Blockchain Sharding Impact Calculator

-- TPS

Estimated with current configuration

--

Security Risk Level

- Parallel Processing: Multiple shards process transactions simultaneously

- Reduced Node Requirements: Lower storage and compute needs per node

- Energy Efficiency: Lower per-node power consumption

- Scalability: Horizontal growth by adding more shards

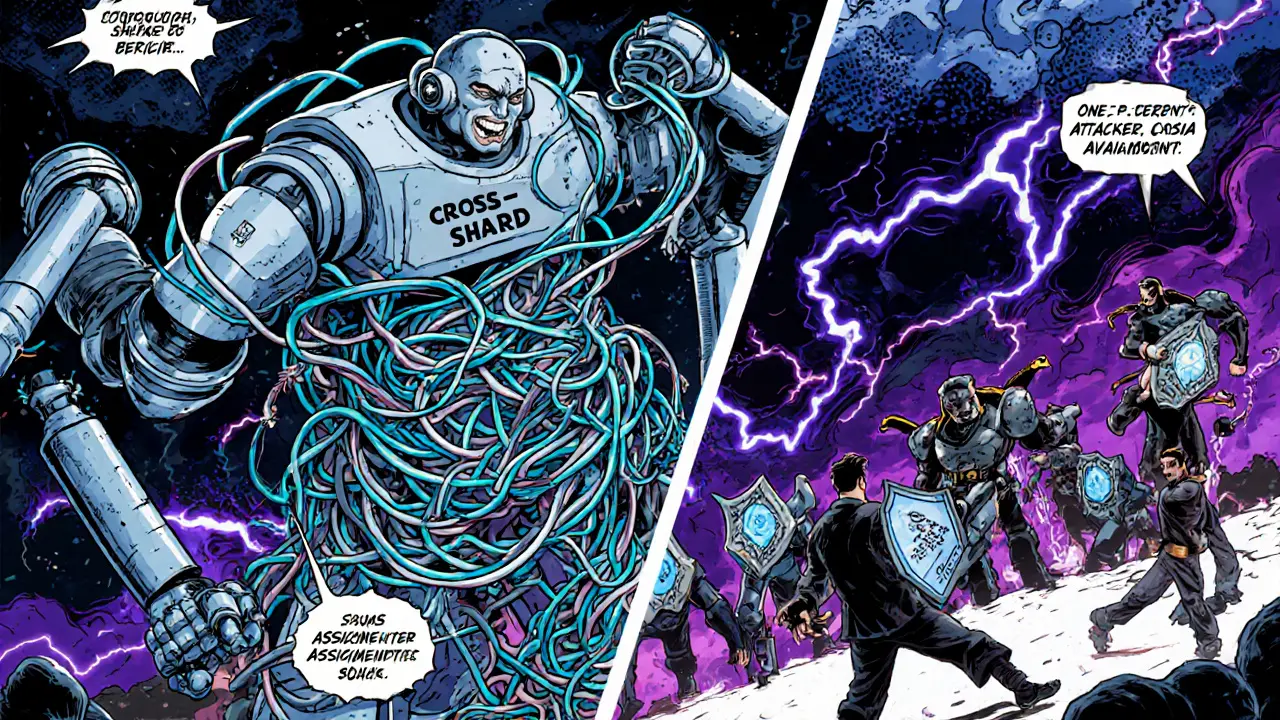

- Cross-Shard Communication: Coordination adds latency

- Data Availability: Ensuring data completeness across shards

- One Percent Attacks: Vulnerability to targeted shard attacks

- Implementation Complexity: High development and testing overhead

| Aspect | Benefit | Challenge |

|---|---|---|

| Performance | Multiple parallel transaction streams increase TPS dramatically | Cross-shard coordination adds latency |

| Scalability | Horizontal growth by adding shards | Complexity of network synchronization |

| Node requirements | Reduced storage and compute per node | Need for advanced monitoring across shards |

| Energy use | Lower per-node power consumption | Additional cryptographic proof generation |

| Security | Random validator assignment mitigates attacks | One-percent attacks on individual shards |

When you hear the term blockchain sharding is a horizontal scaling method that splits a blockchain into multiple smaller chains, called shards, each handling a fraction of the total transaction load, the first thought is usually speed. And it’s right: sharding promises the kind of throughput that could push blockchains from niche experiments to mainstream platforms. But the promise comes with a bundle of technical headaches that developers must untangle before users see a smooth experience.

Why Sharding Matters: The Core Benefits

At its heart, sharding attacks the biggest bottleneck in most public ledgers: every full node processes every transaction. By giving each shard a separate transaction pool, networks can run many transactions in parallel, slashing latency and raising overall throughput.

- Transaction speed: Parallel processing means a network with ten shards can, in theory, handle ten times more transactions per second compared to a single-chain model.

- Scalability: Adding new shards is a matter of deploying extra validator groups, letting the system grow horizontally as demand spikes.

- Lower hardware demands: Nodes only need to store and verify data for their assigned shard, reducing storage and CPU requirements and opening participation to less powerful devices.

- Energy efficiency: Fewer resources per node translate into a lower overall carbon footprint, an increasingly important metric for environmentally‑conscious projects.

- Security through randomness: Modern designs assign validators to shards using cryptographic random selection, making it hard for an attacker to target a specific shard without controlling a large share of total stake.

These benefits are not just theory. Early testnets that incorporated sharding, such as the prototype runs for Ethereum 2.0 the next‑generation upgrade of the Ethereum network that includes a full sharding architecture, reported throughput increases from under 30TPS to several thousand TPS under ideal conditions.

The Dark Side: Technical and Security Challenges

Sharding’s upside is paired with a set of challenges that can stall or even break a network if not addressed properly.

- Data availability: When data is split across shards, each shard must prove that its data is complete and accessible. Solutions like data replication and cryptographic proofs (e.g., erasure coding) add overhead and require careful design.

- Cross‑shard communication: Transactions that involve accounts on different shards need a coordination layer. This adds latency and complexity, and if mishandled, opens the door to double‑spending attacks.

- One‑percent attacks: Because a shard only needs a fraction of total staking power to function, an attacker with a modest share of the overall network can potentially hijack a single shard, compromising its transaction history.

- Network synchronization: Keeping all shards in sync without a single point of failure demands robust consensus mechanisms and frequent checkpointing.

- Implementation complexity: Building a sharded protocol involves multiple moving parts - validator assignment, shard bootstrapping, state transition functions - each of which must be rigorously tested.

- Fragmentation risk: If shards drift apart or lose connectivity, users may find themselves isolated on a shard that can’t interact with the rest of the ecosystem, hurting usability.

These challenges are why many projects adopt a phased approach, starting with a limited number of shards and gradually adding more as tooling matures.

Security Mechanisms in Modern Sharding Designs

To counter the threats listed above, developers rely on a handful of proven techniques.

- Random validator assignment: Protocols like Proto‑Dank Sharding a lightweight sharding proposal for Ethereum that uses random sampling to allocate validators to shards use verifiable random functions (VRFs) to ensure no predictable pattern can be exploited.

- Cross‑shard proofs: By publishing Merkle proofs of state changes from one shard to another, networks can verify that a cross‑shard transaction is legitimate without trusting a single shard.

- Periodic checkpointing: Every few epochs, the network aggregates a snapshot of all shard states into a “beacon chain” or main chain, creating a single source of truth that can be referenced if a shard goes rogue.

- Stake slashing: If a validator is caught attempting to sign conflicting blocks within or across shards, its stake is confiscated, deterring malicious behavior.

These safeguards, while effective, also increase the protocol’s computational load, feeding back into the overall complexity challenge.

Practical Implementation Considerations

For teams looking to adopt sharding, the road map typically includes:

- Skill acquisition: Engineers must understand distributed systems, cryptographic proofs, and consensus algorithms. Training or hiring specialists is often the first cost.

- Tooling selection: Open‑source frameworks like Parity Substrate a modular blockchain development kit that supports sharding modules provide building blocks, but they still require deep integration work.

- Hardware planning: Nodes can run on modest VM instances, but monitoring multiple shards demands robust orchestration tools (Kubernetes, Prometheus) to keep latency low.

- Testing strategy: Simulated networks with dozens of shards help uncover edge‑case bugs before mainnet launch. Some projects run “shadow” shards that mirror live traffic for real‑world validation.

- Governance design: Deciding how many shards exist, how validator sets rotate, and how upgrades roll out requires clear on‑chain governance to avoid contentious forks.

When done right, the reduced resource requirements can democratize node operation - hobbyists can run a shard node on a laptop, expanding decentralization beyond the big data‑center players.

Industry Adoption and Market Outlook

Sharding is no longer a niche academic concept. Major projects like Ethereum 2.0, Polkadot a heterogeneous multi‑chain framework that uses parachains, a form of sharding, and Zilliqa the first public blockchain to launch sharding in production have all shipped sharding components. Analyst reports from 2024‑2025 predict that sharding‑enabled chains will capture a growing share of DeFi and NFT transaction volume, simply because users won’t tolerate the high fees and slow confirmations of single‑chain systems.

Beyond finance, supply‑chain tracking, gaming, and IoT platforms are eyeing sharding to handle millions of micro‑transactions per day. The ability to run lightweight nodes on edge devices aligns well with the push for decentralized, trust‑less data pipelines.

Future Directions: Closing the Gaps

Research is still racing to iron out the remaining pain points. Recent breakthroughs include:

- Improved validator assignment algorithms that blend randomness with stake weighting, reducing the odds of shard takeovers.

- New cross‑shard communication protocols that batch multiple transfers into a single proof, cutting the latency hit from inter‑shard messaging.

- Hybrid models that combine sharding with layer‑2 rollups, letting rollups handle frequent micro‑payments while shards provide the base throughput.

When these advances become production‑ready, the vision of a blockchain that scales to millions of concurrent users without sacrificing decentralization or security will finally be within reach.

Quick Comparison: Benefits vs. Challenges

| Aspect | Benefit | Challenge |

|---|---|---|

| Performance | Multiple parallel transaction streams increase TPS dramatically | Cross‑shard coordination adds latency |

| Scalability | Horizontal growth by adding shards | Complexity of network synchronization |

| Node requirements | Reduced storage and compute per node | Need for advanced monitoring across shards |

| Energy use | Lower per‑node power consumption | Additional cryptographic proof generation |

| Security | Random validator assignment mitigates attacks | One‑percent attacks on individual shards |

Next Steps for Developers and Stakeholders

If you’re evaluating sharding for your own project, follow this checklist:

- Define the target throughput and estimate the number of shards needed.

- Choose a framework that supports modular sharding (e.g., Substrate, Cosmos SDK).

- Design a validator incentive model that rewards honest cross‑shard behavior.

- Implement robust data‑availability proofs; test under network partitions.

- Plan a phased rollout: start with a testnet of 2‑3 shards, then scale.

Stakeholders should also keep an eye on regulatory developments, especially around data residency, as sharding can split data across jurisdictions.

Frequently Asked Questions

What exactly is a shard in a blockchain?

A shard is a smaller, independent chain that processes a subset of the total transactions. Each shard maintains its own state and consensus, but all shards together form the complete ledger.

How does sharding improve transaction speed?

Because shards run in parallel, the network can handle several transactions at the same time. If you double the number of shards, you roughly double the throughput, assuming the cross‑shard overhead stays low.

What are cross‑shard transactions and why are they tricky?

A cross‑shard transaction touches accounts on two different shards. The network must lock the assets on one shard, send a proof to the other, and finally release the assets. Coordinating this safely requires extra consensus steps, which can slow the process and open attack vectors if not implemented correctly.

Can sharding be combined with layer‑2 solutions?

Yes. Many projects stack rollups on top of a sharded base chain. The rollup handles micro‑transactions off‑chain, while the shards provide the ultimate data availability and security guarantees.

What is a one‑percent attack?

It’s an attack where an adversary controls just enough stake to dominate a single shard (often around 1% of total network power) and can then rewrite that shard’s history or censor its transactions.

Brooklyn O'Neill

July 30, 2025 AT 04:56Sharding really changes the game for scalability.

Ciaran Byrne

July 30, 2025 AT 20:13Parallel transaction processing slashes latency. It also cuts hardware costs for node operators.

Patrick MANCLIÈRE

July 31, 2025 AT 11:29When you look at real‑world testnets, you’ll see throughput jump from a few dozen TPS to several thousand after shards are added.

Each shard runs its own consensus, so validators only validate a slice of the chain.

This reduces the data each node has to store, which makes it easier for hobbyists to run a node.

Cross‑shard messaging does add some complexity, but modern designs use succinct proofs to keep the overhead low.

Overall, the trade‑off leans heavily toward scalability for most use‑cases.

Carthach Ó Maonaigh

August 1, 2025 AT 02:46Yo, the hype train’s full of hot air if you ignore the latency that cross‑shard gossip brings.

People love the buzz about “thousands of TPS” while forgetting that a single bad shard can bottle‑neck the whole system.

And let’s not even start on the security nightmares when validators get shuffled haphazardly.

Bottom line: it’s not a silver bullet, it’s a messy juggling act.

Marie-Pier Horth

August 1, 2025 AT 18:03Behold, the mighty sharding – a revolution destined to lift blockchain into the heavens! Yet, beneath the glitter lies toil and terror. Only the brave survive this gauntlet.

Gregg Woodhouse

August 2, 2025 AT 09:19sharding sounds cool but real world apps still lag. u gotta wait for proper rollouts.

F Yong

August 3, 2025 AT 00:36Sure, sharding will fix everything – unless the hidden elites decide to siphon the extra throughput for themselves. It’s a neat idea, but keep an eye on who controls the validator randomizer.

Sara Jane Breault

August 3, 2025 AT 15:53Sharding cuts the load on each node lets more people join the network and it also helps save energy by needing less hardware

Iva Djukić

August 4, 2025 AT 07:09Blockchain scalability has long been the Achilles' heel of decentralized finance.

Sharding offers a promising architectural shift by partitioning state and transaction processing across multiple parallel chains.

The core premise is that each shard can operate semi‑independently while still contributing to a global consensus.

Empirical data from Ethereum 2.0 testnets shows linear throughput gains as shard count increases, provided cross‑shard overhead remains bounded.

However, the coordination layer that reconciles inter‑shard transactions introduces latency that can erode some of the raw performance benefits.

Moreover, data availability proofs must be propagated across shards to guarantee that no piece of the ledger is lost or hidden.

One‑percent attacks exploit the fact that a malicious actor only needs a small fraction of stake to dominate a single shard, potentially rewriting its history.

Mitigation strategies such as random validator assignment and frequent checkpointing to a beacon chain reduce this risk but increase computational load.

The engineering complexity of implementing secure cross‑shard messaging cannot be overstates; developers must design robust Merkle proof systems and fallback mechanisms.

From an economic perspective, reducing per‑node storage and compute requirements democratizes participation, enabling smaller validators to contribute.

Energy consumption per transaction declines as the work is distributed, aligning blockchain with sustainability goals.

Yet, the additional cryptographic operations required for cross‑shard verification offset some of those gains.

Governance frameworks also need to evolve to manage shard allocation, validator rotation, and upgrade protocols without centralizing power.

In practice, many projects adopt a phased rollout, starting with a handful of shards and scaling iteratively as tooling matures.

Consequently, while sharding holds the promise of scaling blockchains to millions of users, its successful deployment hinges on resolving security, latency, and governance challenges in tandem.

Maggie Ruland

August 4, 2025 AT 22:26Sounds like a textbook, but the real world loves to break theory.

jit salcedo

August 5, 2025 AT 13:43Ah, the elegant dance of shards-so graceful until a rogue validator steps on the toe and the whole ballet collapses. The poetry of cryptography meets the harsh reality of network latency. One‑percent attacks are the mischievous imps in this story, forever trying to steal the spotlight. Yet, we keep choreographing new moves, hoping the audience won’t notice the slip.

Joyce Welu Johnson

August 6, 2025 AT 04:59I get why developers feel the pressure; they’re trying to make systems that can handle billions of tiny transactions while keeping trust intact. It’s a balancing act that can feel overwhelming, but every successful shard rollout proves it’s doable.

Lisa Strauss

August 6, 2025 AT 20:16Exciting times ahead-each new shard is another step toward mainstream adoption!

Enya Van der most

August 7, 2025 AT 11:33Let’s push the limits, add more shards and watch the network roar!

Eugene Myazin

August 8, 2025 AT 02:49Sharding plus rollups is the combo we’ve been waiting for, hands down.

Latoya Jackman

August 8, 2025 AT 18:06Precision in validator selection is key.

karyn brown

August 9, 2025 AT 09:23Sharding is cool 😎 but don’t forget the hidden pitfalls.

Megan King

August 10, 2025 AT 00:39i think more shards r great bc they spread load but u gotta watch the cross shard sync.

Rachel Kasdin

August 10, 2025 AT 15:56Our blockchain must stay sovereign, no foreign shard meddling allowed.

Nilesh Parghi

August 11, 2025 AT 07:13Ever wonder how many shards we could support before the sync overhead drowns the gains? It’s a puzzle worth solving.

Adeoye Emmanuel

August 11, 2025 AT 22:29Keep testing aggressively; each iteration brings you closer to a stable, scalable network.

Michael Ross

August 12, 2025 AT 13:46Balanced security measures are essential.

Deepak Chauhan

August 13, 2025 AT 05:03In the grand tapestry of decentralization, shards are the threads that bind diversity; yet, they must be woven with care 🤔.

Aman Wasade

August 13, 2025 AT 20:19Sure, just add more shards and everything magically works.

karsten wall

August 14, 2025 AT 11:36From a protocol design perspective, the trade‑off matrix between latency and throughput becomes increasingly multidimensional as shard count rises.

Keith Cotterill

August 15, 2025 AT 02:53One must acknowledge, dear colleagues, that while sharding ostensibly resolves scalability, it simultaneously engenders a plethora of novel attack vectors, which-if unmitigated-could, in fact, compromise the very security paradigm we seek to enhance.