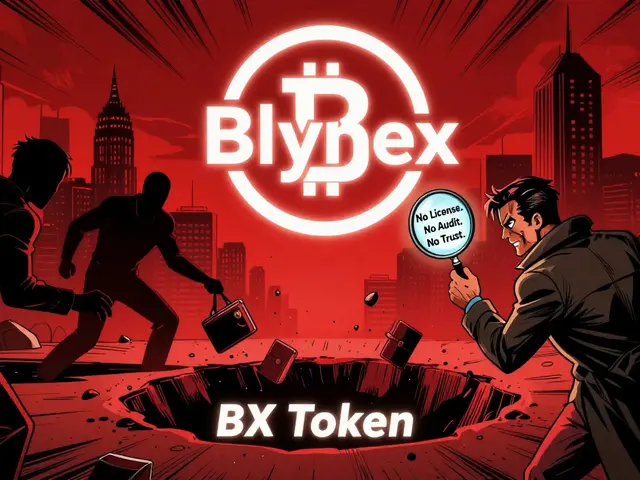

When you hear about a new crypto exchange promising AI tools, token rewards, and instant trades, it’s easy to get excited. But Blynex isn’t just another newcomer. It’s a red flag wrapped in flashy marketing. If you’re thinking of depositing money here, stop. Read this first.

What Is Blynex Exchange?

Blynex Exchange launched in 2024 with a simple pitch: a fast, user-friendly platform for trading crypto. It claims to support spot, futures, and even stock trading. The website says it’s built for beginners and pros alike. But behind the smooth interface and AI-powered analytics, there’s almost nothing real. The company behind it, GM PROJECT, LLC, is registered at a residential address in Yerevan, Armenia. No office. No physical presence. Just a PO box and a phone number. Legitimate exchanges don’t operate like this. Even small platforms like KuCoin or Gate.io have clear legal entities, offices, and public leadership teams. Blynex doesn’t. Its mobile app, available on Android and iOS, has just over 1,000 downloads on Google Play. That’s less than a single popular meme coin’s community. Compare that to Binance, which has over 50 million downloads. If no one’s using it, why should you?The BX Token: A Token With No Value

Blynex has its own token: BX. It runs on the BNB Smart Chain. The contract address is real - 0xFA3a42aD2260135538e4AEf265bd2bcCF7f1D179. But here’s the problem: its price is around $0.00000208. That’s two hundredths of a cent. Its market cap? Listed as $0.00 on Coinbase. That’s not a glitch. That’s a death sentence. Legitimate exchange tokens - like BNB, UNI, or OKB - trade for dollars, not fractions of a cent. Even obscure tokens from smaller exchanges hover above $0.10. BX trades at a level that only scam projects reach. According to crypto analyst Michael van de Poppe, tokens under $0.0001 with no volume are almost always pump-and-dump schemes. BX fits perfectly. The platform promotes a “BX Spinner” game where you earn points for trading. You can then convert those points into BX tokens. Sounds fun? It’s a trap. There’s no liquidity. You can’t sell BX for anything meaningful. No major exchange lists it. No wallet supports it for transfers. You’re just playing a game with digital play money.No Audits. No Licenses. No Trust.

Security claims? “Advanced encryption” and “multi-signature wallets.” Sounds good? It’s meaningless without proof. There are zero third-party security audits for Blynex. No report from CertiK, Hacken, or SlowMist. Zero. Regulatory licenses? None. Blynex doesn’t hold a license from the SEC, FCA, MAS, or any other major financial authority. It claims to “adhere to global standards” - but names none. That’s not compliance. That’s evasion. Compare this to Coinbase, which is regulated in the U.S. and Europe. Or Kraken, licensed in over 50 jurisdictions. Blynex operates in the grayest of gray zones. And that’s not a feature. It’s a warning.

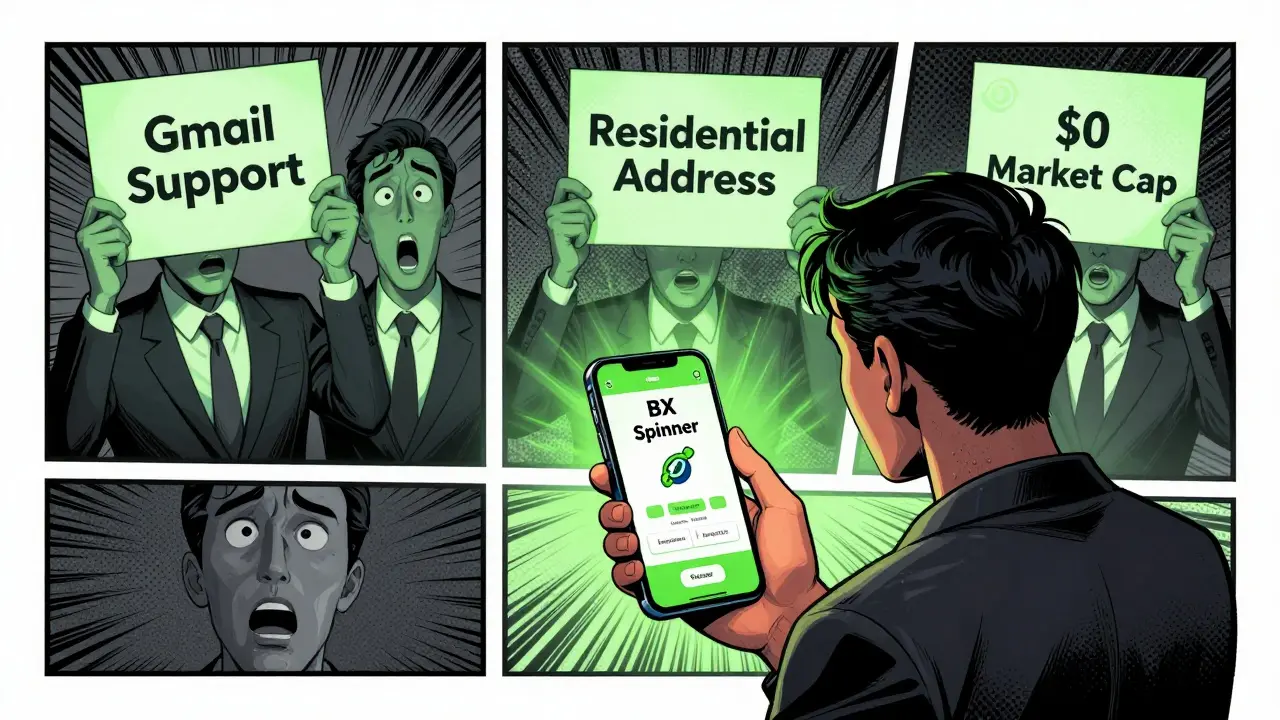

Customer Support: A Gmail Address?

How do you contact support? You don’t. Not really. The official website has no live chat. No help center. No ticket system. The only contact method listed on Google Play is a Gmail address: [email protected]. A personal Gmail account. For a financial platform. CipherTrace’s 2025 Exchange Security Guidelines say this is a major red flag. Legitimate companies use domain-based emails - like [email protected]. Not a random Gmail account tied to a name that looks like a typo. If they can’t even set up a proper email, how are they securing your funds? And the phone number? +374 99 110219. That’s a mobile number in Armenia. No recorded call logs. No verified customer service history. Just a number on a Play Store page.Trading Volume? Doesn’t Exist

Blynex says it has “rapid order execution.” But how fast? No numbers. No benchmarks. No TPS (transactions per second) data. Nothing. More importantly - where’s the trading volume? CoinGecko, CoinMarketCap, CryptoCompare - none list Blynex. Not even as a minor exchange. That’s not oversight. That’s exclusion. These sites track every active platform. If Blynex had $1 million in daily volume, it would be on the list. But it’s not. Because there’s none. Binance processed $693 billion in spot trading in October 2025. Blynex? Probably less than $10,000. Maybe $0. The lack of volume means no liquidity. That means you can’t buy or sell without slippage. Or worse - you can’t withdraw at all.User Reviews? None.

You’d think at least a few people tried it. You’d be wrong. No reviews on Trustpilot. No posts on BitcoinTalk. No threads on Reddit. Not even a single complaint on HackerNews or HackerOne. That’s not normal. Even sketchy exchanges get talked about. People rage about delays, hacks, or locked funds. Blynex? Silence. The only mention on r/CryptoCurrencyScams was a warning about “BX token pumps” and “suspicious distribution patterns.” That’s not a user review. That’s a public service announcement. If no one’s talking about it - good or bad - it’s because almost no one is using it. And if no one’s using it, why would you risk your money?

What’s the Real Risk?

Let’s be clear: Blynex isn’t a broken exchange. It’s a potential scam. The signs are textbook:- Token price under $0.0001

- $0.00 market cap

- No trading volume on any tracker

- No regulatory licenses

- No security audits

- Residential business address

- Gmail customer support

- Zero community presence