China's Crypto Regulation Timeline

Key Regulatory Milestones

Regulation Impact Calculator

Estimate the potential impact of a crypto ban on a country's digital economy:

Estimated Impact Analysis

- Market Disruption:

- Miner Relocation:

- Price Volatility:

- Regulatory Compliance Costs:

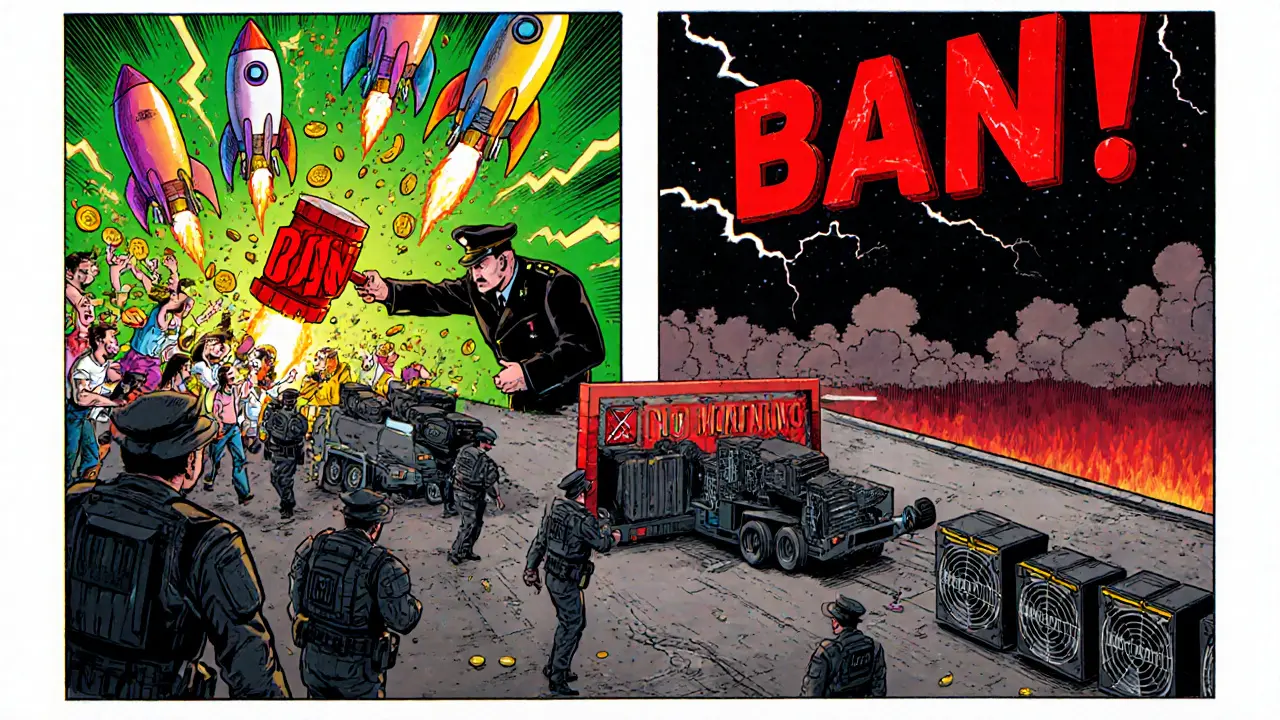

Chinese government cryptocurrency seizures and enforcement actions are the most sweeping anti‑crypto measures ever enacted by a major economy. Starting with a vague warning in 2009 and culminating in a blanket prohibition on June 1, 2025, the campaign has reshaped the global crypto landscape and accelerated the rollout of the state‑backed digital yuan.

Quick Take

- June12025: Complete ban on crypto trading, mining, and private ownership.

- Enforcement includes confiscation of digital assets, VPN monitoring, and heavy fines.

- China’s PBOC leads the effort, citing financial stability and digital‑yuan promotion.

- International cases, like the 2018 UK seizure of 61,000BTC, show cross‑border fallout.

- Global markets felt repeated shocks; miners relocated, exchanges migrated, and volatility spiked.

Early Regulations (2009‑2014)

In June2009 the People’s Bank of China (PBOC) issued its first warning, labeling virtual tokens as “non‑legal tender” to prevent merchants from accepting them for real‑world goods. By December2013, the central bank ordered banks and payment institutions to stop facilitating Bitcoin transactions, citing money‑laundering risks. The crackdown deepened in April2014 when the PBOC forced the closure of all Bitcoin trading accounts, effectively cutting off retail access to the market.

Escalation: ICO Ban and Exchange Shut‑downs (2017‑2018)

September2017 marked a turning point. China banned Initial Coin Offerings (ICOs) and ordered the shutdown of domestic crypto exchanges, arguing that mass fundraising through unregulated tokens threatened investors. The move pushed many projects offshore and triggered a rapid exodus of capital. In January2018 the government intensified the clamp‑down, compelling miners to either cease operations or move abroad. By the end of 2018, China’s share of global crypto trading volume had fallen dramatically.

Mining Crackdown (2021)

June2021 saw the first explicit ban on crypto mining, framed as an environmental measure. Authorities cited excessive energy consumption and the need to curb speculative capital flows. Massive shutdowns forced an estimated 300,000 miners to relocate equipment to North America, Kazakhstan and Russia. The loss of Chinese hash power caused a steep drop in Bitcoin’s network hashrate and a short‑term price dip.

The 2025 Comprehensive Ban

On May302025 the PBOC issued a decree that took effect on June1, prohibiting any form of cryptocurrency trading, mining, and even private ownership of digital assets. The regulation also bars citizens from accessing foreign exchanges via Virtual Private Networks (VPNs). Violators face asset seizure, heavy fines up to 10millionCNY, and possible imprisonment.

The decree’s key provisions are:

- All crypto‑related transactions must be halted within 30days.

- Mining rigs are classified as illegal industrial equipment.

- Individuals caught holding any crypto token will have assets confiscated.

- Financial institutions must report suspicious crypto activity to the PBOC.

- Internet service providers are required to block VPN traffic that accesses known crypto platforms.

The ban is positioned as a catalyst for the digital yuan (China’s Central Bank Digital Currency), ensuring that all digital payments funnel through a state‑controlled channel.

Enforcement Mechanics

China’s enforcement arsenal combines traditional policing with advanced cyber‑surveillance:

- Asset seizure protocols: Authorities can freeze wallet addresses linked to identified individuals, then compel exchanges to surrender private keys.

- Network traffic analysis: Deep‑packet inspection monitors traffic for VPN signatures and encrypted crypto API calls.

- Financial transaction monitoring: Banks flag large transfers to and from offshore crypto exchanges.

- Penalties: First‑time offenders may face a 1‑year ban on financial services; repeat offenders risk criminal charges.

These mechanisms have already led to the confiscation of millions of dollars worth of Bitcoin and Ethereum, though exact figures remain classified.

International Ripple Effects: The UK Bitcoin Seizure Case

In October2025 a Chinese national pleaded guilty in a UK court for operating a fraudulent crypto investment scheme. UK law enforcement seized nearly $7billion worth of Bitcoin during an October2018 raid - the largest Bitcoin confiscation ever recorded. The operation uncovered wallets storing roughly 61,000BTC, valued at about £5.5billion at the time of seizure. Negotiations between British and Chinese authorities continue over the disposition of the assets, highlighting how China’s domestic crackdown can spill over into global jurisdictions.

Impact on the Global Crypto Market

China’s 16‑year regulatory journey has been a roller‑coaster for global markets. Each tightening wave triggered sharp price corrections, forced exchanges to relocate, and reshaped mining geography. After the 2025 ban, China’s contribution to worldwide crypto trading volume fell to near‑zero, and hash power from former Chinese miners now accounts for less than 5% of the global total.

Investors responded with increased volatility; Bitcoin’s price swung ±12% in the week following the ban announcement. Meanwhile, alternative markets in the United States, Europe and the Middle East saw inflows as traders sought jurisdictions with clearer regulatory frameworks.

Digital Yuan Promotion - The Strategic Goal

The digital yuan is more than a payment token; it is a tool for monetary policy, capital control and data collection. By eradicating private cryptocurrencies, Chinese authorities aim to funnel all digital payments into the state‑run ecosystem, giving the PBOC real‑time oversight of cash flows and the ability to implement targeted stimulus directly to citizens’ wallets.

Early pilot programs in major cities have already shown higher adoption rates, and the 2025 ban is expected to accelerate nationwide rollout. The digital yuan’s integration with existing mobile payment platforms (Alipay, WeChat Pay) further entrenches its dominance.

Future Outlook

Analysts agree that a reversal of the ban is unlikely in the near term. The policy aligns with broader strategic goals: financial sovereignty, tighter capital controls, and the promotion of the digital yuan. Some experts predict even harsher penalties and more sophisticated monitoring tools in the coming years. For crypto enthusiasts, the message is clear - operating within Chinese borders will remain illegal, and any attempts to bypass the ban via VPNs or offshore services will be met with swift enforcement.

Timeline of Major Chinese Crypto Regulations

| Year | Action | Market Impact |

|---|---|---|

| 2009 | Initial warning against virtual tokens | Limited public awareness |

| 2013‑14 | Banks prohibited from Bitcoin transactions; trading accounts closed | Retail trading contracts shrink by ~70% |

| 2017 | ICOs banned; exchanges shut down | Capital outflow to offshore exchanges |

| 2021 | Mining ban announced | ~30% drop in global hash rate |

| 2025 | Comprehensive ban on trading, mining, ownership | China exits crypto market entirely |

Frequently Asked Questions

What does the 2025 China crypto ban prohibit?

The decree makes any private cryptocurrency activity illegal - buying, selling, mining, holding, or even accessing foreign exchanges via VPNs. Violations lead to asset seizure and hefty fines.

How does the ban affect the digital yuan?

By removing competing private tokens, the government nudges citizens and businesses toward the state‑issued digital yuan, allowing the PBOC full control over digital payments and monetary policy.

Can Chinese citizens still use Bitcoin abroad?

Holding Bitcoin outside China is not illegal per se, but any attempt to transfer, trade, or access foreign platforms from within China via VPNs is a criminal offense.

What happened to the miners forced out in 2021?

Most relocated their hardware to Kazakhstan, the United States, and Russia, where regulatory environments are more permissive. This shift reduced China’s share of global hash power to below 5%.

Will the ban ever be lifted?

Current policy direction and expert analysis suggest no. The ban aligns with China’s wider financial control strategy and the promotion of the digital yuan, making a reversal unlikely in the foreseeable future.

Sonu Singh

October 4, 2025 AT 00:56Peter Schwalm

October 4, 2025 AT 16:37Alex Horville

October 5, 2025 AT 06:54Marianne Sivertsen

October 5, 2025 AT 08:44Shruti rana Rana

October 6, 2025 AT 01:03Stephanie Alya

October 6, 2025 AT 18:36olufunmi ajibade

October 7, 2025 AT 13:44Manish Gupta

October 8, 2025 AT 04:27Gabrielle Loeser

October 8, 2025 AT 11:22